Gentex (GNTX) Margin Dip Reinforces Value Narrative Versus Peers This Earnings Season

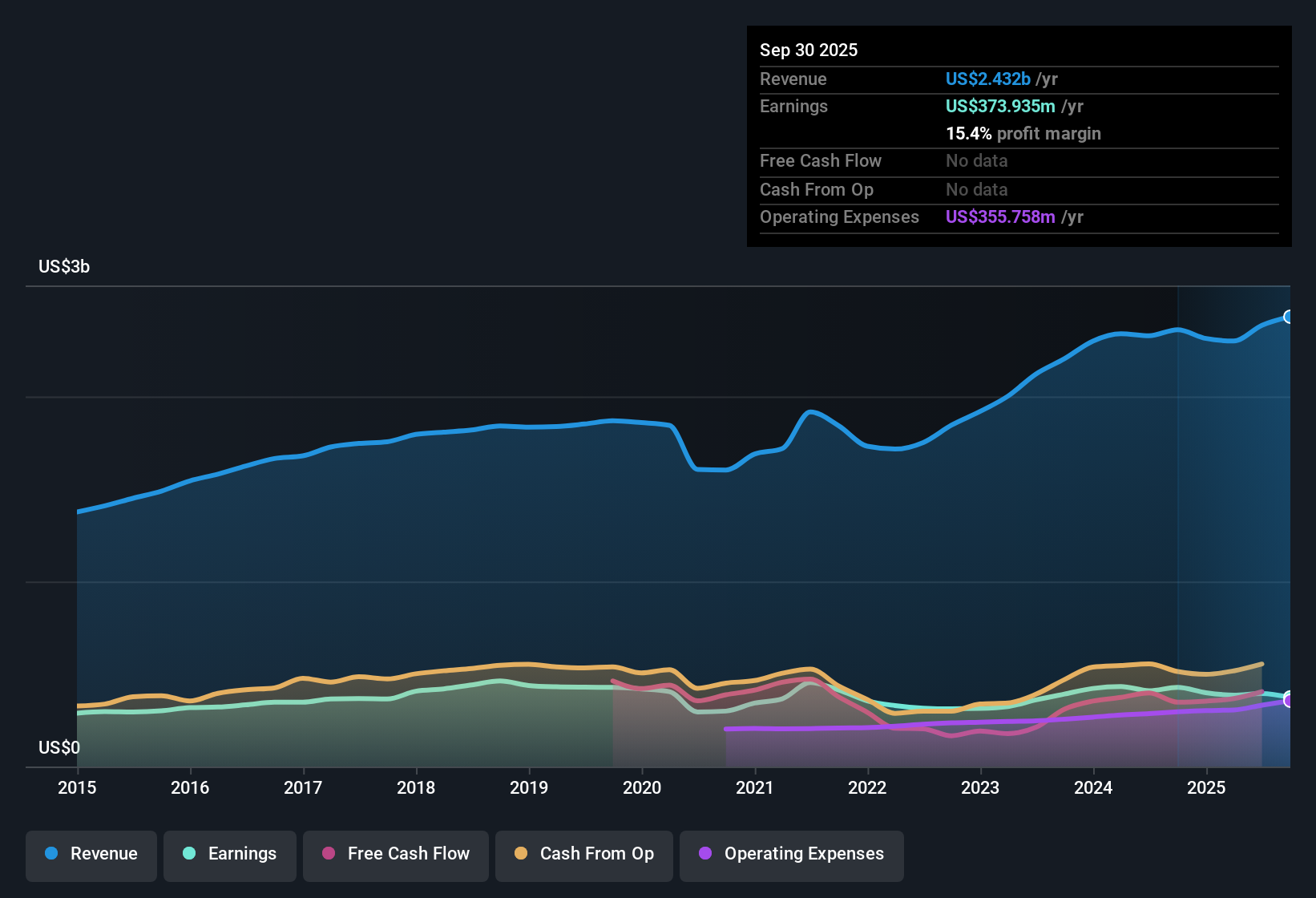

Gentex (GNTX) closed the period with net profit margins of 16.6%, showing a slight pullback from last year’s 17.6%. While five-year earnings have grown at a steady 3.7% annual pace, management now forecasts earnings to accelerate by 12.3% per year and revenue by 6.4% per year. Both figures are just below US market averages. With high earnings quality, an attractive dividend, and no significant flagged risks, Gentex’s discounted valuation versus peers may help drive investor interest through earnings season.

See our full analysis for Gentex.Next, we will put these headline numbers side by side with Simply Wall St’s market narratives to see which stories hold up and which might need a rethink.

See what the community is saying about Gentex

Margin Expansion Forecasts Gain Credibility

- Analysts expect Gentex’s profit margins to climb from 16.6% today to 17.9% in three years, suggesting improved operational leverage and product mix as the company integrates new technologies and cost savings programs.

- The analysts' consensus view highlights that Gentex’s ongoing initiatives, such as manufacturing automation, a focus on high-margin products, and targets set after the VOXX acquisition, are seen as catalysts for further margin gains over the next 24 months.

- Consensus notes these improvements reinforce a constructive case for sustained profitability even as the broader US auto components industry faces rising input costs.

- Analysts see the company’s margin progress distinguishing it from peers who are struggling with margin pressure in a competitive sector.

- See how consensus expectations and recent margin trends stack up in the full Gentex Consensus Narrative for more insights. 📊 Read the full Gentex Consensus Narrative.

Valuation Still Lags Fair Value Estimates

- Gentex shares currently trade at $23.64, which is not only well below analyst price targets of $31.13 but also at a steep discount to the DCF fair value of $42.16. This reflects a price-to-earnings ratio of just 13.1x compared to the industry’s 18.5x average.

- The analysts' consensus view argues that this valuation gap, combined with projected revenue of $3.0 billion and earnings of $529.5 million by 2028, signals Gentex remains undervalued given its balance of growth, profitability, and diversification potential.

- Consensus sees discounted valuation as a potential catalyst, especially if the margin improvements and top-line ambitions materialize.

- Despite a muted premium to analyst target ($31.13 vs. $23.64 current), the upside versus DCF fair value stands out and could sway value-focused investors.

Analyst Projections Back Sustained Growth

- Revenue is forecast to grow at 6.4% annually, compared to the US market’s 10%, while earnings growth is called at 12.3% per year. This indicates Gentex is expected to generate steady but slightly lower growth than the broader market.

- The analysts' consensus view emphasizes Gentex’s focus on expansion into new markets and technologies, noting the company’s push into Full Display Mirror and advanced in-cabin systems alongside the VOXX acquisition provide greater earnings diversification and open up new secular growth drivers for the business.

- Analysts highlight that even with automotive sector headwinds, these expansion strategies position Gentex for more consistent revenue streams beyond traditional mirrors.

- The ongoing share repurchase program, with an 18% authorization, is cited as a structural tailwind for earnings per share over the next several years.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Gentex on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Got another take on the data? Share your perspective and shape your own unique narrative in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Gentex.

See What Else Is Out There

Gentex is posting solid profit growth, but its forecast revenue expansion lags the wider US market. This highlights a challenge for investors seeking faster top-line momentum.

If you’re looking for alternatives with proven ability to deliver steady revenue and earnings growth, use stable growth stocks screener (2098 results) to quickly uncover stocks built for reliable performance across market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English