Top 3 Defensive Stocks Which Could Rescue Your Portfolio In Q4

Benzinga·10/16/2025 10:53:11

Listen to the news

The most oversold stocks in the consumer staples sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

Nomad Foods Ltd (NYSE:NOMD)

- On Oct. 10, Nomad Foods announced the appointment of Dominic Brisby as its new Executive President, Chief Executive Officer-Elect and member of the Board of Directors effective Nov. 3. Outgoing CEO Stéfan Descheemaeker said, “I am proud of what we have built at Nomad Foods. The Company has become the leading savory frozen food business in Europe and one of the largest savory frozen food companies worldwide. We have built a portfolio of market-leading brands in an on-trend category while attracting top-tier talent which positions the Company to win. After 10 years as CEO, I believe now is the appropriate time to transition to new leadership who can take the Company to new heights.” The company's stock fell around 13% over the past month and has a 52-week low of $11.86.

- RSI Value: 23.8

- NOMD Price Action: Shares of Nomad Foods fell 3.7% to close at $11.96 on Wednesday.

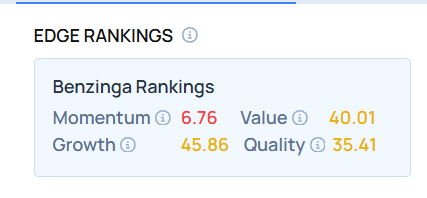

- Edge Stock Ratings: 6.76 Momentum score with Value at 40.01.

JBS NV (NYSE:JBS)

- On Aug. 15, Stephens & Co. analyst Pooran Sharma reiterated JBS with an Overweight rating and maintained a $19 price target. The company's stock fell around 19% over the past month and has a 52-week low of $12.37.

- RSI Value: 25.7

- JBS Price Action: Shares of JBS gained 0.4% to close at $12.81 on Wednesday.

- Benzinga Pro’s charting tool helped identify the trend in JBS stock.

Moolec Science SA (NASDAQ:MLEC)

- On Sept. 11, Moolec Science announced regulatory approval in Argentina for Safflower GLASO Technology and appointed Valeria Falottico as CFO. “The progress of our U.S. safflower season, coupled with the regulatory green light in Argentina, demonstrates Moolec’s ability to execute its science and translate it into scalable, tangible outcomes. These steps directly reinforce our commitment to delivering reliable, high-quality supply to our partners. At the same time, the integration of Mycofood™ expands our technological base beyond molecular farming into fungal precision fermentation, adding a new layer of protein solutions under commercial development in North America and Europe,” said Alejandro Antalich, Chief Executive Officer of Moolec Science. The company's stock fell around 46% over the past month and has a 52-week low of $0.65.

- RSI Value: 15.1

- MLEC Price Action: Shares of Moolec Science fell 9.6% to close at $0.68 on Wednesday.

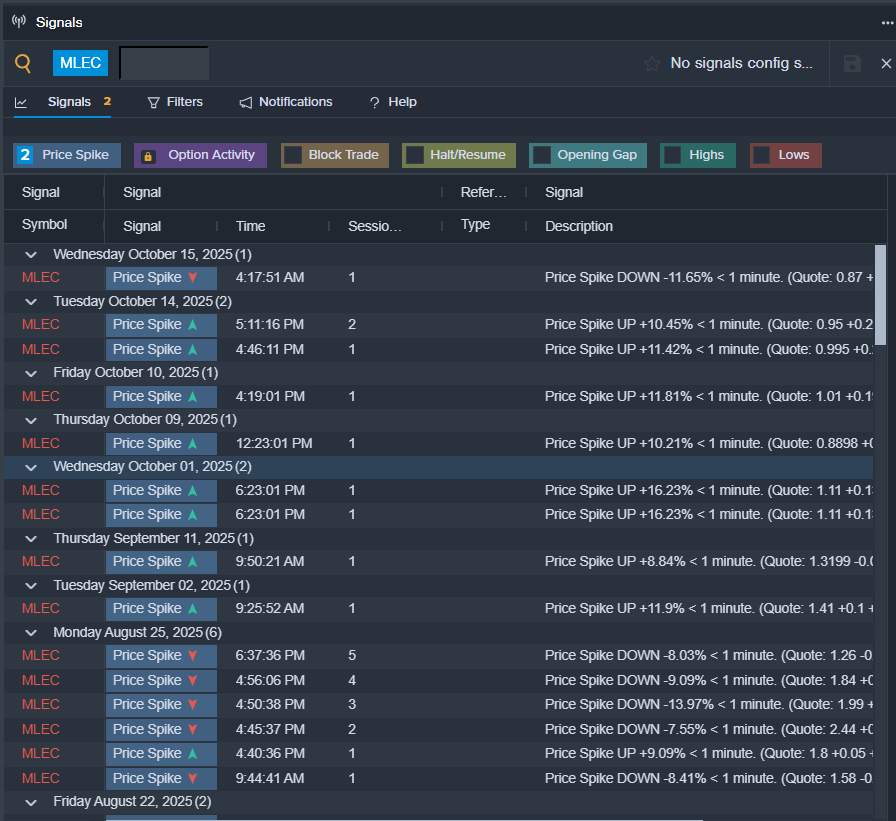

- Benzinga Pro’s signals feature notified of a potential breakout in MLEC shares.

BZ Edge Rankings: Find out where other stocks stand—explore the full comparison now.

Read This Next:

Photo via Shutterstock

Contact Us

Contact Number : +852 3852 8500Monday 7:00 AM - Saturday 9:00 AM (HKT)

Service Email : service@webull.hkOnline Support: Monday - Friday: 9:00 - 16:00; 22:30 - 5:00 (HKT)

Business Cooperation : marketinghk@webull.hkRisk Disclosure: The content of this page is not an investment advice and does not constitute any offer or solicitation to offer or recommendation of any investment product. It is for general purposes only and does not take into account your individual needs, investment objectives and specific financial circumstances. All investments involve risk and the past performance of securities, or financial products does not guarantee future results or returns. Keep in mind that while diversification may help spread risk it does not assure a profit, or protect against loss, in a down market. There is always the potential of losing money when you invest in securities, or other financial products. Investors should consider their investment objectives and risks carefully before investing. For more details, please refer to risk disclosure.

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

Language

English

©2025 Webull Securities Limited. All rights reserved.