Can Interactive Brokers' (IBKR) AI Investments Sustain Its Competitive Edge as Trading Activity Accelerates?

- Interactive Brokers Group reported third-quarter 2025 results, posting net income of US$263 million compared to US$184 million a year ago, alongside robust growth in client accounts and trading activity, and the continued rollout of innovative AI and tax planning tools on its trading platforms.

- The launch of new AI-powered portfolio analysis features, combined with strong financial results and higher commission revenue, highlights Interactive Brokers’ ongoing investment in technology to enhance client engagement and operational efficiency.

- We'll now examine how the surge in trading activity and innovative product launches shape Interactive Brokers' investment narrative.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

Interactive Brokers Group Investment Narrative Recap

To be a shareholder of Interactive Brokers Group, you need to believe in the continued rise of active trading, global account growth, and the company's commitment to technology-driven brokerage services. The latest quarterly results showed strong net income and client engagement, reinforcing trading activity as the key short-term catalyst. However, the intensifying competition within the brokerage sector remains the biggest risk, and the Q3 update does not fundamentally change that picture.

Among the recent announcements, the launch of Ask IBKR, the AI-powered portfolio analytics tool, directly supports Interactive Brokers’ push to enhance client engagement and retain active investors, aligning well with the surge in trading volume. This innovation complements the company’s focus on delivering new features seen as crucial for maintaining momentum in commission-generating activity.

But in contrast, investors should be aware that persistent competition and the risk of declining business activity during quieter markets could...

Read the full narrative on Interactive Brokers Group (it's free!)

Interactive Brokers Group's narrative projects $5.9 billion in revenue and $740.3 million in earnings by 2028. This requires 5.9% yearly revenue growth and a $42.3 million increase in earnings from $698.0 million today.

Uncover how Interactive Brokers Group's forecasts yield a $67.44 fair value, in line with its current price.

Exploring Other Perspectives

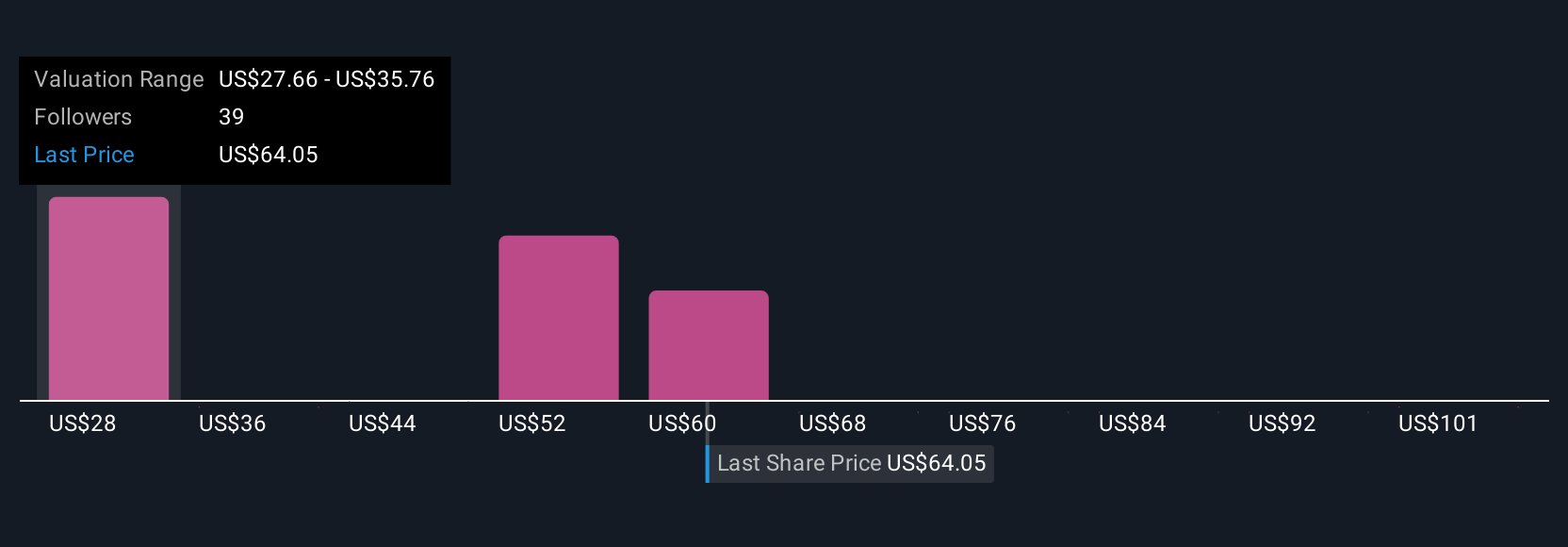

Nine community estimates on fair value for Interactive Brokers Group range from US$28.94 to US$74.60, reflecting a wide spectrum of investor views. The current boost in trading activity and account growth highlights how differing expectations on market volatility can shape the outlook for future revenue.

Explore 9 other fair value estimates on Interactive Brokers Group - why the stock might be worth as much as 9% more than the current price!

Build Your Own Interactive Brokers Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Interactive Brokers Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Interactive Brokers Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Interactive Brokers Group's overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English