3 Asian Growth Companies With Insider Ownership Expecting Up To 69% Earnings Growth

As global markets navigate through a landscape marked by cautious monetary policies and fluctuating economic indicators, Asia's stock markets have shown resilience, with notable gains in regions like China despite broader concerns of growth slowdowns. In this context, companies with strong insider ownership can be particularly appealing to investors as they often signal confidence in the firm's future prospects and align management incentives with shareholder interests—a crucial factor when assessing potential for significant earnings growth.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Leapmotor Technology (SEHK:9863) | 14.6% | 57.6% |

| Suzhou Sunmun Technology (SZSE:300522) | 33.2% | 84.7% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 84.6% |

| PharmaResearch (KOSDAQ:A214450) | 35% | 30.9% |

| Novoray (SHSE:688300) | 23.6% | 30.3% |

| Laopu Gold (SEHK:6181) | 35.5% | 34% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 24.9% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 35.2% |

| Fulin Precision (SZSE:300432) | 11.8% | 50.7% |

| Ascentage Pharma Group International (SEHK:6855) | 12.8% | 91.9% |

Here we highlight a subset of our preferred stocks from the screener.

Dongyue Group (SEHK:189)

Simply Wall St Growth Rating: ★★★★☆☆

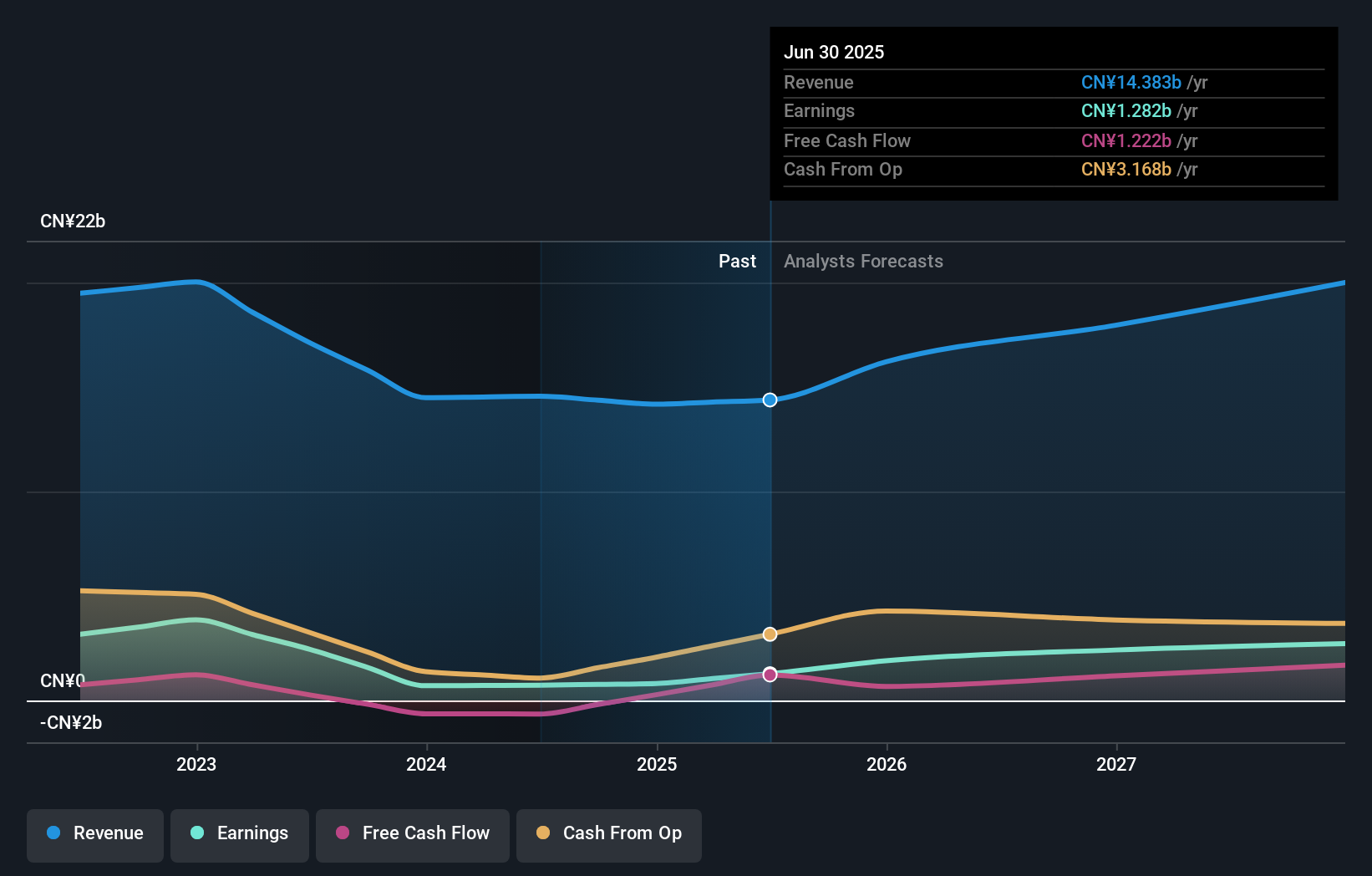

Overview: Dongyue Group Limited is an investment holding company that manufactures, distributes, and sells polymers, organic silicone, refrigerants, dichloromethane, liquid alkali, and other products in China and internationally with a market cap of HK$21.14 billion.

