Can Adient's (ADNT) New Safety Tech Redefine Its Premium Position in Next-Gen Auto Interiors?

- Adient and Autoliv recently announced the mass production readiness of their co-developed safety system for zero-gravity automotive seating, combining Adient's Z-Guard seat concept with Autoliv's advanced occupant protection technologies.

- This innovation directly addresses industry-wide safety challenges in deeply reclined seating positions, setting new standards for occupant protection as next-generation vehicle cabins evolve.

- We'll assess how current and future mass adoption of Z-Guard technology may influence Adient's outlook and premium product positioning.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

Adient Investment Narrative Recap

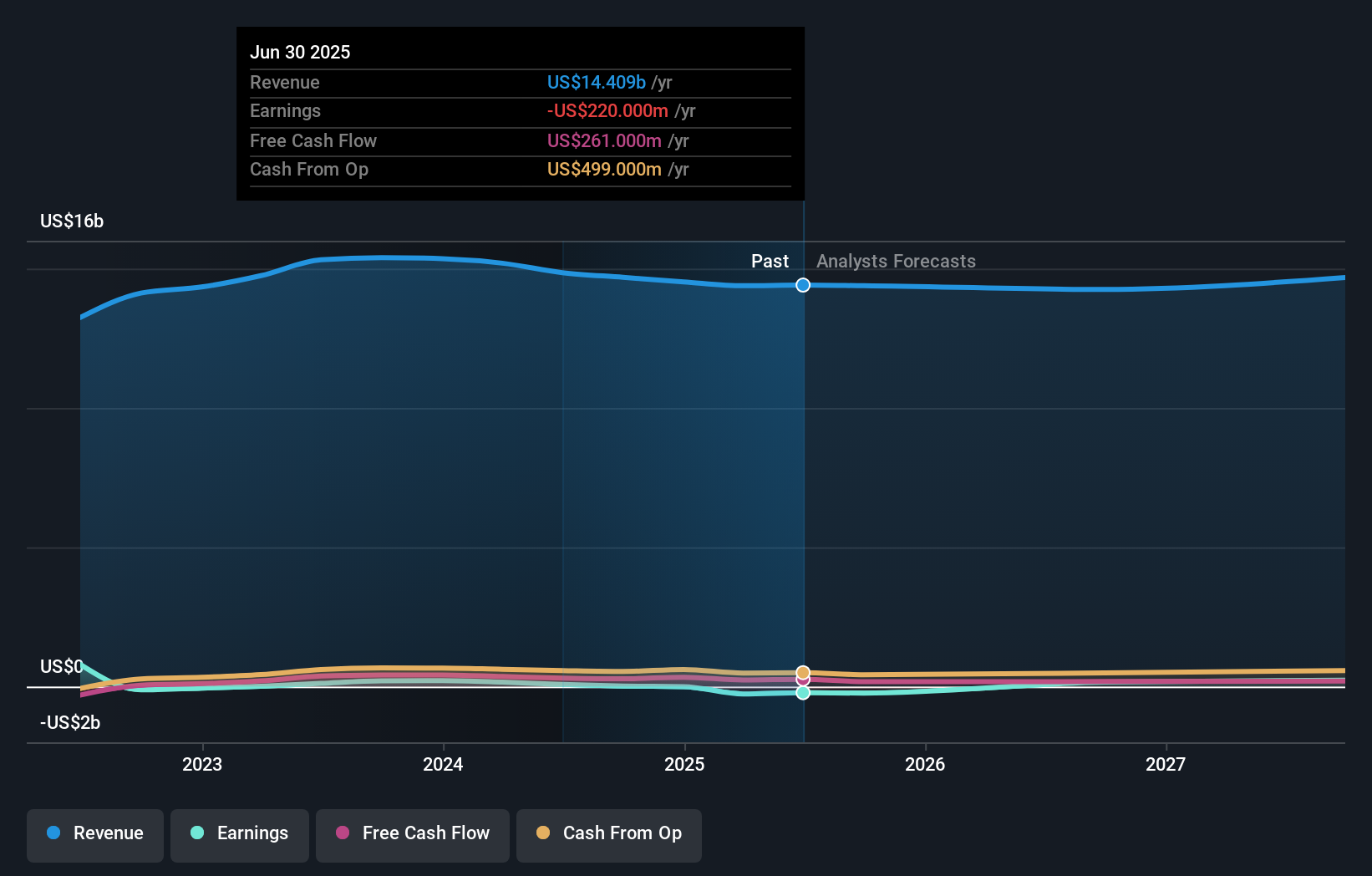

Belief in Adient centers on its ability to lead innovation in automotive seating, capitalize on EV and premium vehicle trends, and secure OEM partnerships while managing cyclical volume and margin pressures. The recent Z-Guard safety system announcement could enhance product differentiation in high-growth, technology-driven segments, but does not appear to immediately outweigh the most pressing catalyst: ramping new program launches and recovering volumes in critical markets such as China. The material risk remains margin compression, particularly in EMEA, where restructuring and cost headwinds continue to challenge profitability and free cash flow.

Among recent announcements, the debut of the mechanical massage seat in the GAC-Trumpchi M8 stands out. While not directly tied to Z-Guard, it reflects a focus on premium, comfort-forward features, important as growing demand for intelligent, user-centric interiors fuels OEM sourcing decisions and influences Adient’s potential to win next-generation seating contracts.

By contrast, investors should stay alert to the risk that ongoing restructuring efforts and persistent European margin weakness could weigh on bottom-line recovery if...

Read the full narrative on Adient (it's free!)

Adient's outlook anticipates $15.1 billion in revenue and $330.3 million in earnings by 2028. This is based on a projected annual revenue growth rate of 1.6%, and an increase in earnings of $550.3 million from the current loss of $-220.0 million.

Uncover how Adient's forecasts yield a $28.21 fair value, a 23% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members offer two fair value estimates for Adient, ranging widely from US$28.21 to US$75.99 per share. While community views differ sharply, many are watching how Adient's premium product push and OEM wins can offset ongoing cost headwinds in key global markets.

Explore 2 other fair value estimates on Adient - why the stock might be worth over 3x more than the current price!

Build Your Own Adient Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Adient research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Adient research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Adient's overall financial health at a glance.

No Opportunity In Adient?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English