Bally’s $1.19 Billion Chicago Casino Project Might Change The Case For Investing In GLPI

- In September 2025, Bally’s Corporation announced a partnership with Gaming and Leisure Properties, Inc. to develop a US$1.19 billion integrated casino resort in Chicago’s River West neighborhood, featuring a casino, luxury hotel, entertainment venues, and community riverwalk at the former Chicago Tribune site.

- This project marks one of GLPI’s largest investments to date, reflecting a significant commitment to expanding its presence in major US gaming markets through transformative real estate collaborations.

- We’ll explore how GLPI’s major Chicago resort development with Bally’s may influence expectations for its long-term growth and income stability.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Gaming and Leisure Properties Investment Narrative Recap

To own shares of Gaming and Leisure Properties, investors must be confident in the long-term rental and income stability fueled by marquee projects like the Bally’s Chicago development, while weighing the tenant concentration risk tied to Bally’s financial health. The newly announced Chicago resort adds meaningful potential for expanded revenue, but does not materially change the fact that exposure to Bally’s remains the most important near-term catalyst, and the biggest risk, for GLPI’s outlook.

One recent, highly relevant announcement is GLPI’s acquisition of land for the Hard Rock Casino in Rockford, establishing a 99-year lease. While this deal underlines the company’s effort to broaden its geographic footprint, these types of expansions still place project-specific and tenant risk front and center in shaping near-term results and sentiment.

By contrast, while the Chicago project highlights growth ambitions, it also intensifies exposure to Bally’s tenant profile, which is information investors should be aware of…

Read the full narrative on Gaming and Leisure Properties (it's free!)

Gaming and Leisure Properties is projected to achieve $2.0 billion in revenue and $1.1 billion in earnings by 2028. This outlook relies on 9.0% annual revenue growth and a $382 million increase in earnings from the current $717.9 million.

Uncover how Gaming and Leisure Properties' forecasts yield a $54.07 fair value, a 15% upside to its current price.

Exploring Other Perspectives

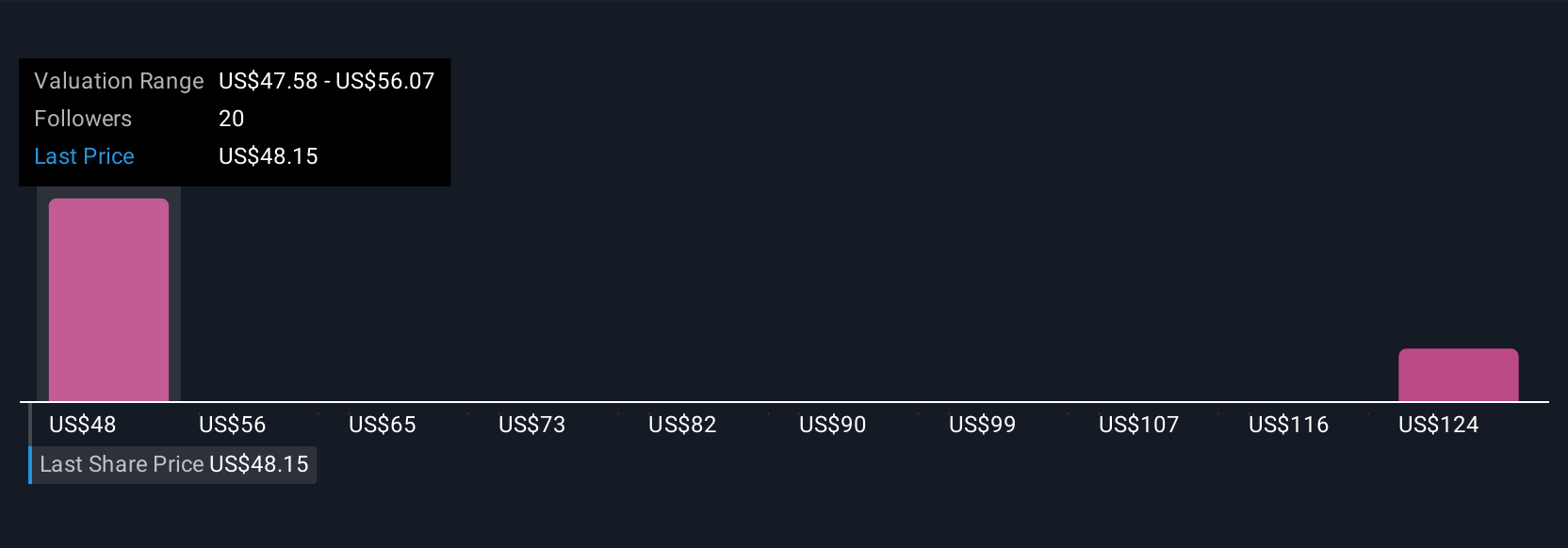

Three fair value estimates from the Simply Wall St Community range widely, from US$47.58 to US$129.61 per share. With ongoing capital committed to major development projects, investor opinions on future growth and risk vary significantly, consider viewing several perspectives to inform your outlook.

Explore 3 other fair value estimates on Gaming and Leisure Properties - why the stock might be worth just $47.58!

Build Your Own Gaming and Leisure Properties Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Gaming and Leisure Properties research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Gaming and Leisure Properties research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Gaming and Leisure Properties' overall financial health at a glance.

Seeking Other Investments?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are the new gold rush. Find out which 31 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English