As Nio Launches Its ES8 SUV, Should You Buy, Sell, or Hold NIO Stock?

The stage lights glowed in Hangzhou, China recently as Nio (NIO) — a pioneer in the global smart electric vehicle (EV) market — gathered its community under the theme “Grow with the Light.” The launch of the third-generation ES8 SUV, offered in seven- and six-seater Executive Premium Editions, gave the audience a sense of how far the brand has come.

With a 925 volt system, 5C fast charging, and a sleek screen-powered CEDA operating system, the ES8 signaled that innovation continues to sit at the center of Nio's journey. Alongside, the unveiling of the ET9 Horizon Edition executive sedan strengthened the company’s luxury portfolio.

To spice up the evening, the firm introduced celebrated Hong Kong singer Karen Mok as the ES8’s Chief Experience Officer, underscoring Nio's intent to blend lifestyle with mobility. On Wall Street, Morgan Stanley analyst Timothy Hsiao observed that the ES8 has brought “sparkle” back to Nio Day, with channel checks pointing toward robust preorder conversions.

About Nio Stock

Headquartered in Shanghai, China, Nio designs, develops, manufactures, and sells its electric SUVs and sedans across international markets. With a market capitalization of roughly $14.7 billion, it provides services such as charging, battery swapping, repair and insurance, auto financing, and energy packages.

NIO stock’s journey has been no less dynamic. Over the past 52 weeks, NIO stock has advanced 10%. Gains strengthened further this year with a 64% rise year-to-date (YTD), while the past three months have delivered a striking 107% rally.

Currently, NIO stock trades at 1.73 times forward sales. While the valuation stands higher than the broader industry average, it remains at a discount when compared to its own five-year average multiple. This positioning captures the balance investors often weigh between growth potential and historical benchmarks.

A Closer Look at Nio’s Q2 Earnings

On Sept. 2, Nio unveiled its second-quarter 2025 financial results in which total revenues grew 9% year-over-year (YOY) to $2.65 billion. The figure fell short of analyst estimates of $2.77 billion, but performance on the ground told a deeper story.

Vehicle deliveries reached 72,056 in the quarter, an increase of 26% from the year-ago period. These deliveries were spread across the three brands: 47,132 vehicles from Nio's premium smart EV brand, 17,081 from its family-focused ONVO brand, and 7,843 from its high-end small electric car brand Firefly.

Gross profit rose 12.4% from a year earlier to $264.9 million, signaling a healthier underlying business. Net loss narrowed 1% to $697.2 million, while net loss per share also narrowed to $0.32. However, it missed the consensus estimate of a $0.29 loss per share. While the red ink still runs deep, the direction is toward improvement.

The company has delivered forward-looking guidance in which, for Q3 2025, management expects deliveries between 87,000 and 91,000 vehicles, an increase of roughly 40.7% to 47.1% from the prior year’s period. Revenue guidance is set at $3.05 billion to $3.19 billion, representing growth of 16.8% YOY to 22.5% YOY.

On the other hand, analysts forecast Q3 2025 loss per share to narrow 33% YOY to $0.24. For the full fiscal year 2025, they expect another 34% narrowing to $0.99. By fiscal 2026, loss per share is projected to shrink 73% to $0.27.

What Do Analysts Expect for Nio Stock?

Market reactions have been measured yet constructive. Bank of America lifted its price target on NIO to $7.60 from $7.10, citing steady progress, although the firm maintained a “Neutral” rating. The rationale was that much of the optimism from vehicle volume growth and narrowing losses is already priced into current valuations.

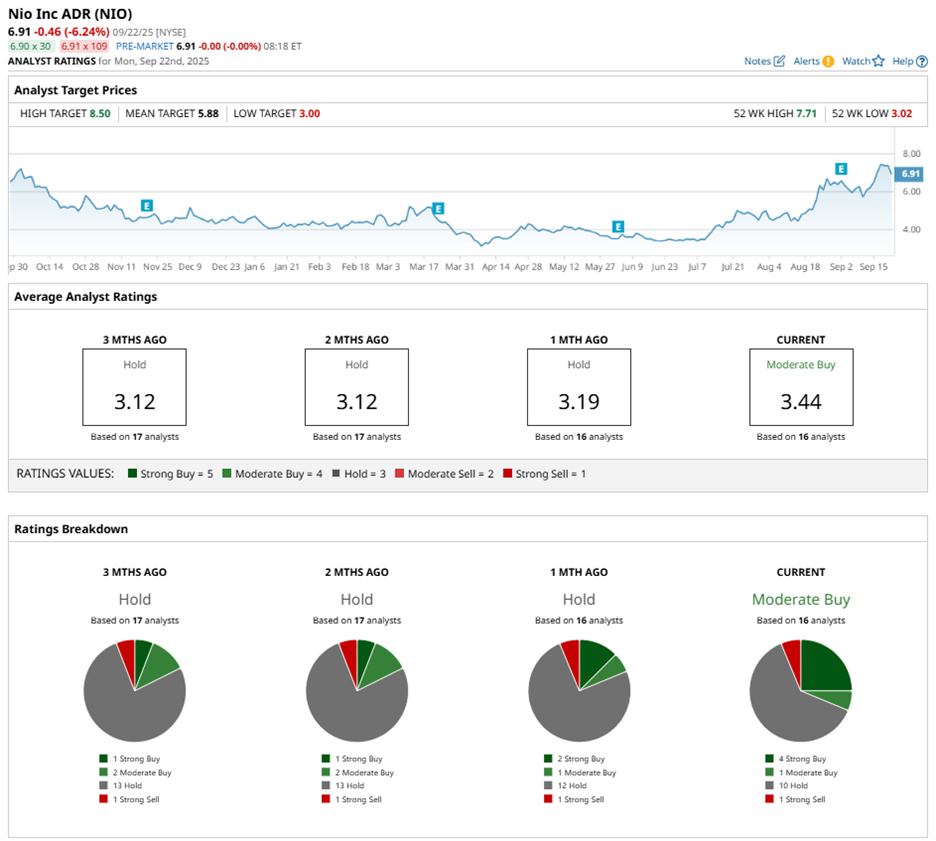

Overall, analysts tracking NIO stock maintain an optimistic view, with the stock holding a consensus rating of “Moderate Buy.” Among 16 analysts, four recommend “Strong Buy,” one suggests “Moderate Buy,” 10 call for a “Hold" rating, and one advises a “Strong Sell.”

NIO stock already trades above its average price target of $6.02. Meanwhile, the Street-high target of $8.60 suggests room for a potential 22% gain from current levels.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English