Demystifying Assurant: Insights From 6 Analyst Reviews

6 analysts have expressed a variety of opinions on Assurant (NYSE:AIZ) over the past quarter, offering a diverse set of opinions from bullish to bearish.

The table below summarizes their recent ratings, showcasing the evolving sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 2 | 3 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 1 | 0 | 0 |

| 2M Ago | 0 | 2 | 1 | 0 | 0 |

| 3M Ago | 0 | 0 | 1 | 0 | 0 |

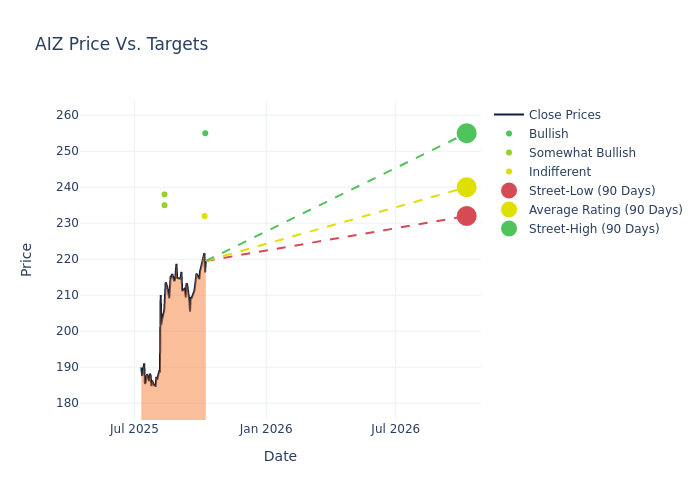

Insights from analysts' 12-month price targets are revealed, presenting an average target of $234.67, a high estimate of $255.00, and a low estimate of $218.00. Observing a 2.93% increase, the current average has risen from the previous average price target of $228.00.

Decoding Analyst Ratings: A Detailed Look

The analysis of recent analyst actions sheds light on the perception of Assurant by financial experts. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| John Nadel | UBS | Raises | Buy | $255.00 | $250.00 |

| Bob Huang | Morgan Stanley | Raises | Equal-Weight | $232.00 | $230.00 |

| Bob Huang | Morgan Stanley | Raises | Equal-Weight | $230.00 | $218.00 |

| Charlie Lederer | BMO Capital | Announces | Outperform | $238.00 | - |

| Tommy McJoynt | Keefe, Bruyette & Woods | Raises | Outperform | $235.00 | $225.00 |

| Bob Huang | Morgan Stanley | Raises | Equal-Weight | $218.00 | $217.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Assurant. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts unravel qualitative evaluations for stocks, ranging from 'Outperform' to 'Underperform'. These ratings offer insights into expectations for the relative performance of Assurant compared to the broader market.

- Price Targets: Delving into movements, analysts provide estimates for the future value of Assurant's stock. This analysis reveals shifts in analysts' expectations over time.

For valuable insights into Assurant's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on Assurant analyst ratings.

Unveiling the Story Behind Assurant

Assurant Inc is a protection company that partners with the brands to safeguard and service connected devices, homes and automobiles. It operate in North America, Latin America, Europe and Asia Pacific through two operating segments: Global Lifestyle and Global Housing. Global Lifestyle: includes mobile device solutions (including extended service contracts, insurance policies and related services), extended service contracts and related services for consumer electronics and appliances, and financial services and other insurance products. Global Housing: includes lender-placed homeowners, manufactured housing and flood insurance, as well as voluntary manufactured housing, condominium and homeowners insurance. Key revenue is generated from Global Lifestyle segment.

Unraveling the Financial Story of Assurant

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Revenue Growth: Assurant displayed positive results in 3M. As of 30 June, 2025, the company achieved a solid revenue growth rate of approximately 7.98%. This indicates a notable increase in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Financials sector.

Net Margin: The company's net margin is below industry benchmarks, signaling potential difficulties in achieving strong profitability. With a net margin of 7.45%, the company may need to address challenges in effective cost control.

Return on Equity (ROE): Assurant's ROE lags behind industry averages, suggesting challenges in maximizing returns on equity capital. With an ROE of 4.38%, the company may face hurdles in achieving optimal financial performance.

Return on Assets (ROA): Assurant's ROA is below industry averages, indicating potential challenges in efficiently utilizing assets. With an ROA of 0.67%, the company may face hurdles in achieving optimal financial returns.

Debt Management: With a high debt-to-equity ratio of 0.38, Assurant faces challenges in effectively managing its debt levels, indicating potential financial strain.

The Significance of Analyst Ratings Explained

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English