Can Mettler-Toledo (MTD) Sustain Its Market Leadership Ahead of Third-Quarter Earnings?

- Mettler-Toledo International recently announced it will report its fiscal third-quarter 2025 earnings after market close on November 6, with analysts expecting profit growth and continued strong performance.

- The company’s dominance in the precision weighing instrumentation market and consistently strong financial strength underscore its reputation for operational consistency and market leadership.

- We'll explore how anticipation around Mettler-Toledo's upcoming earnings and its record of exceeding analyst expectations impact its investment narrative.

Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

Mettler-Toledo International Investment Narrative Recap

Owning shares in Mettler-Toledo International today means believing in the company's ability to leverage its leadership in precision instrumentation and navigate persistent macroeconomic uncertainties, such as tariffs and softer end-markets, to deliver consistent profitability and margin recovery. The latest news about the fiscal third-quarter earnings date aligns with the key short-term catalyst, further clarity on profit growth and margin trends, yet does not materially alter the biggest risk: a prolonged period of weak organic revenue growth in key geographies.

Among the recent company announcements, the updated guidance for Q3 2025, anticipating a 3% to 4% increase in local currency sales, is most pertinent to this context. Steady sales growth guidance supports investor expectations heading into the upcoming results, but does little to alleviate concerns around the ongoing softness in organic demand cycles, especially in markets like China and Europe.

However, investors should also understand the risk that ongoing demand uncertainty in these key regions means their assumptions about near-term recovery may...

Read the full narrative on Mettler-Toledo International (it's free!)

Mettler-Toledo International's outlook anticipates $4.4 billion in revenue and $1.0 billion in earnings by 2028. This scenario assumes 4.5% annual revenue growth and a $170 million increase in earnings from the current $829.8 million.

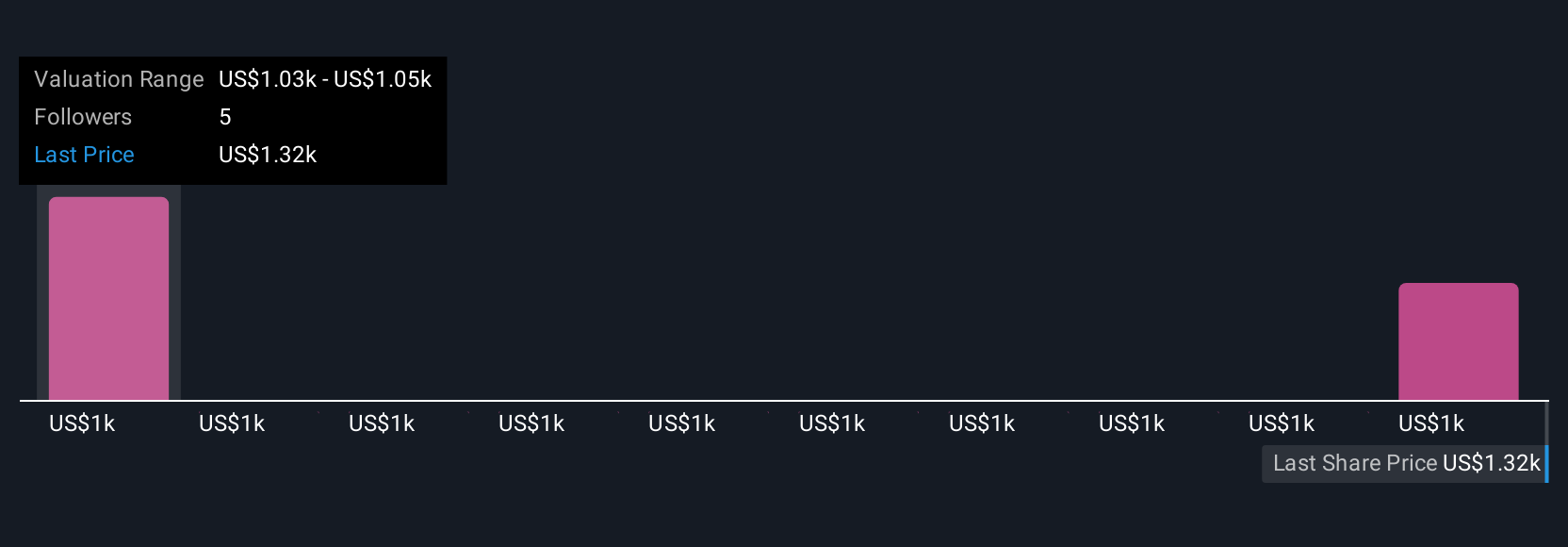

Uncover how Mettler-Toledo International's forecasts yield a $1328 fair value, a 8% downside to its current price.

Exploring Other Perspectives

Simply Wall St Community members offered two unique fair value estimates for Mettler-Toledo International, ranging from US$997 to US$1,328 per share. While opinions differ, the company’s slower revenue growth and exposure to shifting global demand may continue to shape expectations for future performance.

Explore 2 other fair value estimates on Mettler-Toledo International - why the stock might be worth 31% less than the current price!

Build Your Own Mettler-Toledo International Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mettler-Toledo International research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Mettler-Toledo International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mettler-Toledo International's overall financial health at a glance.

Interested In Other Possibilities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English