Operations: The company's revenue is primarily derived from its segments in refrigerants (CN¥6.21 billion), organic silicon (CN¥4.77 billion), polymers (CN¥3.73 billion), and dichloromethane PVC and liquid alkali (CN¥1.25 billion).

Insider Ownership: 15.4%

Earnings Growth Forecast: 26.6% p.a.

Dongyue Group's recent earnings report showed substantial growth, with net income rising from CNY 307.65 million to CNY 779.2 million year-over-year, highlighting its strong performance. The company is trading significantly below its estimated fair value and is expected to achieve a notable annual profit growth rate of 26.6%, outpacing the Hong Kong market average of 12.8%. Despite this, future revenue growth is forecasted at a moderate pace of 12.7% annually.

- Dive into the specifics of Dongyue Group here with our thorough growth forecast report.

- The valuation report we've compiled suggests that Dongyue Group's current price could be quite moderate.

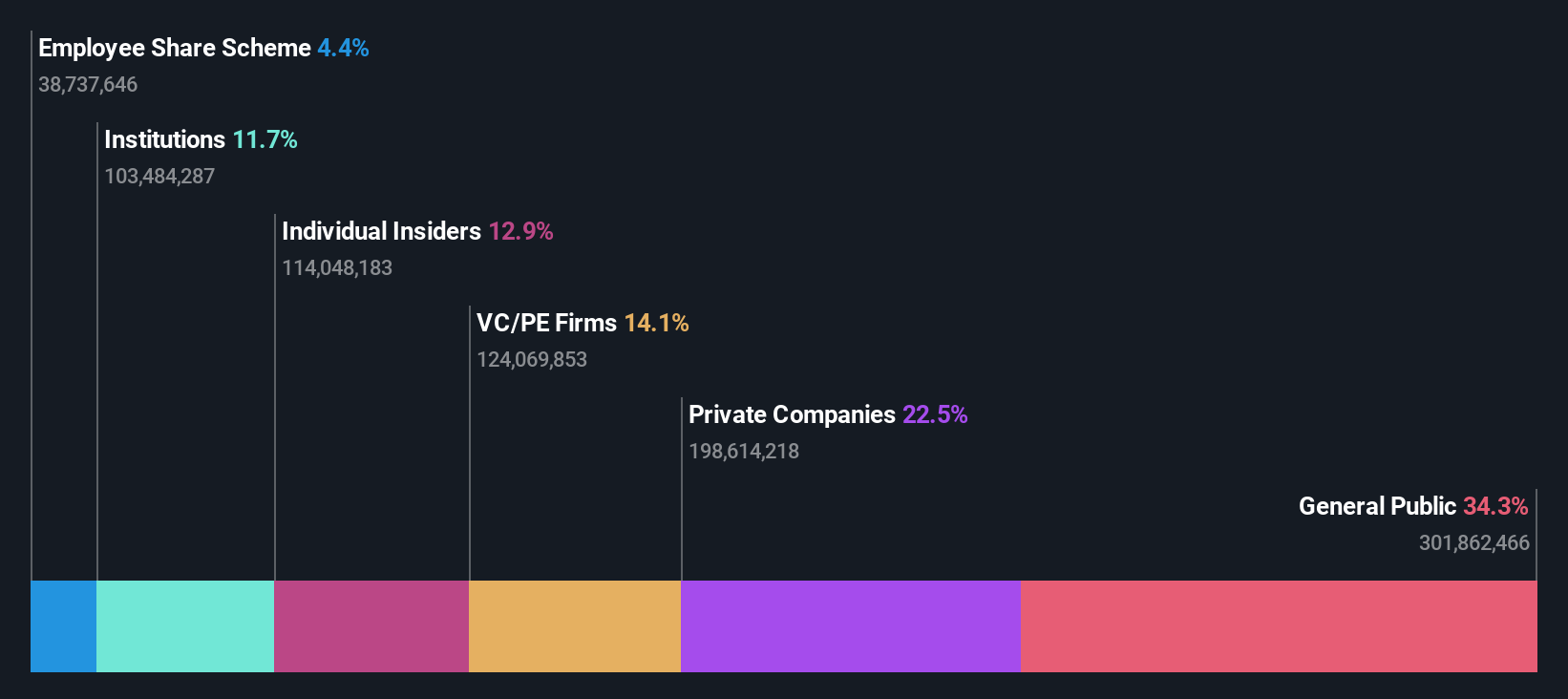

InnoScience (Suzhou) Technology Holding (SEHK:2577)

Simply Wall St Growth Rating: ★★★★★★

Overview: InnoScience (Suzhou) Technology Holding Co., Ltd. operates in the technology sector and has a market capitalization of HK$81.93 billion.

