TrueCar And 2 Other Promising Penny Stocks For Your Consideration

As the U.S. stock market navigates a volatile landscape, with major indexes ending mostly higher despite ongoing economic uncertainties, investors are exploring diverse opportunities to maximize their portfolios. Penny stocks, often associated with smaller or newer companies, remain an intriguing investment avenue due to their potential for significant returns when backed by solid financials. Despite the term's vintage connotation, these stocks can offer both affordability and growth potential; in this article, we will explore several penny stocks that stand out for their financial strength and potential long-term value.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $1.86 | $387.89M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.86 | $647.38M | ✅ 4 ⚠️ 0 View Analysis > |

| CuriosityStream (CURI) | $4.76 | $275.17M | ✅ 4 ⚠️ 2 View Analysis > |

| WM Technology (MAPS) | $1.14 | $189.83M | ✅ 4 ⚠️ 2 View Analysis > |

| Global Self Storage (SELF) | $4.93 | $55.56M | ✅ 5 ⚠️ 1 View Analysis > |

| Performance Shipping (PSHG) | $1.8401 | $23.5M | ✅ 4 ⚠️ 2 View Analysis > |

| CI&T (CINT) | $4.26 | $554.22M | ✅ 5 ⚠️ 0 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| BAB (BABB) | $0.9848 | $6.97M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.61 | $77.26M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 357 stocks from our US Penny Stocks screener.

Let's uncover some gems from our specialized screener.

TrueCar (TRUE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: TrueCar, Inc. is an internet-based company in the United States providing information, technology, and communication services with a market cap of $130.89 million.

Operations: TrueCar generates revenue from its Internet Information Providers segment, amounting to $184.56 million.

Market Cap: $130.89M

TrueCar, Inc. is navigating the penny stock landscape with a market cap of US$130.89 million and revenue of US$184.56 million from its Internet Information Providers segment. Despite being debt-free, TrueCar remains unprofitable with increased losses over five years and negative return on equity at -27.68%. Recent developments include a definitive agreement for acquisition by Scott Painter for approximately US$260 million, pending shareholder approval and regulatory conditions, expected to close late 2025 or early 2026. This strategic move aims to refocus on profitable growth and industry alignment under Painter’s leadership upon completion.

- Click to explore a detailed breakdown of our findings in TrueCar's financial health report.

- Understand TrueCar's earnings outlook by examining our growth report.

FutureFuel (FF)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: FutureFuel Corp. manufactures and sells diversified chemical, bio-based fuel, and bio-based specialty chemical products in the United States, with a market cap of $168.20 million.

Operations: The company generates revenue through its Biofuels segment, which accounts for $97.16 million, and its Chemicals segment, contributing $68.70 million.

