China Tower (SEHK:788) Profit Margin Improvement Reinforces Bullish Narrative on Earnings Quality

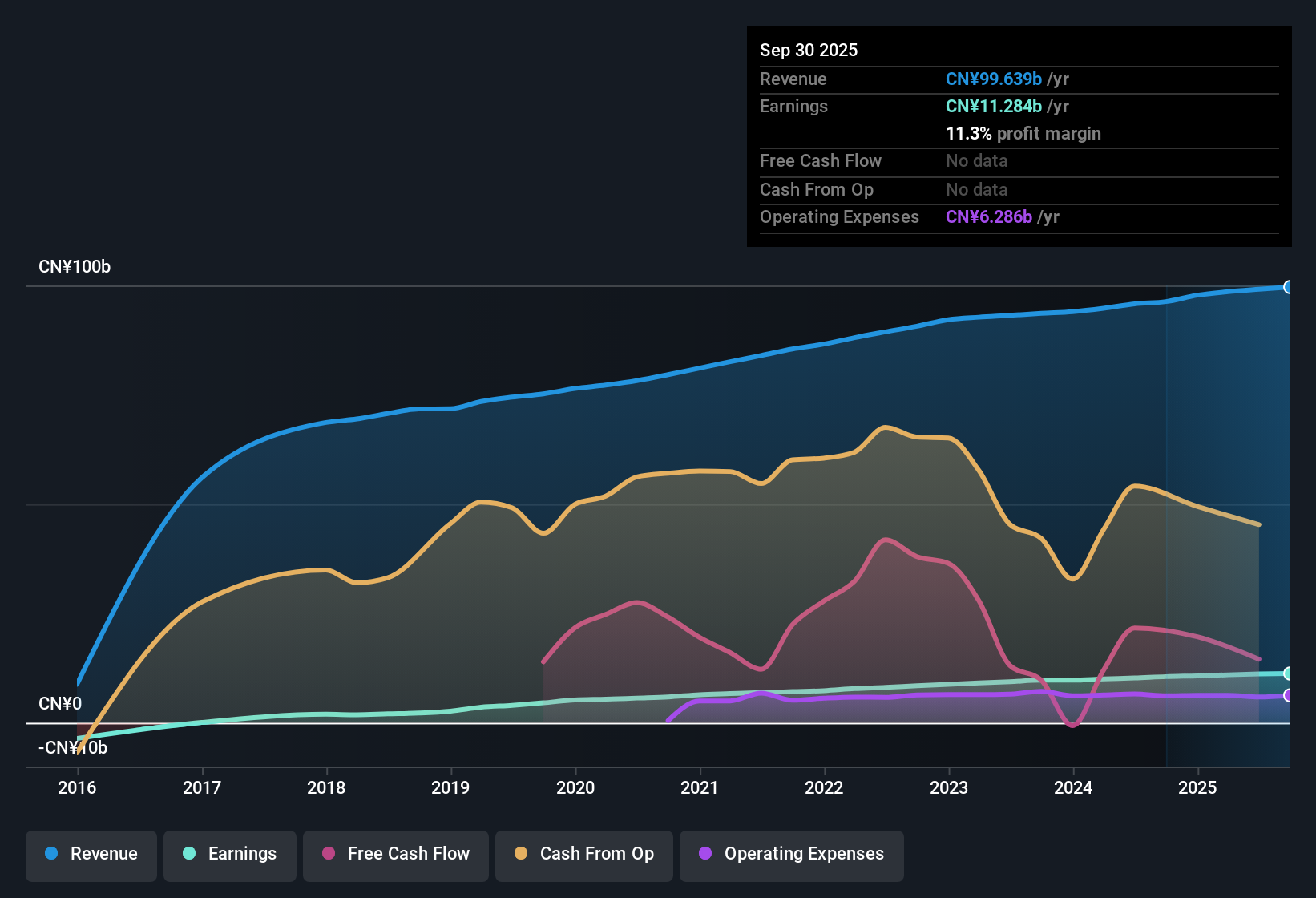

China Tower (SEHK:788) posted an 11.3% net profit margin, up from 11% the previous year, marking its continued earnings momentum with 12.3% annual earnings growth over the past five years. Looking ahead, revenues are forecast to grow 3.6% per year and earnings are expected to surge by 20.3% per year over the next three years. This would outpace the sector earnings average even as revenue growth trails the broader Hong Kong market. Investors are likely to take note of the company’s improved profitability metrics and attractive valuation, including a price-to-earnings ratio of 16.2x that sits below both industry and peer averages.

See our full analysis for China Tower.The next section puts these headline numbers side by side with the consensus narratives investors follow, highlighting where the stories align and where surprises might emerge.

See what the community is saying about China Tower

5G and Digital Infrastructure Power Smart Tower Growth

- “Two Wings” businesses now account for 14% of total revenue and are growing over 15% year-on-year, highlighting diversification into higher-margin digital segments beyond traditional tower leasing.

- Analysts' consensus view highlights that expansion in Smart Tower solutions and integrated digital infrastructure, fueled by China’s 5G rollout and demand for smart campuses and emergency response networks, is expected to deliver new high-margin opportunities and drive positive earnings momentum.

- Rising demand for digital applications is expected to support stable leasing growth; ongoing investment is required to maintain technology leadership.

- Segment diversification could reduce risk from over-reliance on telecom customers and support more stable long-term cash flows according to consensus narrative.

Analysts say robust digital trends are setting up China Tower for its next leap in profitability. See what else drives consensus in the full narrative. 📊 Read the full China Tower Consensus Narrative.

Margin Expansion Backed by Cost Discipline

- Operating cost and CapEx discipline, shown by declining site-related OpEx and lower maintenance costs, is forecast to help net profit margins jump from 11.3% today to 19.8% over the next three years.

- Consensus narrative notes that improved cost efficiency, including reduced site augmentation outlays, will enhance free cash flow and long-term return on capital. This makes China Tower’s earnings quality more durable even if revenue growth lags the broader Hong Kong market.

- Ongoing margin improvement supports analyst expectations of a 20.3% annual earnings increase through 2028, outpacing sector peers.

- Margin stability relies on continued cost restraint and successful scaling of new business segments as traditional tower growth plateaus.

Valuation Discount Versus Peers

- The current share price of 11.40 sits well below the analyst price target of 13.51 and is also less than the DCF fair value of 31.88. The price-to-earnings ratio of 16.2x is lower than both the Asia telecom industry average (14.0x) and peer group metrics.

- Analysts' consensus view underscores that investors are seeing a potential value opportunity, as quality earnings growth and margin expansion combine with a below-average PE and discounted trading level relative to the sector.

- Consensus expects sustained earnings performance to potentially justify a higher share price, provided diversification and cost control targets are met.

- Room for re-rating exists if new digital businesses scale smoothly, but analyst views are divided with price targets ranging from 13.51 to more bullish or defensive outlooks, creating tension around fair value expectations.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for China Tower on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think there’s another way to look at the numbers? Share your perspective and shape your personal story in just a few minutes by using Do it your way

A great starting point for your China Tower research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Explore Alternatives

While China Tower is posting rapid earnings growth, its revenue expansion is trailing the broader market and is highly dependent on successfully scaling new digital businesses.

If you want more dependable revenue and earnings progress, focus your research on companies known for steady consistency by exploring stable growth stocks screener (2097 results) that deliver reliable results across cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English