Interactive Brokers (IBKR) Profit Growth Outpaces Five-Year Trend, Reinforcing Bullish Narratives

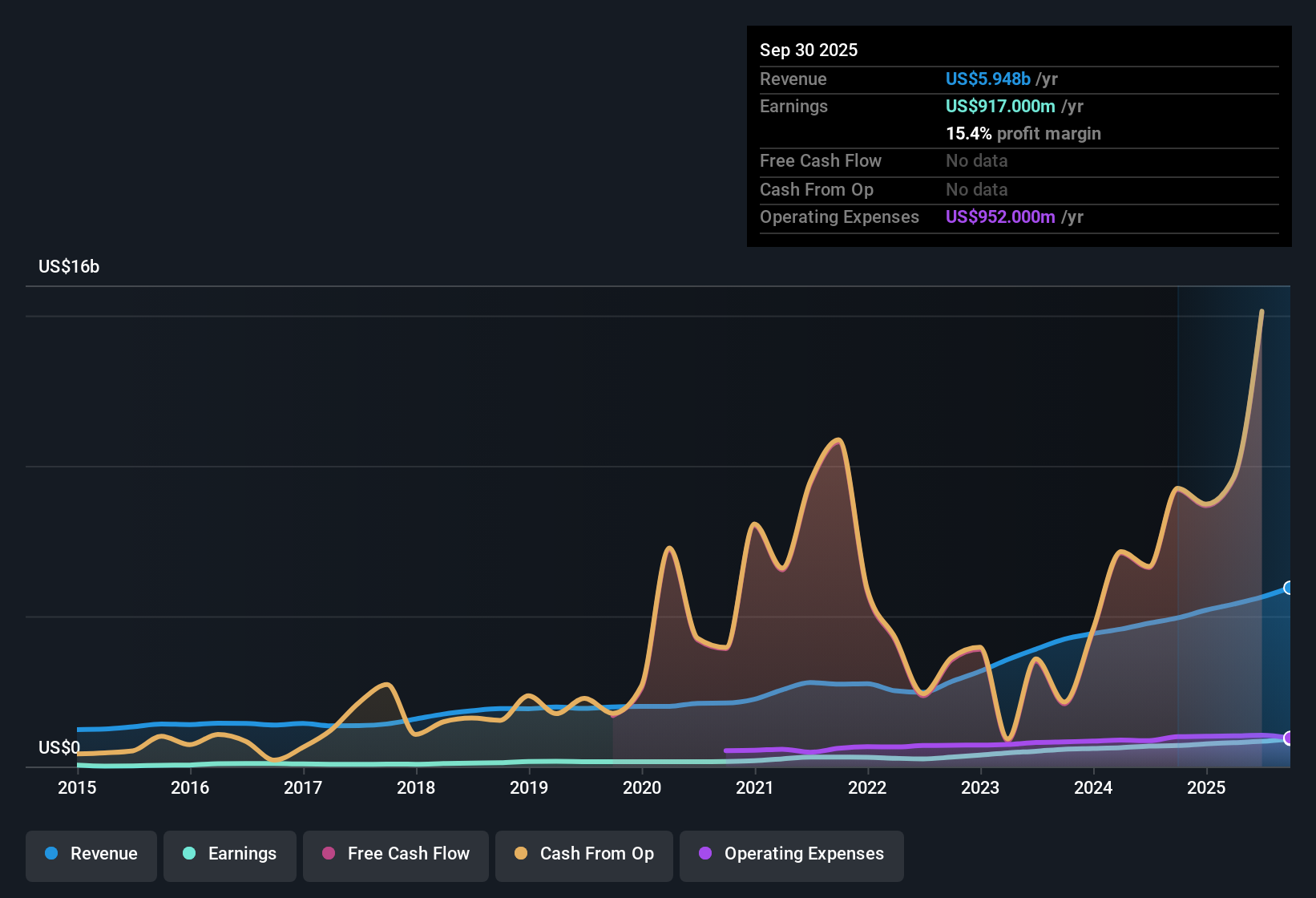

Interactive Brokers Group (IBKR) reported a 31.4% increase in earnings over the past year, well ahead of its five-year average annual growth of 29.8%. Net profit margins also improved to 15.4%, rising from last year’s 14.1%, underscoring the company’s consistently high-quality earnings. With analysts forecasting annual revenue growth of 4.1% and projected EPS growth of 10.08% moving forward, the numbers show that profitability is still the company’s highlight. However, expectations for future growth now trail the broader US market’s 15.6% rate.

See our full analysis for Interactive Brokers Group.The next section will dig into how these results stack up against the narratives investors have been following. Some long-held views could be reinforced, while others might get challenged by the latest data.

See what the community is saying about Interactive Brokers Group

Premium Valuation Versus Peers

- Interactive Brokers’ price-to-earnings ratio stands at 32.2x, which is meaningfully above both the US Capital Markets industry average of 25.4x and the peer average of 29.5x.

- According to the analysts' consensus view, the company’s valuation premium is justified in part by its record $107.1 billion client credit balances and strong new account growth. However, this also sets high expectations for delivery.

- The stock’s current share price of $66.23 is also substantially above the DCF fair value estimate of $36.14, raising questions around future upside if growth stalls.

- Consensus narrative notes that to meet current price targets, investors would need to believe in the sustainability of new product launches, successful international expansions, and above-industry profit margins.

What drives the consensus view on IBKR’s growth and risk balance? Find out what’s behind the diverging narrative and where the numbers point next. 📊 Read the full Interactive Brokers Group Consensus Narrative.

Net Margins Set a High Bar

- Net profit margins have climbed to 15.4% from last year's 14.1%, further outpacing the 12.6% margin analysts forecast for three years ahead.

- Analysts' consensus narrative emphasizes that steady high margins are a powerful support for potential earnings growth. However, these will be tested as expansion risks and the reliance on trading volumes could pressure margins in less bullish market cycles.

- Consensus also highlights the risks of international expansion and the challenge of sustaining above-industry profit margins as competitors invest and expand.

- Expectations are for margins to moderate, not improve. Any margin compression would quickly feed into valuation pressures at a premium multiple.

Forecast Growth Lags Market Pace

- Despite recent momentum, Interactive Brokers’ forecast annual revenue growth of 4.1% and EPS growth of 10.08% both fall short of the 15.6% average growth rate projected for the broader US market.

- Consensus narrative notes that continued expansion in trading products, an uptick in net interest income, and new global partnerships like HSBC WorldTrader are intended to offset these slower headline growth figures.

- However, critics highlight the risk that market volatility or rate cuts could dampen trading volumes and net interest gains, exposing revenue to shortfall versus more diversified industry peers.

- This slower forecast makes meeting the analysts’ price target even more dependent on strategic execution, rather than underlying industry momentum.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Interactive Brokers Group on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think the story looks different through your lens? Take just a few minutes to share your perspective and shape your own view. Do it your way

A great starting point for your Interactive Brokers Group research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

While Interactive Brokers Group boasts high profit margins, its slowing revenue and earnings growth trail the broader market and could limit future upside.

Looking for companies that offer better value for their price? Our these 878 undervalued stocks based on cash flows helps you uncover opportunities where strong fundamentals meet more attractive valuations today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English