Zijin Mining Group (SEHK:2899): Valuation Spotlight After Launch of Tres Quebradas Lithium Production

So, you’ve been following Zijin Mining Group (SEHK:2899) and are wondering if now is the time to make a move. The company just hit a major milestone, launching production at its Tres Quebradas lithium project in Argentina. This isn’t just a ribbon-cutting moment; it marks Zijin stepping further into the global battery materials space at a time when demand for electric vehicle batteries is hitting new highs. With over USD 600 million invested in development since acquiring the asset in 2022, the start of production highlights Zijin’s focus on capturing a bigger share of the fast-growing lithium market.

This development is even more notable given the broader momentum in Zijin’s share price. Over the past year, shares have risen an impressive 78 percent, with gains accelerating in the past month and a surge of over 50 percent in the past three months alone. Investors have taken notice of Zijin’s capacity expansions and its efforts to diversify beyond gold and copper, particularly after recent delays for its gold unit’s IPO due to heavy storms in Hong Kong. As a result, lithium appears increasingly important in Zijin’s growth narrative.

After such a run-up, is Zijin Mining Group still undervalued, or is the market already factoring in the company’s future growth prospects?

Most Popular Narrative: 3.2% Overvalued

Based on the most widely followed narrative, Zijin Mining Group is considered slightly overvalued relative to its expected earnings growth and future performance. Analysts believe the market anticipates robust expansion but may already be pricing in much of the company's upside.

"The company is accelerating the construction of incremental copper, gold, and lithium projects, including Phase 2 expansion for Julong Copper and debuting new projects like the lithium extraction. These developments are expected to enhance output and contribute to revenue growth. Zijin Mining is strategically focusing on cost control measures, particularly in overseas mines, which could potentially improve net margins and enhance profitability despite challenges such as degrading ore grades."

What is fueling this elevated price tag? The narrative centers on ambitious project pipelines, aggressive margin management, and surprising financial expectations for both earnings and revenue. To uncover the bold assumptions and strategic forecasts behind this valuation, delve into the full narrative to find out which projections keep analysts optimistic and the market on edge.

Result: Fair Value of $28.72 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, rising geopolitical tensions and unpredictable shifts in the lithium market could quickly undermine even the most robust growth projections for Zijin Mining Group.

Find out about the key risks to this Zijin Mining Group narrative.Another View: Discounted Cash Flow Analysis

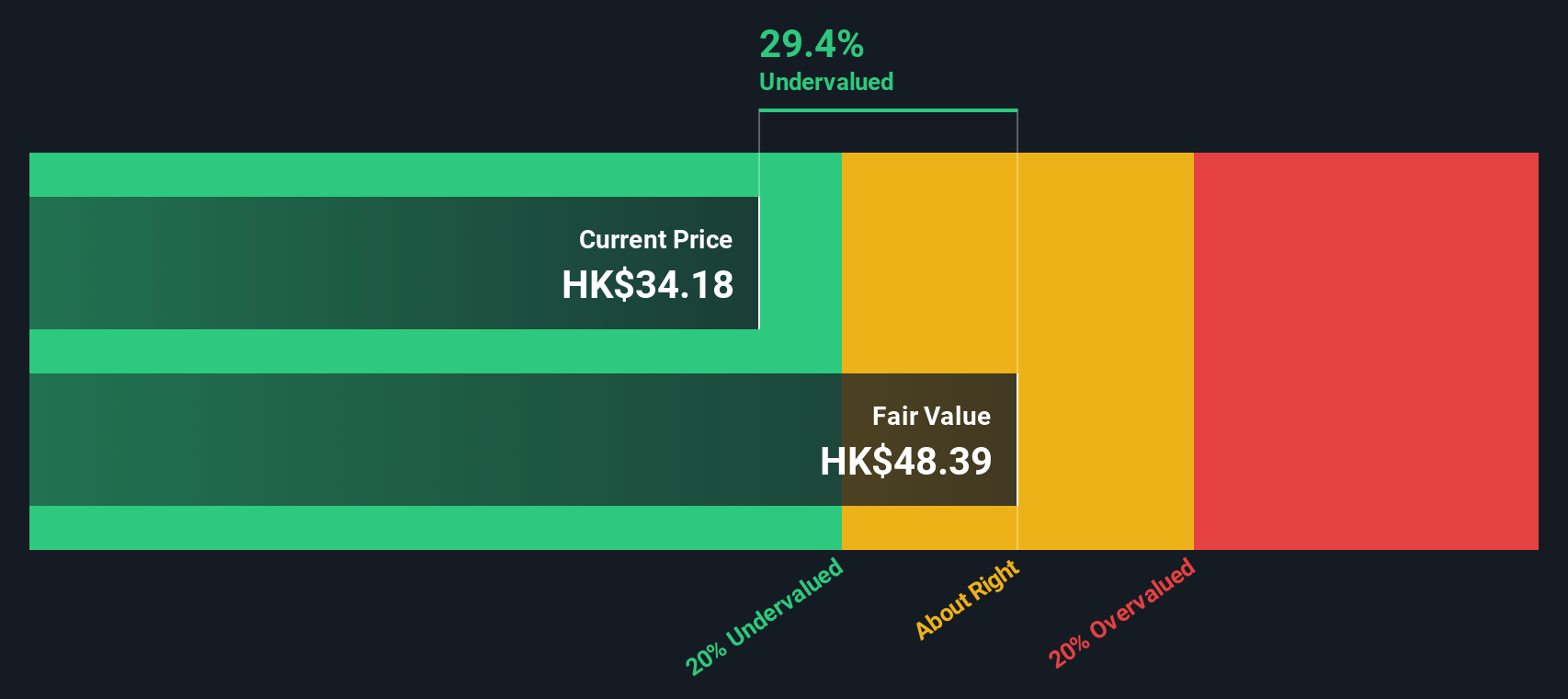

Our SWS DCF model paints a different picture and suggests Zijin Mining Group's shares could be trading at a significant discount to their intrinsic value. Does this mean the market is missing something that others are not?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Zijin Mining Group Narrative

If you see the story unfolding differently or prefer hands-on analysis, you can craft your own view of Zijin Mining Group in just a few minutes. Do it your way.

A great starting point for your Zijin Mining Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t leave your next opportunity on the table. Tap into the latest trends and strategies with these smart stock ideas you can act on today:

- Uncover overlooked small-cap potential and jump ahead of the crowd with penny stocks with strong financials, which could be fueling tomorrow’s winners.

- Maximize your passive income portfolio by targeting companies offering dividend stocks with yields > 3%, providing yields that consistently surpass traditional options.

- Get early access to the next wave in healthcare by focusing on innovators leading advancements in healthcare AI stocks and medical breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English