While shareholders of Eastman Kodak (NYSE:KODK) are in the black over 1 year, those who bought a week ago aren't so fortunate

Passive investing in index funds can generate returns that roughly match the overall market. But investors can boost returns by picking market-beating companies to own shares in. For example, the Eastman Kodak Company (NYSE:KODK) share price is up 35% in the last 1 year, clearly besting the market return of around 17% (not including dividends). So that should have shareholders smiling. However, the longer term returns haven't been so impressive, with the stock up just 14% in the last three years.

Since the long term performance has been good but there's been a recent pullback of 9.1%, let's check if the fundamentals match the share price.

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Over the last twelve months Eastman Kodak went from profitable to unprofitable. While some may see this as temporary, we're a skeptical bunch, and so we're a little surprised to see the share price go up. We might get a clue to explain the share price move by looking to other metrics.

Revenue was pretty stable on last year, so deeper research might be needed to explain the share price rise.

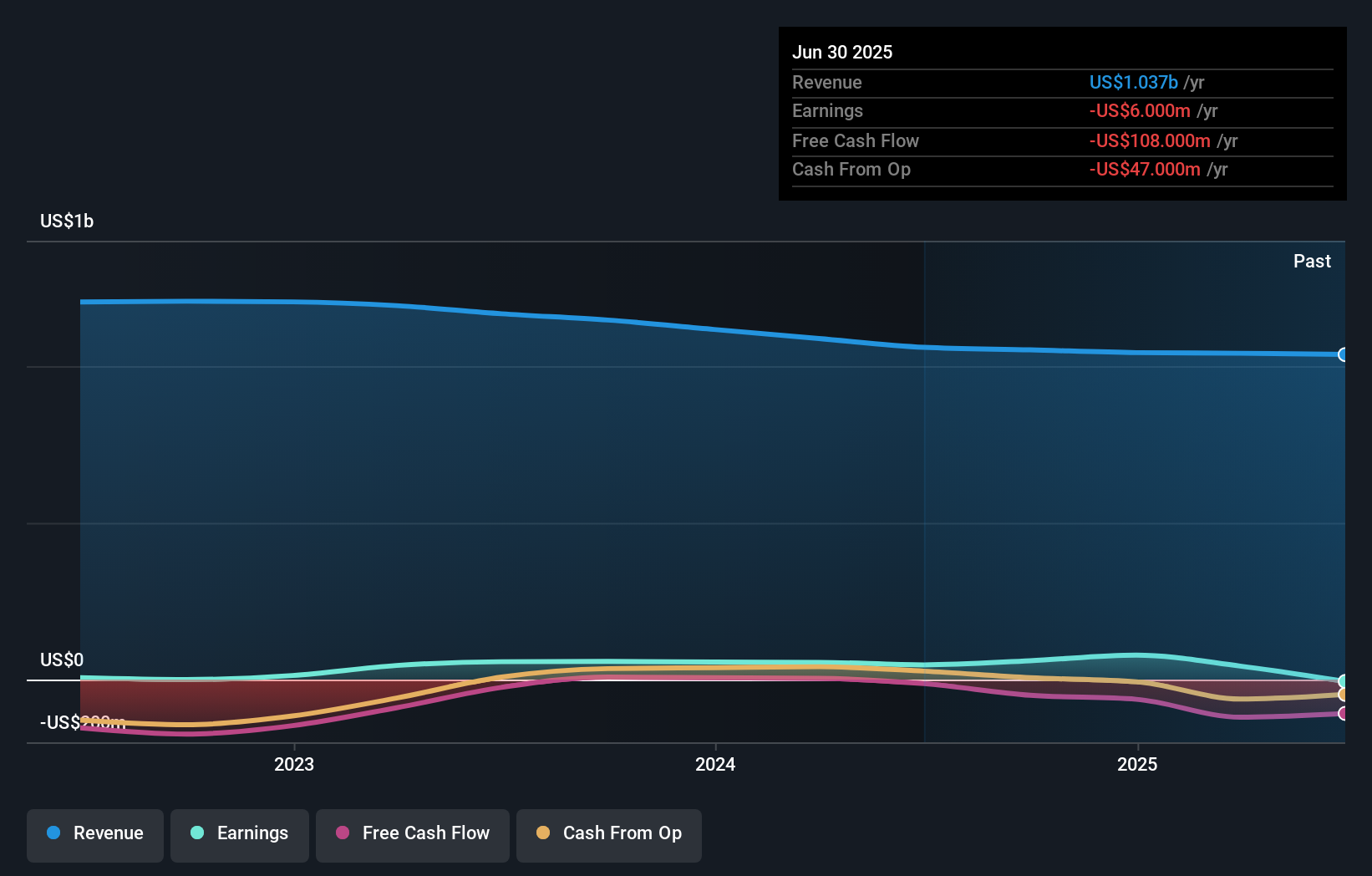

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

It's good to see that there was some significant insider buying in the last three months. That's a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. Dive deeper into the earnings by checking this interactive graph of Eastman Kodak's earnings, revenue and cash flow.

A Different Perspective

It's good to see that Eastman Kodak has rewarded shareholders with a total shareholder return of 35% in the last twelve months. That certainly beats the loss of about 2% per year over the last half decade. This makes us a little wary, but the business might have turned around its fortunes. It's always interesting to track share price performance over the longer term. But to understand Eastman Kodak better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for Eastman Kodak you should know about.

Eastman Kodak is not the only stock that insiders are buying. For those who like to find lesser know companies this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English