Did Strong Q3 Results and Raised Guidance Just Shift Mobileye (MBLY)'s Investment Narrative?

- Mobileye Global Inc. recently reported third-quarter 2025 earnings, posting revenue of US$504 million and a net loss substantially reduced from the prior year, as well as raising its full-year guidance.

- This improvement was supported by strong shipment growth, increased demand for driver-assist technology, and a major program win for Mobileye's EyeQ6 ADAS with a leading Western automaker.

- We'll examine how Mobileye's raised outlook and accelerating demand for ADAS solutions influence its overall investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Mobileye Global Investment Narrative Recap

To be a Mobileye shareholder, you need confidence in sustained global demand for advanced driver-assist technology and in the company’s ability to translate new design wins into future growth. The recent third-quarter results, highlighted by rising revenue, a sharply reduced net loss, and upgraded full-year guidance, reinforce the short-term catalyst of accelerating ADAS shipments, while showing little immediate impact on major risks like global vehicle production volatility or regulatory disruptions.

Among recent announcements, Mobileye’s major customer win for its EyeQ6 ADAS program with a leading Western automaker stands out. This achievement speaks directly to one of the company’s key growth drivers: winning large OEM deals that can underpin its financial outlook and help to further uplift shipments, especially as automakers adopt advanced driver-assist solutions at scale.

By contrast, investors should not overlook the ongoing uncertainty surrounding global light vehicle production and its potential to...

Read the full narrative on Mobileye Global (it's free!)

Mobileye Global's narrative projects $3.0 billion in revenue and $111.5 million in earnings by 2028. This requires 15.6% yearly revenue growth and an earnings increase of about $3.1 billion from current earnings of $-3.0 billion.

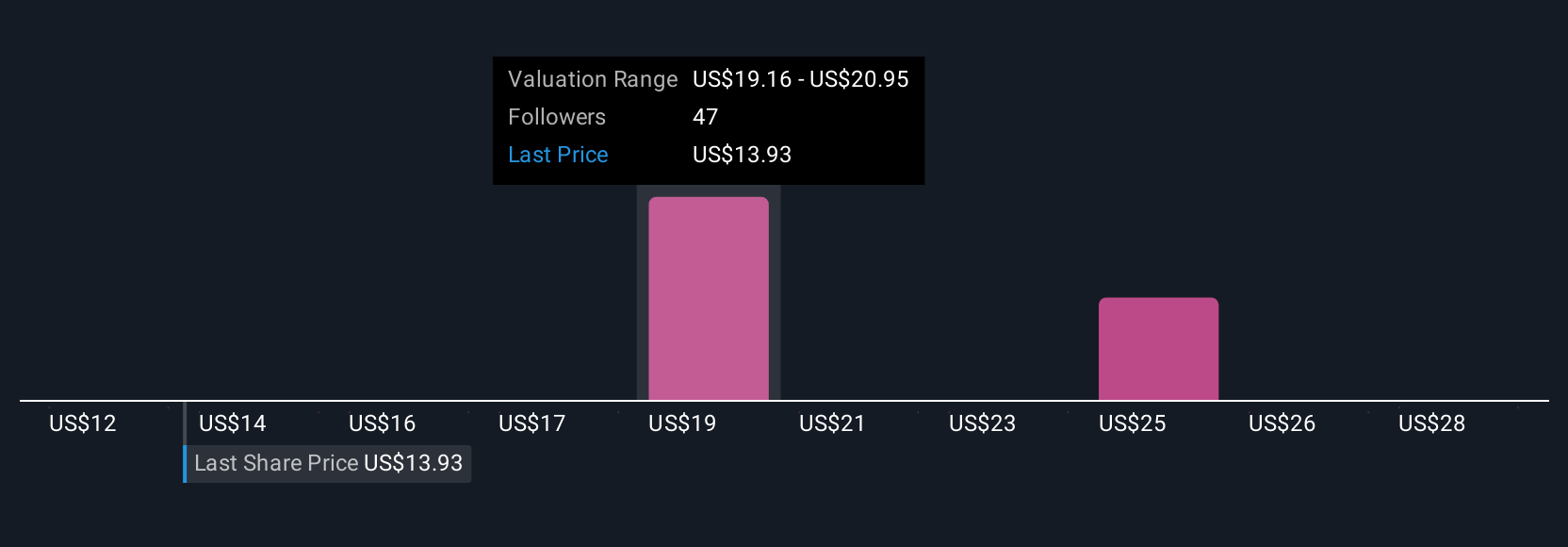

Uncover how Mobileye Global's forecasts yield a $19.28 fair value, a 43% upside to its current price.

Exploring Other Perspectives

Four members of the Simply Wall St Community estimate Mobileye Global’s fair value between US$12 and US$23.20 per share. While opinions clearly differ, the company’s recent boost in revenue outlook adds another piece for you to consider when weighing these varied viewpoints.

Explore 4 other fair value estimates on Mobileye Global - why the stock might be worth as much as 73% more than the current price!

Build Your Own Mobileye Global Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Mobileye Global research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Mobileye Global research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Mobileye Global's overall financial health at a glance.

Ready For A Different Approach?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English