Should Investors Rethink Caterpillar After Norway's Wealth Fund Divestment and 7.6% Rally?

If you own Caterpillar shares or are eyeing the legendary yellow machines as a potential investment, you are probably wondering whether now is the time to hold, buy more, or take profits. Caterpillar’s story has been anything but dull recently. Over the past month alone, the stock has surged 7.6%, adding to what has been a blockbuster year-to-date run of 29.5%. Even if we look back two, three, or even five years, Caterpillar’s stock has left many indexes in the dust, returning 21.0% over the past year, nearly doubling over three years at 199.9%, and soaring 242.7% over five years.

Some of this momentum has been driven by changing perceptions around risk and opportunity. On one hand, big institutional moves like Norway’s sovereign wealth fund divesting its Caterpillar stake created a ripple of concern, stirring headlines and perhaps some short-term hesitation about the company’s ethical risk profile. On the other hand, rumors swirl that even Warren Buffett might be scooping up shares behind the scenes, adding a little extra intrigue and confidence for retail investors.

But numbers tell their own story. Based on a simple six-point valuation scorecard that checks where a company might be undervalued, Caterpillar currently earns a respectable 3 out of 6. This means in half the most common metrics, the stock still looks undervalued. Of course, scores like these are just a starting point. Next, let’s break down how each valuation approach shakes out for Caterpillar and, even more importantly, consider a better way to think about what the company is really worth.

Caterpillar delivered 21.0% returns over the last year. See how this stacks up to the rest of the Machinery industry.Approach 1: Caterpillar Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and then discounting those cash flows back to today’s value. This approach aims to answer how much those future billions could be worth in your hands right now.

For Caterpillar, the current Free Cash Flow stands at $8.28 Billion. Analysts see this growing steadily, projecting Free Cash Flow to reach $13.92 Billion by 2029. Estimates beyond that five-year horizon are extrapolated, but the key takeaway is that Caterpillar’s future cash generation is expected to rise at a robust clip.

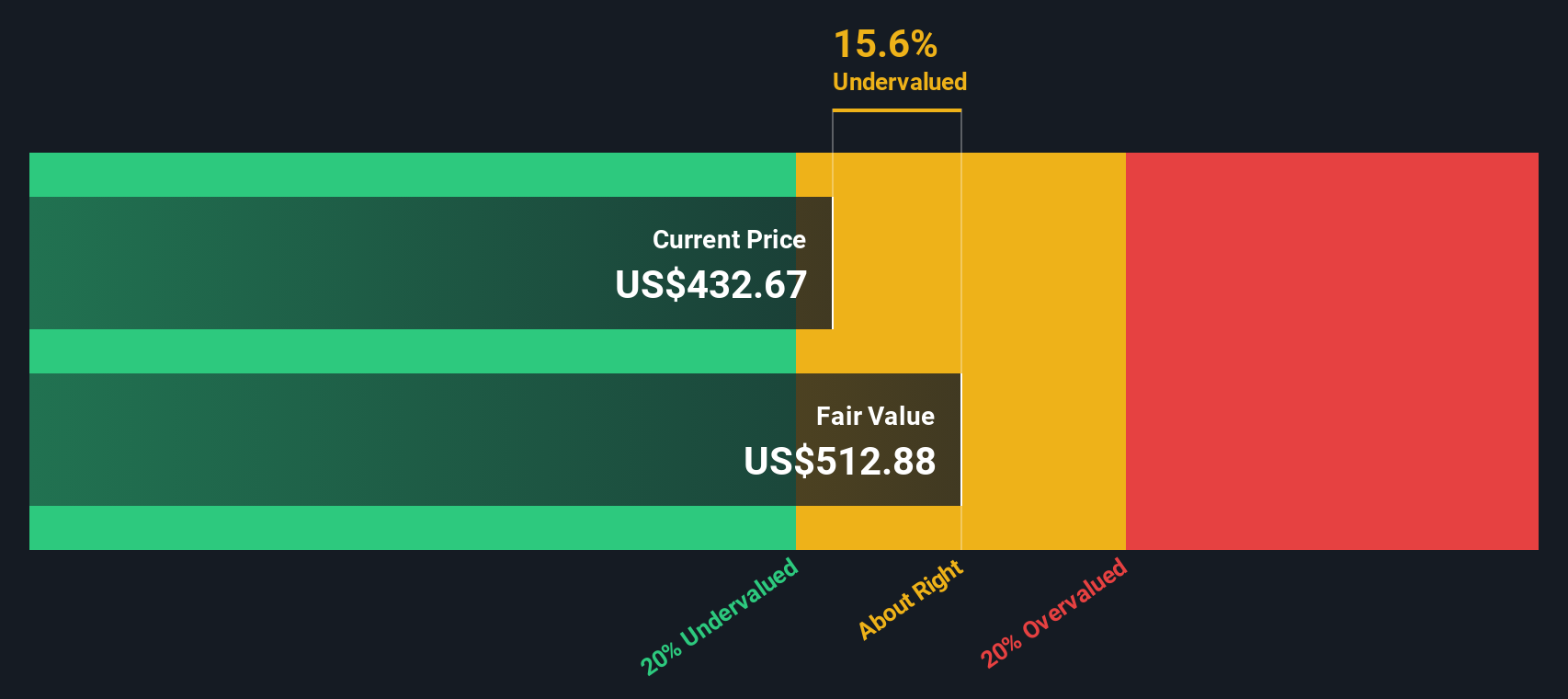

Based on these cash flow projections and using the 2 Stage Free Cash Flow to Equity method, Caterpillar’s estimated intrinsic value comes out to $523.00 per share. This places the stock at a 10.9% discount compared to its current market price, suggesting the shares are undervalued using this approach.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Caterpillar.

