Health Check: How Prudently Does SPT Energy Group (HKG:1251) Use Debt?

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that SPT Energy Group Inc. (HKG:1251) does use debt in its business. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

What Is SPT Energy Group's Debt?

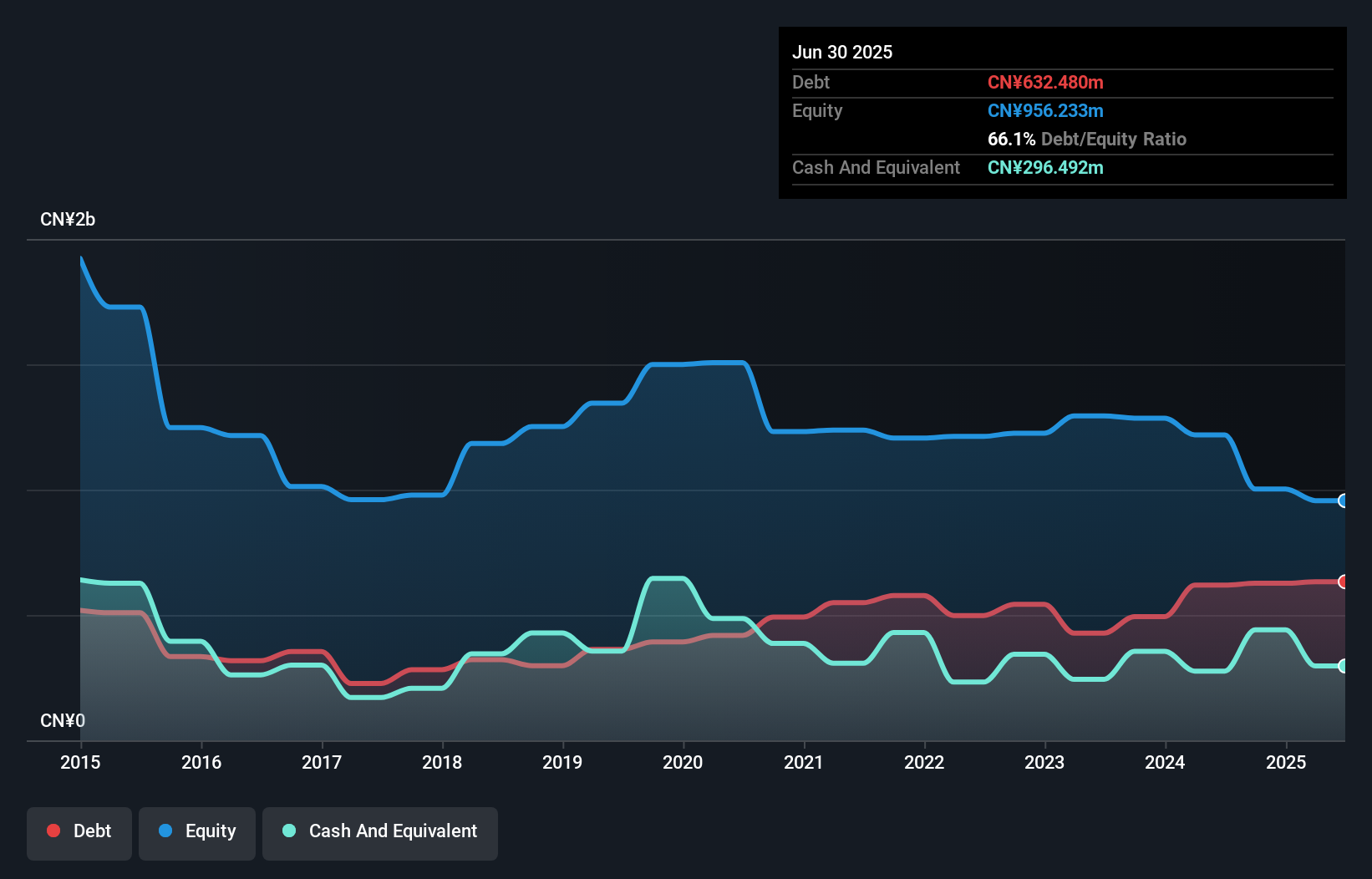

As you can see below, SPT Energy Group had CN¥632.5m of debt, at June 2025, which is about the same as the year before. You can click the chart for greater detail. However, it does have CN¥296.5m in cash offsetting this, leading to net debt of about CN¥336.0m.

How Healthy Is SPT Energy Group's Balance Sheet?

According to the last reported balance sheet, SPT Energy Group had liabilities of CN¥1.24b due within 12 months, and liabilities of CN¥80.2m due beyond 12 months. Offsetting this, it had CN¥296.5m in cash and CN¥638.7m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by CN¥382.5m.

This is a mountain of leverage relative to its market capitalization of CN¥445.1m. This suggests shareholders would be heavily diluted if the company needed to shore up its balance sheet in a hurry. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since SPT Energy Group will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

See our latest analysis for SPT Energy Group

In the last year SPT Energy Group had a loss before interest and tax, and actually shrunk its revenue by 11%, to CN¥1.7b. We would much prefer see growth.

Caveat Emptor

While SPT Energy Group's falling revenue is about as heartwarming as a wet blanket, arguably its earnings before interest and tax (EBIT) loss is even less appealing. Indeed, it lost a very considerable CN¥171m at the EBIT level. Considering that alongside the liabilities mentioned above does not give us much confidence that company should be using so much debt. Quite frankly we think the balance sheet is far from match-fit, although it could be improved with time. We would feel better if it turned its trailing twelve month loss of CN¥241m into a profit. So in short it's a really risky stock. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 2 warning signs for SPT Energy Group you should be aware of, and 1 of them can't be ignored.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English