VivoPower Shares Rally 14% After Announcing $19 Million Equity Raise To Boost XRP Treasury — Stock Sees Slight Pullback Pre-Market

VivoPower International PLC (NASDAQ:VVPR) shares are marginally lower in Thursday's pre-market trading, following a double-digit surge on a $19 million equity raise to support its XRP (CRYPTO: XRP) treasury strategy.

VivoPower Raises Equity To Boost XRP Treasury

The stock slid 0.78% after-hours, a minor pullback after rallying 14% during Tuesday's regular trading session.

The London-headquartered firm completed a $19 million equity raise through an additional common stock offering priced at $6.05 per share

The proceeds will be used to scale up its XRP treasury strategy and pay off debt, the company said in a press release.

See Also: Ripple (XRP) Price Prediction: 2025, 2026, 2030

Indirect XRP Exposure Through Ripple

VivoPower, a sustainable energy solutions company, has pivoted to a cryptocurrency treasury strategy, focusing on the acquisition, management and long-term holding of XRP, the third-largest cryptocurrency by market capitalization. The firm also aims to support the growth of XRP Ledger.

In August, VivoPower announced acquiring $100 million of privately held shares of Ripple Labs, a company that extensively uses XRP and XRPL for its operations. Through this, it became the only U.S.-listed company to provide exposure to Ripple.

Price Action: At the time of writing, XRP was exchanging hands at $2.97, up 3.85% in the last 24 hours, according to data from Benzinga Pro.

VivoPower shares fell 0.78% in pre-market trading after closing 14% higher at $5.130 during Wednesday’s regular trading session. Year-to-date, the stock has soared 285%.

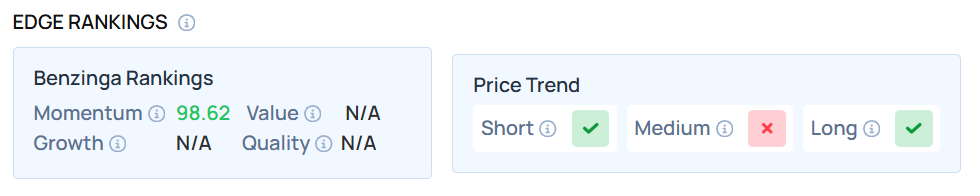

The stock exhibited a very high Momentum score as of this writing. How does it compare with Strategy Inc. (NASDAQ:MSTR) and other cryptocurrency treasury companies? Visit Benzinga Edge Stock Rankings to find out.

Read Next:

Photo courtesy: Shutterstock

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English