Market Cap: $168.2M

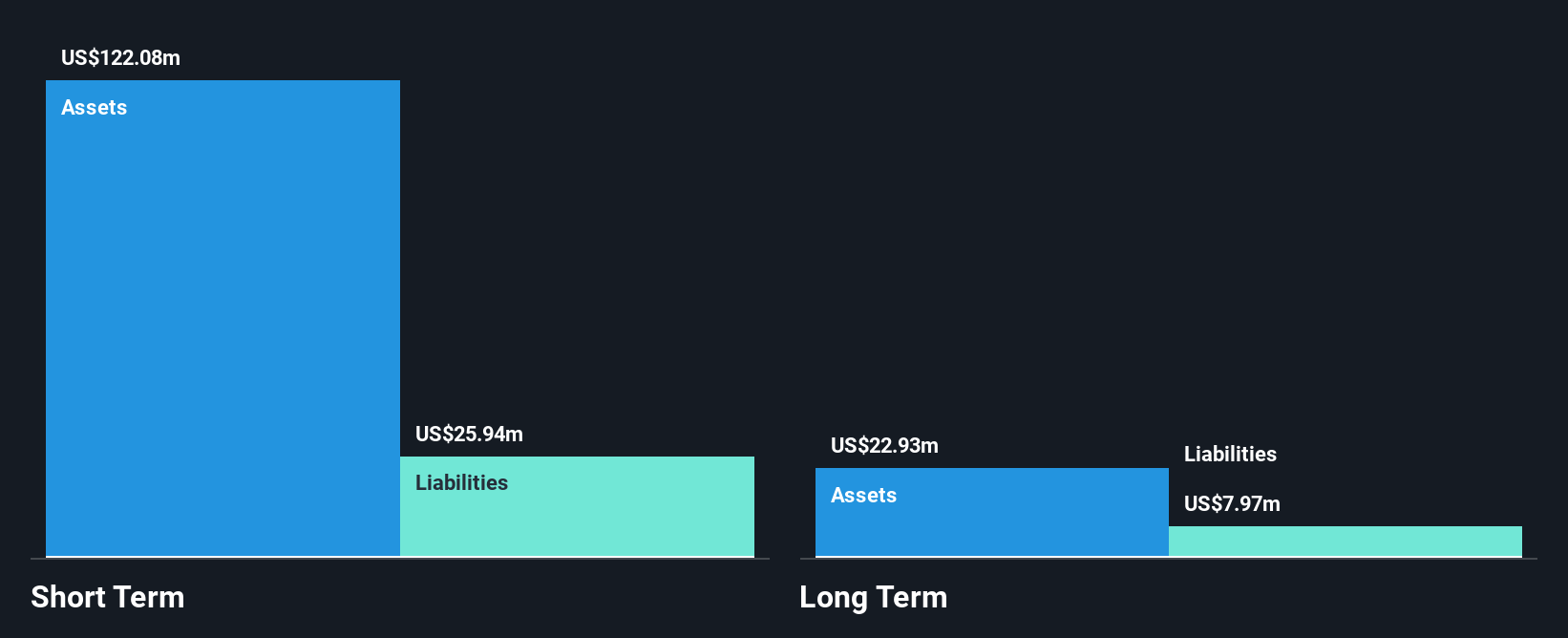

FutureFuel Corp., with a market cap of US$168.20 million, faces challenges typical of penny stocks, including unprofitability and declining earnings over the past five years. Despite being debt-free and having short-term assets exceeding liabilities, FutureFuel's dividend yield of 5.48% is not well supported by earnings or cash flow. Recent business reorganization consolidates operations in Batesville, Arkansas, potentially streamlining costs but coincides with a significant revenue drop to US$35.67 million for Q2 2025 compared to the previous year. Board changes include Terrance C.Z. Egger's retirement, reducing board size to eight members post-annual meeting in November 2025.

- Jump into the full analysis health report here for a deeper understanding of FutureFuel.

- Explore historical data to track FutureFuel's performance over time in our past results report.

Nextdoor Holdings (NXDR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Nextdoor Holdings, Inc. operates a neighborhood network that connects neighbors, businesses, and public agencies both in the United States and internationally, with a market cap of approximately $793.88 million.

Operations: The company generates $250.11 million in revenue from its Internet Information Providers segment.

Market Cap: $793.88M

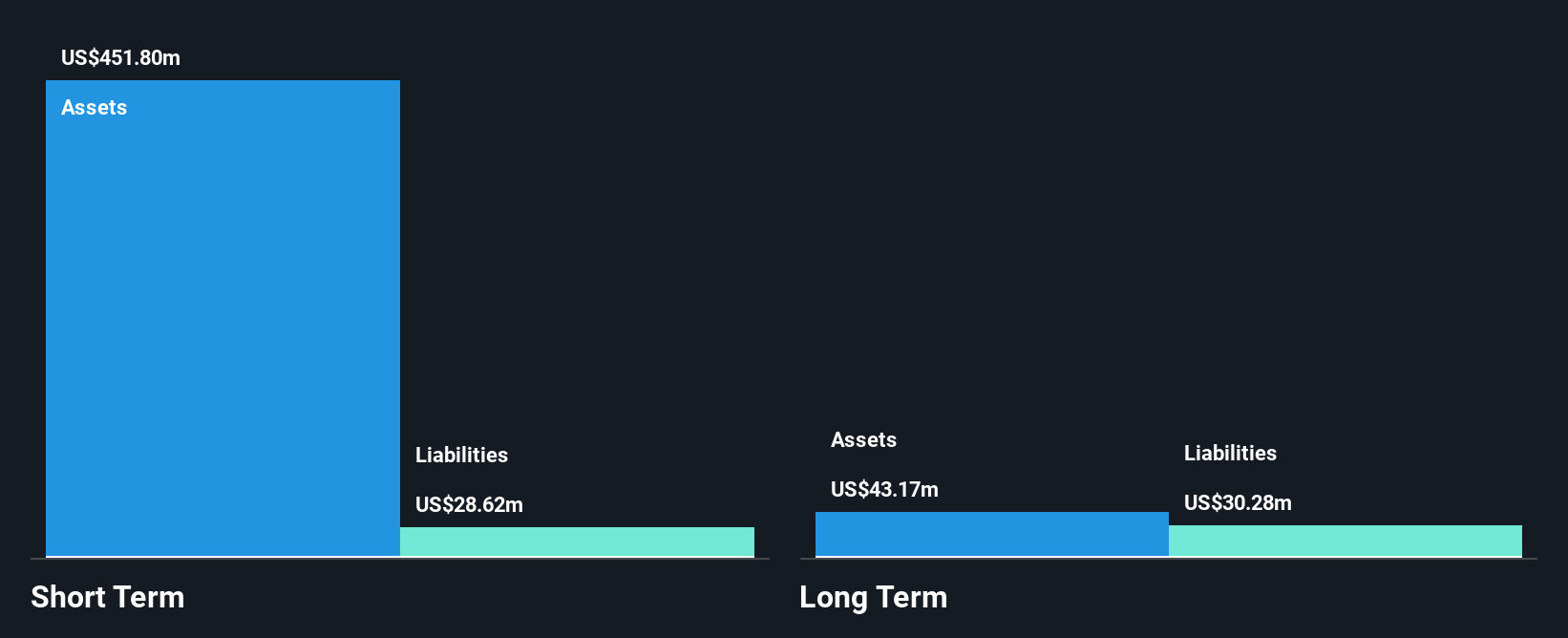

Nextdoor Holdings, Inc., with a market cap of approximately US$793.88 million, operates without debt and has a stable cash runway exceeding three years due to positive free cash flow. Despite being unprofitable and not expected to achieve profitability in the near term, it has managed to reduce its net loss significantly year-over-year. Recent initiatives like the Treat Map enhance community engagement but do not directly impact revenue growth. Management changes include CFO resignation and interim appointments, while restructuring efforts aim to cut annual expenses by US$30 million. The company trades at 43.4% below its estimated fair value with no significant shareholder dilution recently observed.

- Navigate through the intricacies of Nextdoor Holdings with our comprehensive balance sheet health report here.

- Gain insights into Nextdoor Holdings' outlook and expected performance with our report on the company's earnings estimates.

Key Takeaways

- Unlock our comprehensive list of 357 US Penny Stocks by clicking here.

- Searching for a Fresh Perspective? Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English