Revolve Group (RVLV): Evaluating Valuation After Recent 14% Share Price Drop

See our latest analysis for Revolve Group.

The past year has proven challenging for Revolve Group, with a year-to-date share price return of minus 40.32 percent and a one-year total shareholder return of minus 20.99 percent, signaling deteriorating momentum. Short-term pullbacks remain sharp, but the lasting weakness is pushing investors to weigh whether sentiment is shifting or if there could be value opportunities on the horizon.

If you’re weighing high-momentum stocks with insider support, now is an ideal time to explore fast growing stocks with high insider ownership

With shares trading below recent analyst price targets and fundamentals still positive, investors now face a key question: is Revolve Group at a bargain point, or is the market already factoring in its future prospects?

Most Popular Narrative: 18.5% Undervalued

Revolve Group's most popular narrative assigns a fair value of $24.57 per share, notably above the recent close of $20.03. Growing attention focuses on how international expansion and digital strategies could fuel future success for the online retailer.

Expanding international presence, especially with substantial growth in China and other underpenetrated markets, positions Revolve to capture outsized revenue growth as Millennial and Gen Z consumers in these regions increasingly shift spending online. Ongoing investments in owned and exclusive brands are expected to drive higher gross margins and net margins. This is supported by better inventory management, tighter markdown algorithms, and diversification of supply chains to mitigate tariff impacts.

Want to know why this retailer's future is driving such a premium? The narrative hinges on a digital-first transformation, margin expansion, and a confident bet on international demand. Which surprising assumptions lie beneath this optimistic outlook? Only a peek inside the full valuation reveals the secrets behind the target price.

Result: Fair Value of $24.57 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent margin pressures or unexpected changes in consumer behavior could quickly challenge this optimistic outlook and shift sentiment and valuation for Revolve Group.

Find out about the key risks to this Revolve Group narrative.

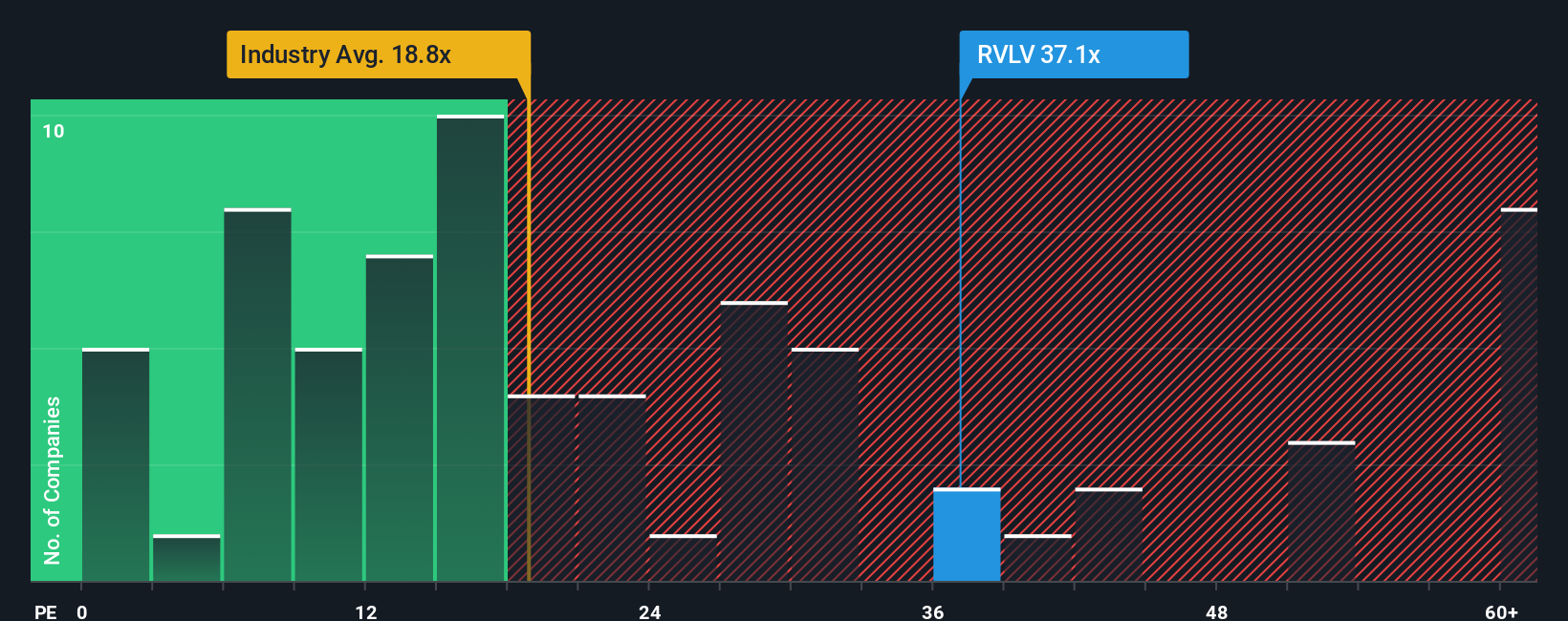

Another View: Multiples Tell a Different Story

Looking beyond the target price, the current price-to-earnings ratio for Revolve Group sits at 31.5x. This is noticeably higher than both the industry average of 16.7x and the peer benchmark of 14.4x. It also exceeds the fair ratio of 17.2x. These elevated ratios suggest investors are paying a premium compared to competitors, raising doubts about how much upside may remain. So is the optimism already priced in?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Revolve Group Narrative

If you see things differently or want to dive into the numbers yourself, crafting a personalized narrative is quick and straightforward. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Revolve Group.

Looking for More Investment Ideas?

Step beyond Revolve Group and uncover exciting opportunities handpicked for forward-thinking investors using the powerful Simply Wall Street Screener. Seize your chance to get ahead of trends that could shape your portfolio’s performance.

- Boost your potential returns by targeting reliable income streams when you check out these 19 dividend stocks with yields > 3%, with standout yields exceeding 3%.

- Capitalize on game-changing tech by starting with these 24 AI penny stocks, from companies driving real innovation in artificial intelligence across industries.

- Supercharge your search for tomorrow’s market winners by acting early with these 898 undervalued stocks based on cash flows, spotlighting stocks trading at attractive valuations based on future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English