How Investors Are Reacting To Mettler-Toledo (MTD) Analyst Upgrades Ahead of Q3 Results

- Mettler-Toledo International announced plans to release its third quarter 2025 financial results after the market close on November 6, 2025, followed by a conference call the next morning to discuss the results, accessible via the company’s investor website.

- Analyst sentiment toward the company has grown more positive due to strong recent business performance, with multiple prominent research firms expressing increased confidence in its outlook.

- We’ll now explore how recent analyst upgrades and positive results might influence Mettler-Toledo’s broader investment narrative.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Mettler-Toledo International Investment Narrative Recap

At its core, Mettler-Toledo offers precision instrumentation critical for customers in life sciences, industrial, and food sectors, investors here are betting on steady demand, despite cyclical pressures from macroeconomic uncertainty. The recent announcement of its upcoming Q3 2025 earnings release and analyst upgrades may provide a short-term sentiment boost but is unlikely to materially shift the biggest near-term risk: supply chain and tariff-related margin pressures remain top of mind.

Of the recent company developments, the latest corporate guidance issued alongside Q2 results stands out, signaling management’s expectation for continued modest local currency sales growth, albeit with the caveat of potential shipping delays. This places further attention on execution risks tied to mitigating cost headwinds as global supply challenges persist.

Yet, despite these signs of optimism, the ongoing complexities around international tariffs and manufacturing adjustments remain key information investors should be aware of...

Read the full narrative on Mettler-Toledo International (it's free!)

Mettler-Toledo International's outlook forecasts $4.4 billion in revenue and $1.0 billion in earnings by 2028, implying 4.5% annual revenue growth and a $170 million increase in earnings from the current $829.8 million.

Uncover how Mettler-Toledo International's forecasts yield a $1309 fair value, a 3% upside to its current price.

Exploring Other Perspectives

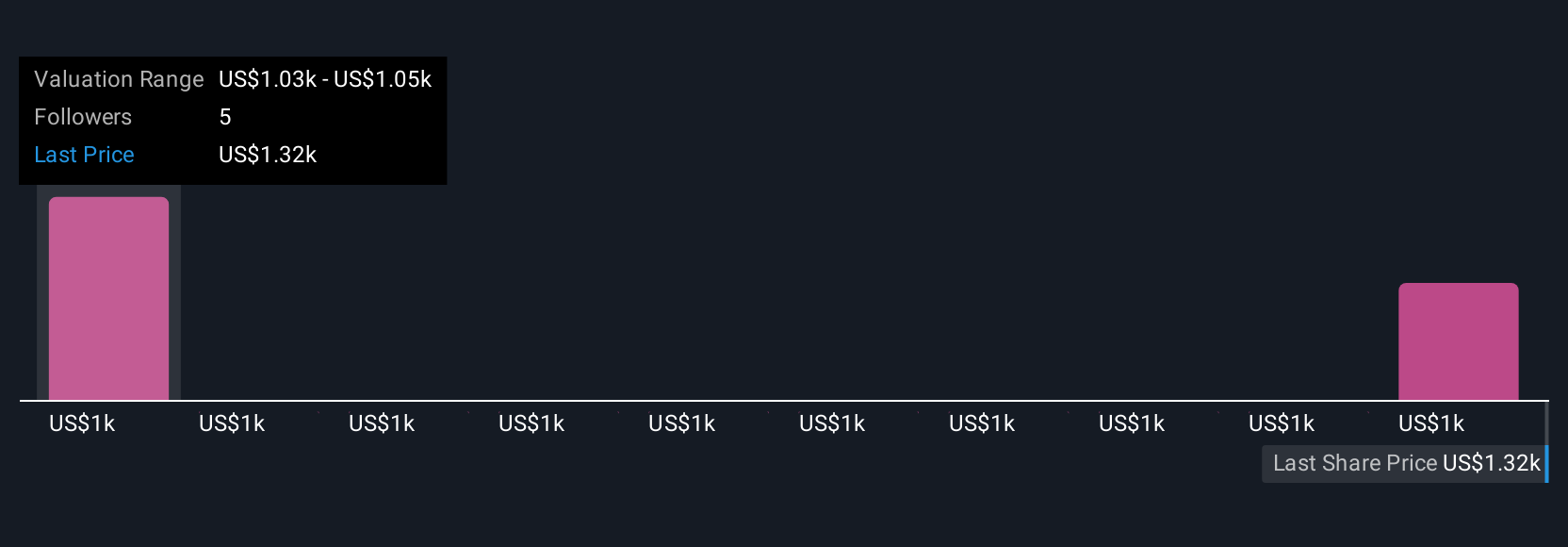

Simply Wall St Community members provided just two fair value estimates for Mettler-Toledo, ranging from US$1,000 to US$1,309 per share. While opinions are split, ongoing concerns about margin volatility from global tariff risks continue to shape investor expectations, explore several perspectives before forming your own view.

Explore 2 other fair value estimates on Mettler-Toledo International - why the stock might be worth as much as $1309!

Build Your Own Mettler-Toledo International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mettler-Toledo International research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Mettler-Toledo International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mettler-Toledo International's overall financial health at a glance.

No Opportunity In Mettler-Toledo International?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English