A Look at Gaming and Leisure Properties (GLPI) Valuation Following Major Chicago Casino Development Announcement

If you are trying to decide what to do with shares of Gaming and Leisure Properties (GLPI), the latest announcement is almost certain to catch your eye. GLPI is committing $1.19 billion to a new partnership with Bally’s, bringing a luxury casino and entertainment destination to the heart of Chicago. With major construction milestones achieved and an ambitious vision for transforming an iconic urban site, this project makes a clear statement about GLPI’s growth ambitions and willingness to bet big on long-term value creation.

This business expansion arrives in a year where GLPI’s share price has not seen a sustained rally. While returns over the past month and year have been negative, the three- and five-year performances remain solidly positive. This suggests that longer-term investors have been rewarded for their patience. The market has yet to fully embrace the company’s recent moves, but continued revenue and net income growth, alongside an ongoing stream of project updates, are keeping the story on investors’ radar.

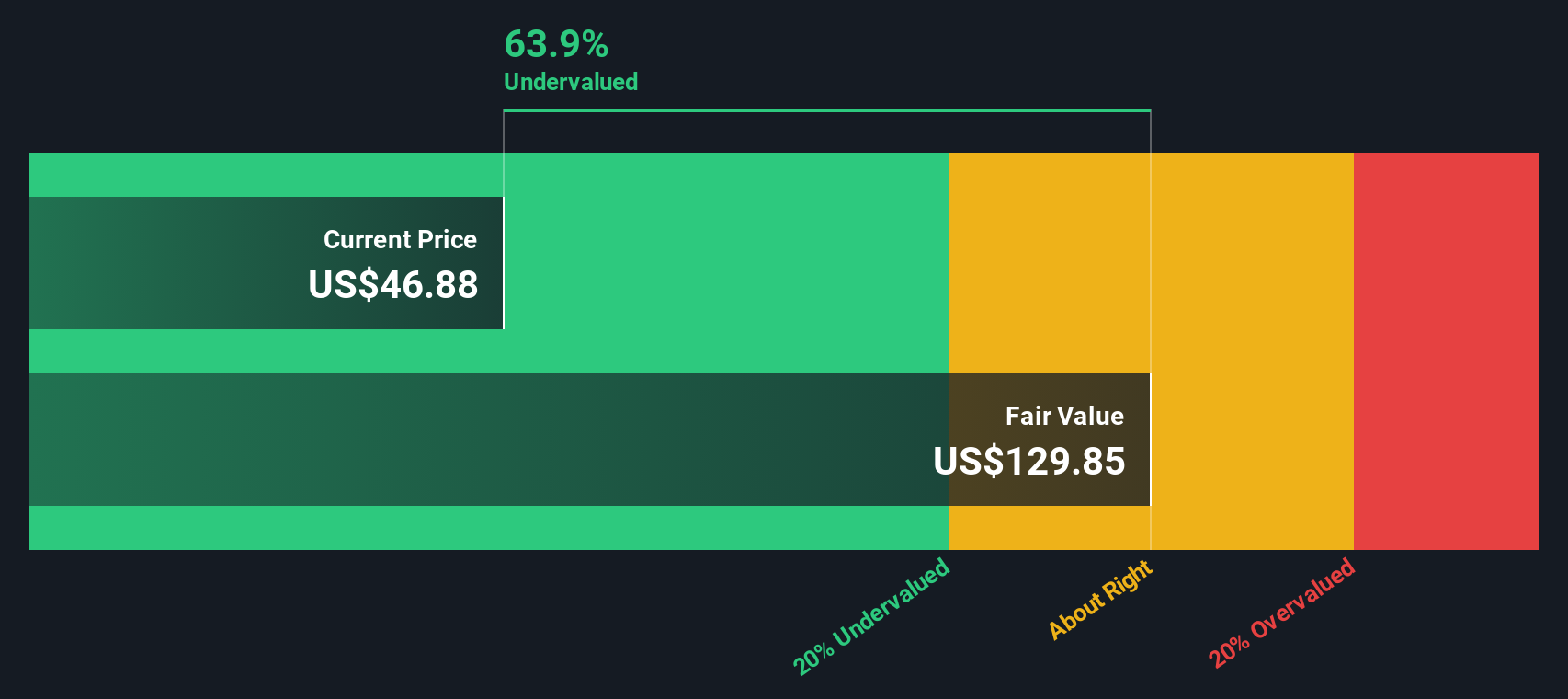

Following the buzz around this massive Chicago casino project and mixed share price momentum, the real question is whether GLPI is trading at a discount or if the market has already priced in future gains.

Most Popular Narrative: 14.2% Undervalued

The most widely followed narrative currently sees Gaming and Leisure Properties as trading well below its estimated fair value. This presents potential upside for investors according to consensus viewpoints.

The ongoing development and deployment of significant investment capital into marquee projects such as the Chicago Bally's, The Belle conversion, and continued land-based upgrades should meaningfully boost long-term rental revenue streams and underlying tenant health. This is expected to ultimately drive steady funds from operations and net income growth. Expanding into tribal gaming real estate, where the company is in advanced discussions with multiple tribal operators, could provide Gaming and Leisure Properties with access to an underserved and growing market. This would diversify the tenant base and support sustained rental and revenue growth.

Curious what drives this bullish view? This narrative is powered by bold financial projections and a future profit multiple that could reshape perceptions of value for this REIT. Want to know the quantitative targets, assumptions, and industry comparisons behind this lofty fair value? The details that set this narrative apart may surprise you.

Result: Fair Value of $54.07 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, significant tenant concentration and exposure to Bally’s financial health could quickly challenge this optimistic outlook for GLPI’s long-term earnings stability.

Find out about the key risks to this Gaming and Leisure Properties narrative.Another View: SWS DCF Model Perspective

Taking a step back from analyst projections, our DCF model also points to shares trading well below fair value. This suggests there may be untapped potential. However, does the model capture every risk and opportunity on the table?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Gaming and Leisure Properties Narrative

If you have a different perspective or prefer to dive deeper into the numbers, it’s easy to craft your own narrative based on the data in just a few minutes. Do it your way.

A great starting point for your Gaming and Leisure Properties research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors never settle for just one opportunity. Set yourself up for success by finding new stocks set to benefit from powerful trends and high potential markets, all tailored to your goals.

- Supercharge your strategy by tapping into AI-driven companies. Get ahead of the curve with the latest breakthroughs in innovation through AI penny stocks.

- Boost your income with stocks offering robust, above-average yields. Secure your portfolio’s stability using dividend stocks with yields > 3%.

- Unlock value with companies the market has overlooked. Spot underpriced opportunities for strong returns by searching via undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English