Operations: The company's revenue primarily comes from the sales of GaN Power Semiconductor Products, amounting to CN¥996 million.

Insider Ownership: 12.8%

Earnings Growth Forecast: 69.5% p.a.

InnoScience (Suzhou) Technology Holding demonstrates strong growth potential with earnings increasing 47.6% annually over the past five years and forecasted revenue growth of 39.6% per year, surpassing market expectations. Despite recent net losses, strategic alliances with NVIDIA and UAES bolster its position in AI data centers and new energy vehicles. Recent inclusion in the S&P Global BMI Index reflects market confidence, although high share price volatility persists without substantial insider trading activity noted recently.

- Unlock comprehensive insights into our analysis of InnoScience (Suzhou) Technology Holding stock in this growth report.

- Insights from our recent valuation report point to the potential overvaluation of InnoScience (Suzhou) Technology Holding shares in the market.

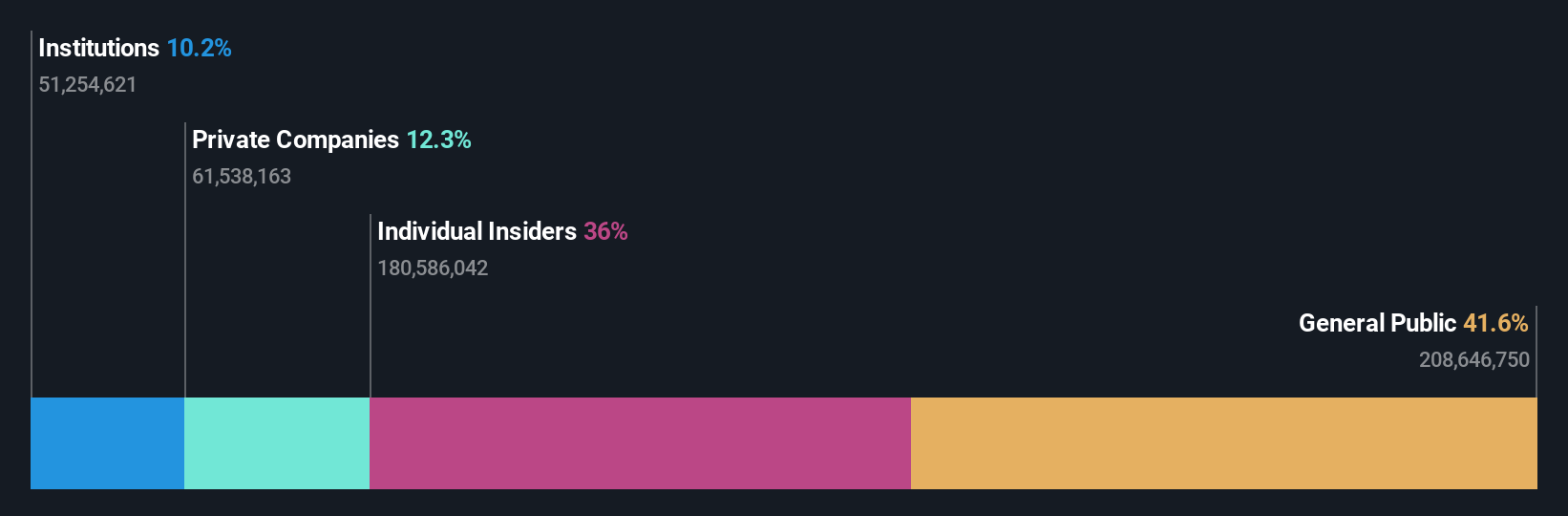

Sineng ElectricLtd (SZSE:300827)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sineng Electric Co., Ltd. specializes in the research, development, manufacture, maintenance, and trading of power electronic products both in China and internationally with a market cap of CN¥18.26 billion.

Operations: The company's revenue is derived from the Photovoltaic Industry (CN¥2.94 billion), Energy Storage Industry (CN¥1.98 billion), Power Quality Management Industry (CN¥46.88 million), and Spare Parts and Technical Services (CN¥54.51 million).

Insider Ownership: 36.2%

Earnings Growth Forecast: 26.6% p.a.

Sineng Electric Ltd. is positioned for robust growth, with revenue expected to rise 20.7% annually, outpacing the Chinese market. Despite earnings forecasted to grow at a slightly slower rate than the market, they remain significant at 26.6% per year. The company trades at a favorable P/E ratio of 39.8x compared to peers and has high insider ownership but no recent insider trading activity noted. Recent corporate restructuring aims to enhance governance and capital management strategies amidst highly volatile share price movements.

- Delve into the full analysis future growth report here for a deeper understanding of Sineng ElectricLtd.

- The analysis detailed in our Sineng ElectricLtd valuation report hints at an deflated share price compared to its estimated value.

Summing It All Up

- Navigate through the entire inventory of 617 Fast Growing Asian Companies With High Insider Ownership here.

- Interested In Other Possibilities? Outshine the giants: these 23 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English