Approach 2: Caterpillar Price vs Earnings (P/E Ratio)

The Price-to-Earnings (P/E) ratio is the preferred multiple when valuing profitable companies such as Caterpillar. It tells you how much investors are currently willing to pay for each dollar of the company’s earnings, making it a straightforward and reliable benchmark for established, earnings-generating businesses.

P/E ratios are shaped by expectations for future growth and the risks perceived by the market. Higher growth prospects and lower risk typically justify a higher P/E, while companies facing uncertainty or stagnating profits tend to trade at lower multiples. Knowing what counts as a “normal” or fair P/E is key to recognizing whether a stock is attractively priced or expensive.

Right now, Caterpillar trades at a P/E of 23.1x. That is just below the industry average for Machinery, which is 24.1x, but notably higher than its peer group average of 19.7x. To help investors cut through the noise of arbitrary comparisons, Simply Wall St’s proprietary “Fair Ratio” estimates where Caterpillar’s multiple should sit based on tangible metrics such as growth rate, profit margin, industry type, company size, and risk profile. For Caterpillar, this Fair Ratio is calculated at 34.2x.

What makes the Fair Ratio approach superior is that it tailors the comparison to Caterpillar’s unique characteristics, rather than relying solely on how competitors are currently valued. It factors in whether the company's growth story or financial profile justifies a premium.

With a Fair Ratio of 34.2x against the current 23.1x P/E, Caterpillar appears notably undervalued by this metric.

Result: UNDERVALUED

Upgrade Your Decision Making: Choose your Caterpillar Narrative

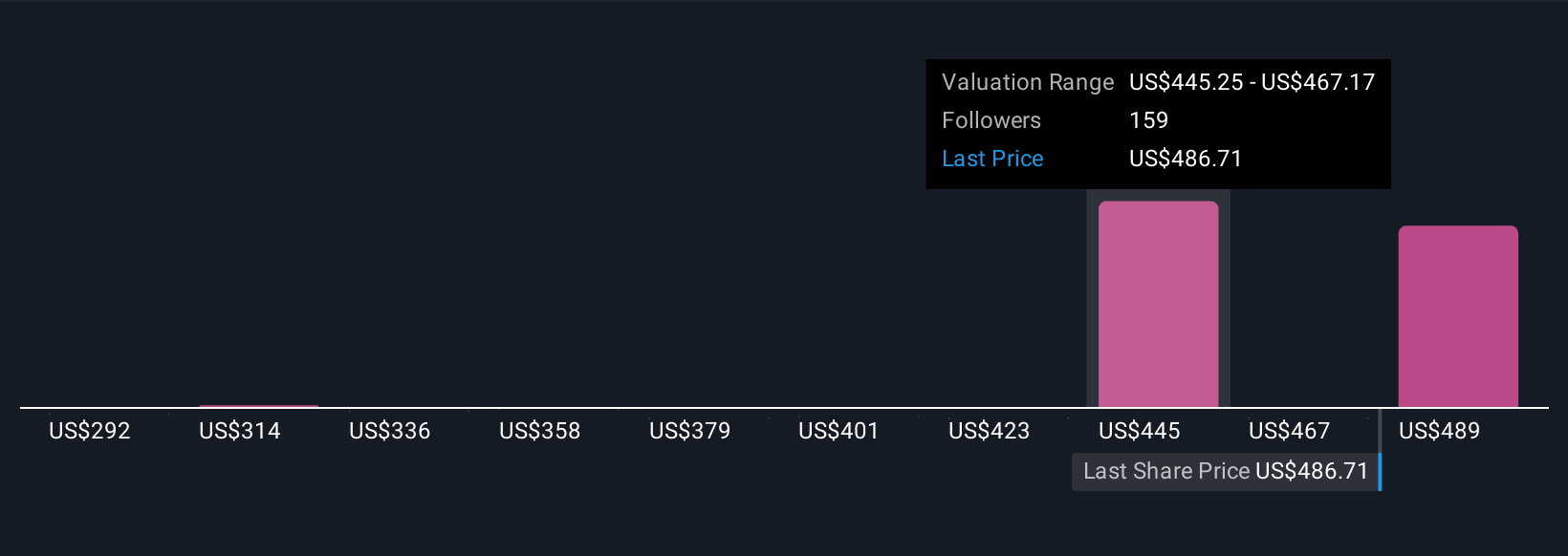

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a story you create about a company that ties together your assumptions about its future, such as sales growth, profit margins, and risks, into a financial forecast that leads to a fair value estimate. Narratives let you move beyond just numbers and ratios to actually express your perspective on what’s driving a business, why it matters, and what that should mean for valuation.

With Simply Wall St’s Narratives, available right now on the Community page, you can build your own view or explore the perspectives shared by millions of other investors. Each Narrative calculates a fair value for the stock and shows how that compares to the price, so you can decide whether to buy, hold, or sell based on your reasoning, not just the herd. Importantly, Narratives update automatically whenever new events or earnings are reported. This ensures your conclusions stay relevant as the story evolves.

For example, some investors might build their Caterpillar Narrative on surging global infrastructure investment, setting a high fair value close to $507.00, while others may lean into tariff risks and assign a more cautious value nearer to $350.00. All of this is based on their outlook for revenue, margins, and industry headwinds.

Do you think there's more to the story for Caterpillar? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English