GEO Group (GEO): Evaluating Valuation After Major Florida Facility Expansion

GEO Group (GEO) recently announced it is entering a joint venture to take over management of the 1,310-bed North Florida Detention Facility in Baker County, Florida. Serving as lead manager, GEO takes on a new contract with the state that expands its operational reach in the Southeast.

See our latest analysis for GEO Group.

GEO Group’s big move in Florida comes after a volatile few months for the stock. While the short-term share price return is down significantly, dropping nearly 20% in the past month alone, longer-term, total shareholder returns paint a very different picture: up over 100% in three years, with a 12% gain over the past year. This momentum shift hints at renewed investor focus on the company’s future growth prospects as it expands its operational footprint.

If you’re interested in finding the next potential outperformer, now’s a good time to expand your search and discover fast growing stocks with high insider ownership

This expansion brings up a timely question for investors: with GEO Group’s operational gains and recent stock volatility, is there real value left on the table or is the market already factoring in all the future growth?

Most Popular Narrative: 55% Undervalued

GEO Group’s most popular narrative sets a fair value target that is more than double its last close price, suggesting that the market is missing something significant as shares trade at $17.47 while the narrative puts fair value at $39.00. The narrative bases this outlook on future growth levers and a pipeline of facility activations.

The recent surge in federal funding for immigration enforcement and detention, $171 billion for border security, $45 billion earmarked for ICE detention, and multi-year discretionary spending authority creates a multi-year runway for substantial increases in facility activations, utilization, and new contract wins. These factors directly drive top-line revenue growth and EBITDA expansion through to at least 2029.

Curious about what’s fueling this price gap? The narrative hints at an ambitious roadmap built on sustained growth, margin expansion, and powerful industry tailwinds. Some key underlying forecasts might surprise you. Dive in to uncover the projections that could reshape GEO’s valuation story.

Result: Fair Value of $39.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a reversal in immigration policy or stagnation in ICE program growth could sharply curtail GEO’s revenue outlook and challenge the optimistic valuation narrative.

Find out about the key risks to this GEO Group narrative.

Another View: The Multiples Comparison

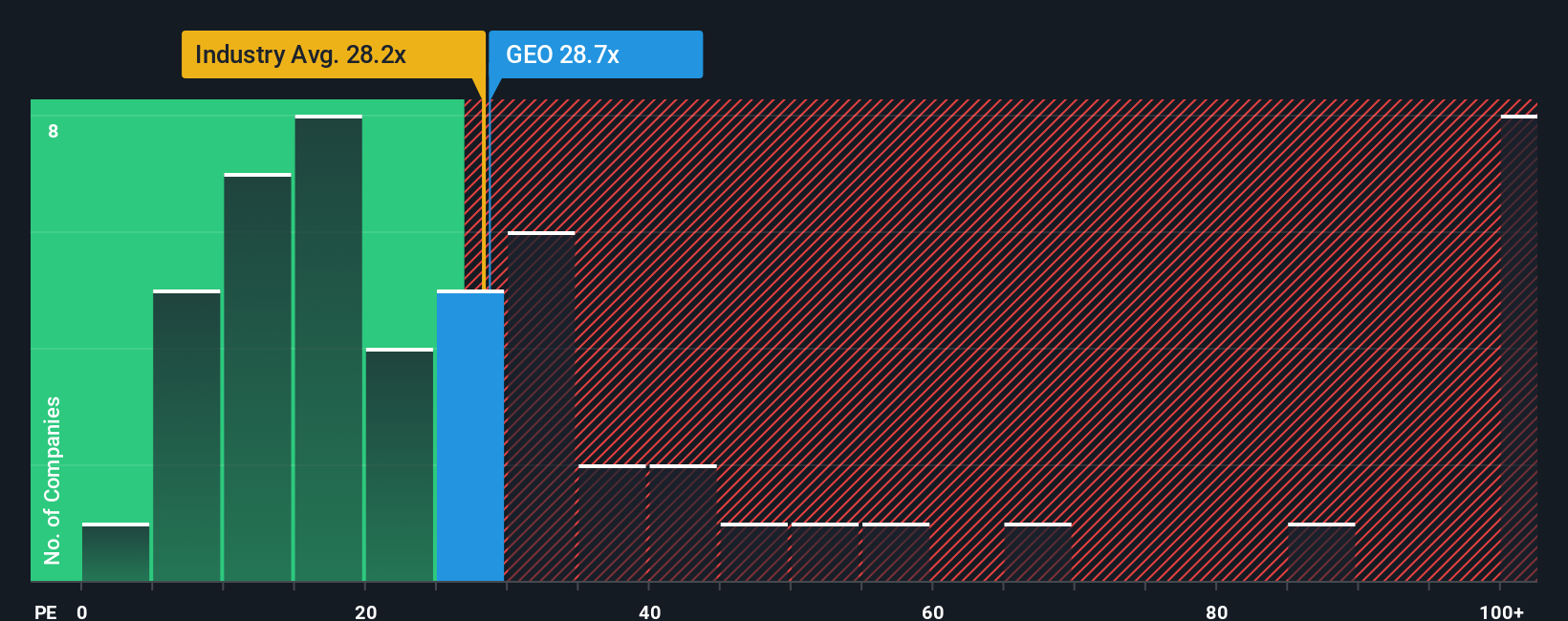

While fair value estimates indicate that GEO may be deeply undervalued, its price-to-earnings ratio presents a different perspective. GEO trades at 27.4x earnings, higher than its peer average of 21.5x and in line with the overall industry at 27.4x. The fair ratio could reach up to 51x, which may imply potential for upward re-rating; however, the current premium also raises questions about valuation risk. The market may be factoring in potential positive developments or pricing in future uncertainty.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own GEO Group Narrative

If you want to dig deeper or would rather chart your own course, you can easily craft a personal take on GEO's outlook in just a few minutes with Do it your way.

A great starting point for your GEO Group research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t limit yourself to just one opportunity. With the right insights, you can get ahead of the crowd and spot tomorrow’s winning stocks today.

- Target hidden gems with explosive upside when you investigate these 3575 penny stocks with strong financials thriving on financial strength and real growth potential.

- Capitalize on the rise of automation by putting these 25 AI penny stocks at the heart of your future-focused strategy as artificial intelligence reshapes entire industries.

- Boost your passive income and stability by checking out these 17 dividend stocks with yields > 3% that deliver yields stronger than 3% for a reliable edge in any market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English