Centenary United Holdings Limited (HKG:1959) Stock Rockets 194% As Investors Are Less Pessimistic Than Expected

Centenary United Holdings Limited (HKG:1959) shareholders have had their patience rewarded with a 194% share price jump in the last month. The last 30 days were the cherry on top of the stock's 381% gain in the last year, which is nothing short of spectacular.

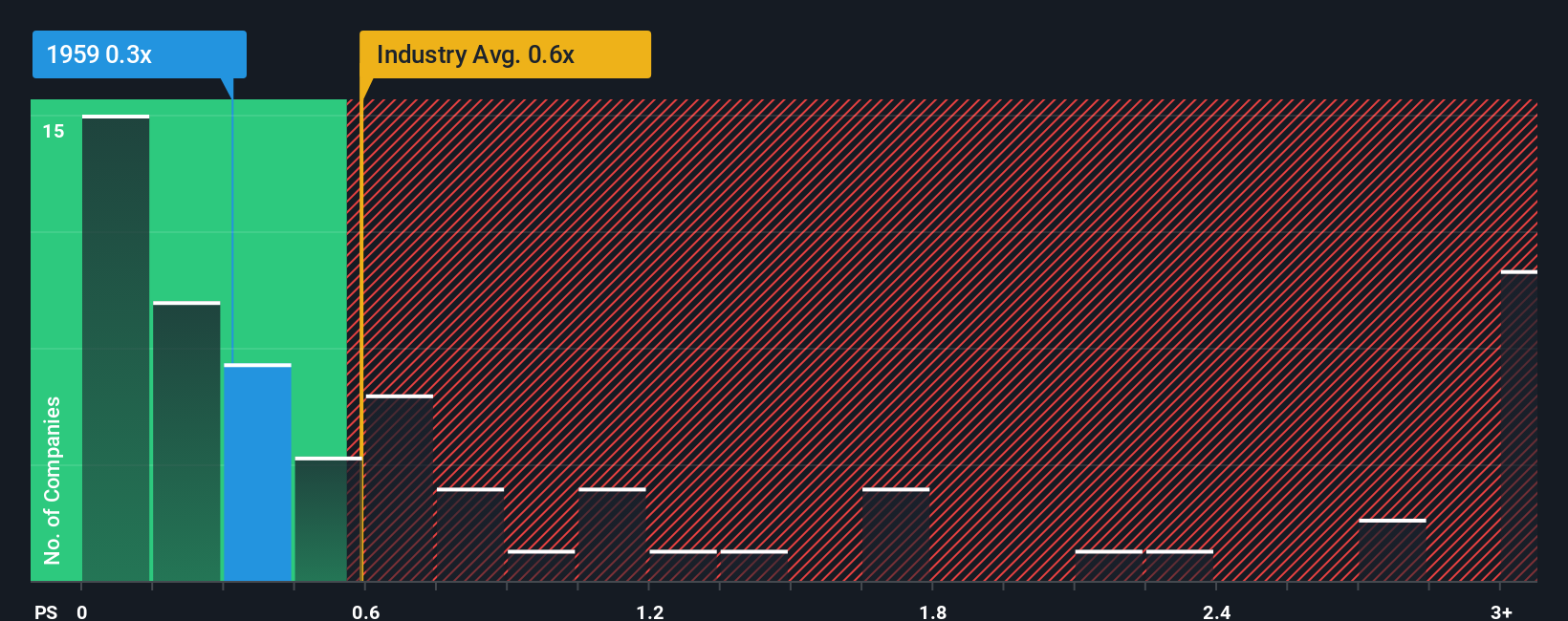

Even after such a large jump in price, it's still not a stretch to say that Centenary United Holdings' price-to-sales (or "P/S") ratio of 0.3x right now seems quite "middle-of-the-road" compared to the Specialty Retail industry in Hong Kong, where the median P/S ratio is around 0.6x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Centenary United Holdings

How Has Centenary United Holdings Performed Recently?

For instance, Centenary United Holdings' receding revenue in recent times would have to be some food for thought. It might be that many expect the company to put the disappointing revenue performance behind them over the coming period, which has kept the P/S from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Centenary United Holdings' earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Centenary United Holdings would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a frustrating 41% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 48% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Comparing that to the industry, which is predicted to deliver 42% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

With this in mind, we find it worrying that Centenary United Holdings' P/S exceeds that of its industry peers. Apparently many investors in the company are way less bearish than recent times would indicate and aren't willing to let go of their stock right now. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

What We Can Learn From Centenary United Holdings' P/S?

Its shares have lifted substantially and now Centenary United Holdings' P/S is back within range of the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look at Centenary United Holdings revealed its shrinking revenues over the medium-term haven't impacted the P/S as much as we anticipated, given the industry is set to grow. Even though it matches the industry, we're uncomfortable with the current P/S ratio, as this dismal revenue performance is unlikely to support a more positive sentiment for long. Unless the recent medium-term conditions improve markedly, investors will have a hard time accepting the share price as fair value.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Centenary United Holdings (2 are concerning) you should be aware of.

If you're unsure about the strength of Centenary United Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English