Why Is Beneficient Stock Surging Overnight?

Beneficient (NASDAQ:BENF) surged 64.25% to $0.80 in after-hours trading on Tuesday following the announcement that Chairman Thomas O. Hicks and Interim CEO James G. Silk converted preferred shares into common stock.

Check out the current price of BENF stock here.

Executive Conversion Transaction

According to the company's Tuesday statement, Hicks converted about $48 million of Preferred A-1 Unit Accounts of Beneficient Company Holdings, L.P., into Class A common stock, receiving 92.49 million shares.

Silk converted $4.6 million of Preferred A-1 Unit Accounts into 8.81 million shares of Class A common stock.

Nasdaq Listing Compliance

On Oct. 3, Nasdaq informed Beneficient that the company failed to meet the minimum stockholders’ equity requirement under Nasdaq Listing Rule 5550(b)(1).

The Texas-based financial services company is now aiming to comply with the market value of listed securities rule, Nasdaq Listing Rule 5550(b)(2), which requires an MVLS of $35 million or more.

See Also: Why Is Beyond Meat Soaring After Hours?

Lock-Up Agreement Provisions

The executives have entered into a voting and lock-up agreement, which requires that the converted shares remain locked until Oct. 1, 2028, according to the company.

First Quarter Results

In a separate Tuesday announcement, Beneficient reported its fiscal 2026 first-quarter results for the period ended on June 30.

The company's investments had a fair value of $263.8 million, down from $291.4 million at the previous fiscal year-end. Operating expenses totaled $80 million, which included a $62.8 million loss contingency accrual.

The company completed asset sales, generating $38.1 million in gross proceeds, and executed three primary capital transactions with $11.8 million an initial aggregate value during the quarter.

Stock Performance

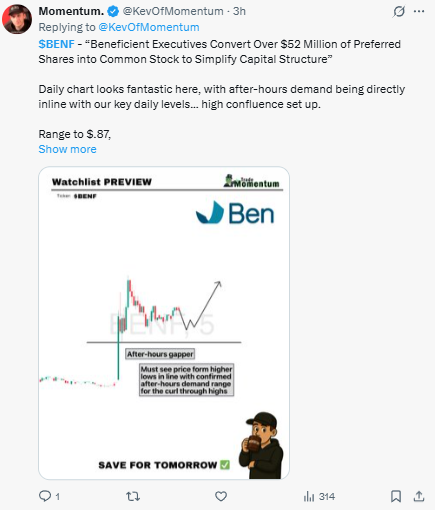

The stock movement drew attention on social media platforms.

Beneficient has experienced a 62.25% loss over the past year but gained 94.80% in the last six months.

The stock has traded within a 52-week range of $0.22 to $2.36, with a market capitalization of $4.71 million, an average volume of 23.72 million shares, and a price-to-earnings ratio of 5.03.

Price Action: Beneficient closed Tuesday at $0.49, down 7.87%, according to Benzinga Pro data.

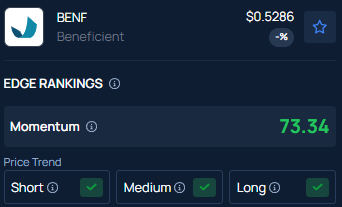

With Momentum in the 73rd percentile, Benzinga’s Edge Stock Rankings indicate that BENF has a positive price trend across all time frames. Know how its momentum lines up with other well-known names.

Read Next:

Photo Courtesy: Jose Mario Bertero on Shutterstock.com

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English