Will Upgraded Analyst Outlooks and Policy Tailwinds Shift SolarEdge Technologies' (SEDG) Narrative?

- In recent days, several major financial institutions raised their outlooks on SolarEdge Technologies, reflecting optimism about the alternative energy sector amid ongoing favorable policy support in the U.S. and Europe.

- This wave of analyst updates signals that confidence in the sector's long-term prospects remains strong, even as SolarEdge continues to encounter operational and financial challenges.

- We'll explore how this coordinated analyst optimism, fueled by supportive sector policies, influences SolarEdge's current investment thesis and future outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

SolarEdge Technologies Investment Narrative Recap

To be a shareholder in SolarEdge Technologies, you need to believe in a recovery story driven by supportive U.S. and European policy, ongoing sector-wide demand for solar and storage, and the company’s ability to work through financial and operational headwinds. Recent positive analyst updates underline that sector optimism remains resilient, but these updates have not altered the most important short-term catalyst, improving cash flows through inventory normalization, or the key risk, which is weak profitability and ongoing financial distress. The impact of recent price target increases is more about restoring confidence than changing the business outlook.

Among recent announcements, SolarEdge’s launch of international shipments of domestically produced solar products stands out, signaling progress in leveraging U.S. policy benefits to strengthen its global manufacturing footprint, a key industry catalyst. This move supports the narrative that backing from government incentives can translate into product and margin improvements, but positive analyst updates have not resolved the pressures on earnings, cash flow, and profitability that remain at the heart of the investment debate.

By contrast, the company’s financial position, including concerns flagged by its low Piotroski F-Score and distressed Altman Z-Score, is information investors should be aware of...

Read the full narrative on SolarEdge Technologies (it's free!)

SolarEdge Technologies is projected to reach $1.6 billion in revenue and $11.8 million in earnings by 2028. This outlook is based on a 20.6% annual revenue growth rate and represents an increase in earnings of about $1.7 billion from the current loss of $-1.7 billion.

Uncover how SolarEdge Technologies' forecasts yield a $25.10 fair value, a 35% downside to its current price.

Exploring Other Perspectives

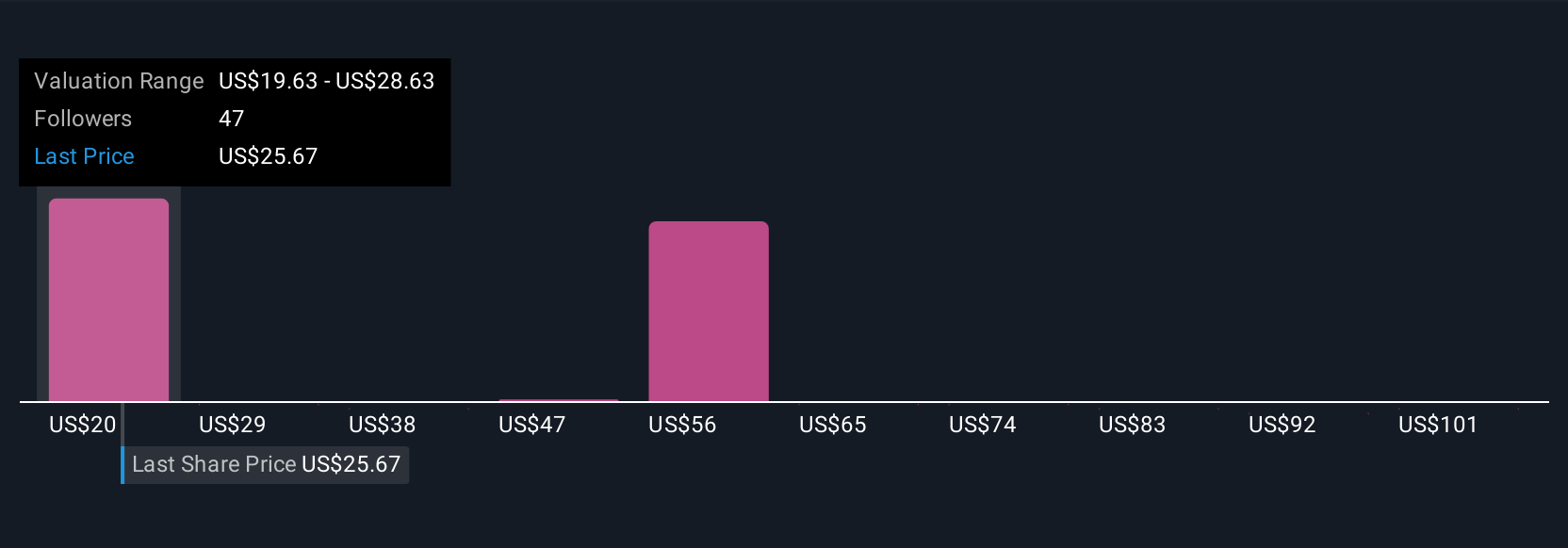

Sixteen fair value estimates from the Simply Wall St Community span US$25.10 to US$90.47, highlighting sharply different outlooks for SolarEdge. In light of ongoing policy support and sector momentum, investors may want to compare these perspectives as the company works toward stabilizing cash flow and margins.

Explore 16 other fair value estimates on SolarEdge Technologies - why the stock might be worth 35% less than the current price!

Build Your Own SolarEdge Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SolarEdge Technologies research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free SolarEdge Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SolarEdge Technologies' overall financial health at a glance.

Ready For A Different Approach?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English