Does ZONQING Environmental (HKG:1855) Have A Healthy Balance Sheet?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that ZONQING Environmental Limited (HKG:1855) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

How Much Debt Does ZONQING Environmental Carry?

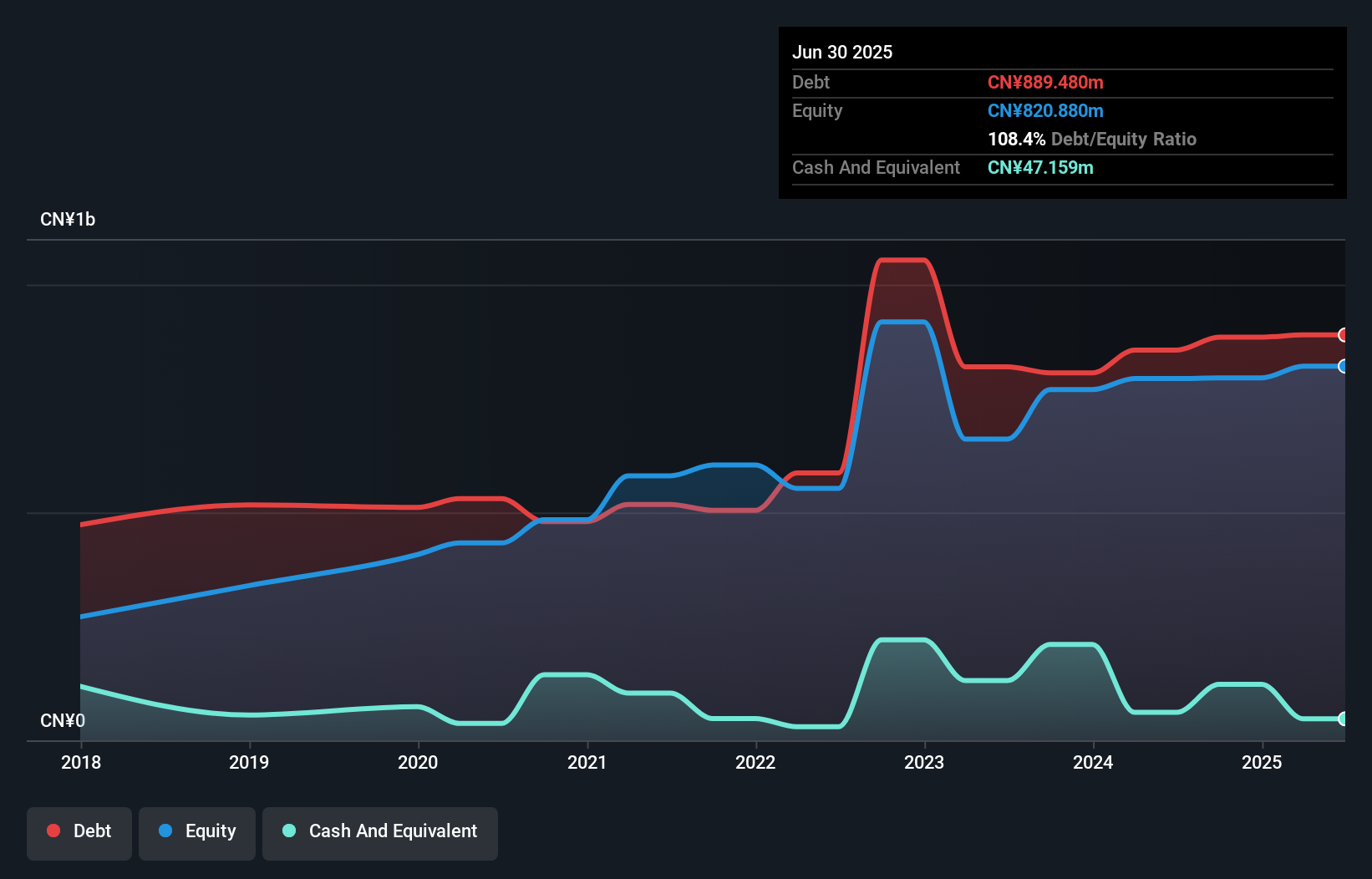

The chart below, which you can click on for greater detail, shows that ZONQING Environmental had CN¥889.5m in debt in June 2025; about the same as the year before. However, it does have CN¥47.2m in cash offsetting this, leading to net debt of about CN¥842.3m.

How Healthy Is ZONQING Environmental's Balance Sheet?

We can see from the most recent balance sheet that ZONQING Environmental had liabilities of CN¥3.69b falling due within a year, and liabilities of CN¥6.15m due beyond that. Offsetting these obligations, it had cash of CN¥47.2m as well as receivables valued at CN¥3.52b due within 12 months. So it has liabilities totalling CN¥122.7m more than its cash and near-term receivables, combined.

Of course, ZONQING Environmental has a market capitalization of CN¥2.21b, so these liabilities are probably manageable. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward.

See our latest analysis for ZONQING Environmental

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Weak interest cover of 2.4 times and a disturbingly high net debt to EBITDA ratio of 5.4 hit our confidence in ZONQING Environmental like a one-two punch to the gut. The debt burden here is substantial. Worse, ZONQING Environmental's EBIT was down 42% over the last year. If earnings keep going like that over the long term, it has a snowball's chance in hell of paying off that debt. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since ZONQING Environmental will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we always check how much of that EBIT is translated into free cash flow. During the last three years, ZONQING Environmental generated free cash flow amounting to a very robust 82% of its EBIT, more than we'd expect. That puts it in a very strong position to pay down debt.

Our View

ZONQING Environmental's EBIT growth rate and net debt to EBITDA definitely weigh on it, in our esteem. But its conversion of EBIT to free cash flow tells a very different story, and suggests some resilience. We think that ZONQING Environmental's debt does make it a bit risky, after considering the aforementioned data points together. Not all risk is bad, as it can boost share price returns if it pays off, but this debt risk is worth keeping in mind. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 2 warning signs for ZONQING Environmental (1 is concerning!) that you should be aware of before investing here.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English