ISP Global Limited (HKG:8487) Soars 30% But It's A Story Of Risk Vs Reward

ISP Global Limited (HKG:8487) shareholders have had their patience rewarded with a 30% share price jump in the last month. Taking a wider view, although not as strong as the last month, the full year gain of 16% is also fairly reasonable.

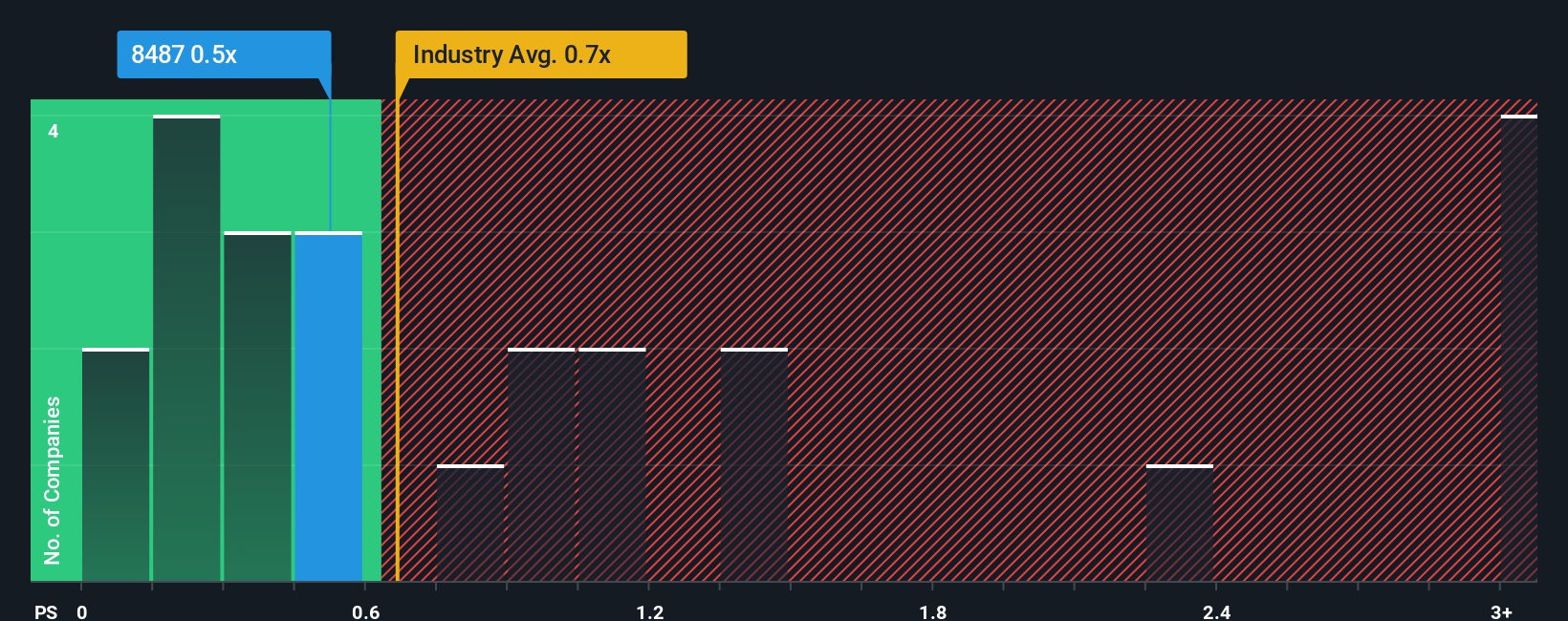

In spite of the firm bounce in price, it's still not a stretch to say that ISP Global's price-to-sales (or "P/S") ratio of 0.5x right now seems quite "middle-of-the-road" compared to the Communications industry in Hong Kong, where the median P/S ratio is around 0.7x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for ISP Global

How ISP Global Has Been Performing

Revenue has risen at a steady rate over the last year for ISP Global, which is generally not a bad outcome. One possibility is that the P/S is moderate because investors think this good revenue growth might only be parallel to the broader industry in the near future. Those who are bullish on ISP Global will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on ISP Global will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, ISP Global would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a decent 7.3% gain to the company's revenues. Pleasingly, revenue has also lifted 197% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenues over that time.

When compared to the industry's one-year growth forecast of 39%, the most recent medium-term revenue trajectory is noticeably more alluring

With this information, we find it interesting that ISP Global is trading at a fairly similar P/S compared to the industry. Apparently some shareholders believe the recent performance is at its limits and have been accepting lower selling prices.

What Does ISP Global's P/S Mean For Investors?

ISP Global's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that ISP Global currently trades on a lower than expected P/S since its recent three-year growth is higher than the wider industry forecast. There could be some unobserved threats to revenue preventing the P/S ratio from matching this positive performance. While recent revenue trends over the past medium-term suggest that the risk of a price decline is low, investors appear to see the likelihood of revenue fluctuations in the future.

There are also other vital risk factors to consider and we've discovered 2 warning signs for ISP Global (1 is concerning!) that you should be aware of before investing here.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English