Does LexinFintech’s (LX) Share Buyback Reflect True Value or a Shift in Capital Priorities?

- LexinFintech Holdings recently announced that its Board of Directors has authorized a share repurchase plan to buy back outstanding shares, following notable shifts in institutional investor positions during the second quarter.

- This move signals management's confidence in the company's valuation and ability to generate long-term shareholder value, often prompting increased investor interest.

- We'll explore how the new share buyback plan could influence LexinFintech's investment narrative and management’s approach to capital returns.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

LexinFintech Holdings Investment Narrative Recap

To be a shareholder in LexinFintech Holdings, you need to believe in the sustained growth of China’s consumer finance sector, management’s ability to balance regulatory demands, and ongoing improvements to risk controls. The recent share repurchase plan highlights management's confidence, but does not materially alter the biggest short-term catalyst, accelerated digital adoption and margin expansion, nor does it fully address the continuing risk of tighter regulation increasing funding costs.

Among LexinFintech’s recent announcements, the increased dividend payout ratio from 25% to 30% of net income stands out as the most relevant to the buyback news. Together, these moves reinforce management’s signal that capital returns are a key priority, but also underscore how capital allocation decisions will intersect with the company’s ability to deliver on growth catalysts.

Yet, investors should be aware that, in contrast to these capital return initiatives, persistent regulatory uncertainty...

Read the full narrative on LexinFintech Holdings (it's free!)

LexinFintech Holdings' narrative projects CN¥20.8 billion revenue and CN¥4.5 billion earnings by 2028. This requires 14.1% yearly revenue growth and a CN¥2.9 billion earnings increase from the current earnings of CN¥1.6 billion.

Uncover how LexinFintech Holdings' forecasts yield a $11.50 fair value, a 128% upside to its current price.

Exploring Other Perspectives

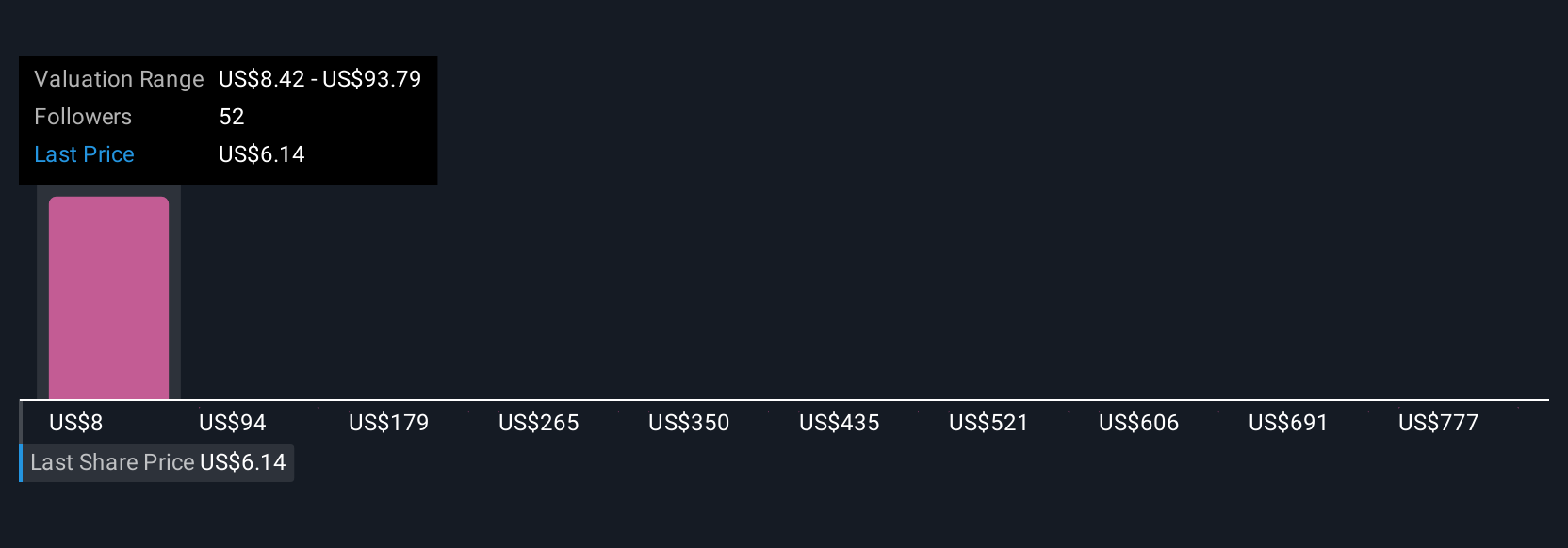

Eight members of the Simply Wall St Community value LexinFintech between US$6.45 and US$120.33 per share. With stricter loan regulations looming, these diverse estimates reflect just how differently investors view the company's risk and growth potential.

Explore 8 other fair value estimates on LexinFintech Holdings - why the stock might be a potential multi-bagger!

Build Your Own LexinFintech Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your LexinFintech Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free LexinFintech Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate LexinFintech Holdings' overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English