Does Cummins’ 31% Stock Rally Signal Room for More Growth?

If you're standing on the edge of a big decision about Cummins stock, you're not alone, and you’re smart to pause and take a deeper look. The steady hum of Cummins’ performance has some investors cheering from the sidelines and others wondering if now's the time to jump in or cash out. Over the past year, Cummins' share price has surged nearly 31%, with an impressive 21.2% gain year-to-date. While the short-term returns, a 2.3% increase in the last week and 0.8% for the month, might seem modest, they continue a multi-year trajectory of strong growth. In the last five years, long-term shareholders have seen returns of 116.7%, which can only raise the question: Is all the good news already priced in?

Much of this momentum can be traced back to recent moves in the commercial vehicle and power solutions industries, with Cummins regularly in the headlines for its push into alternative fuels and strategic collaborations with leading OEMs. These fresh partnerships and innovation announcements have reinforced optimism about Cummins' market position and long-term earnings power, which factors directly into the current valuation debate.

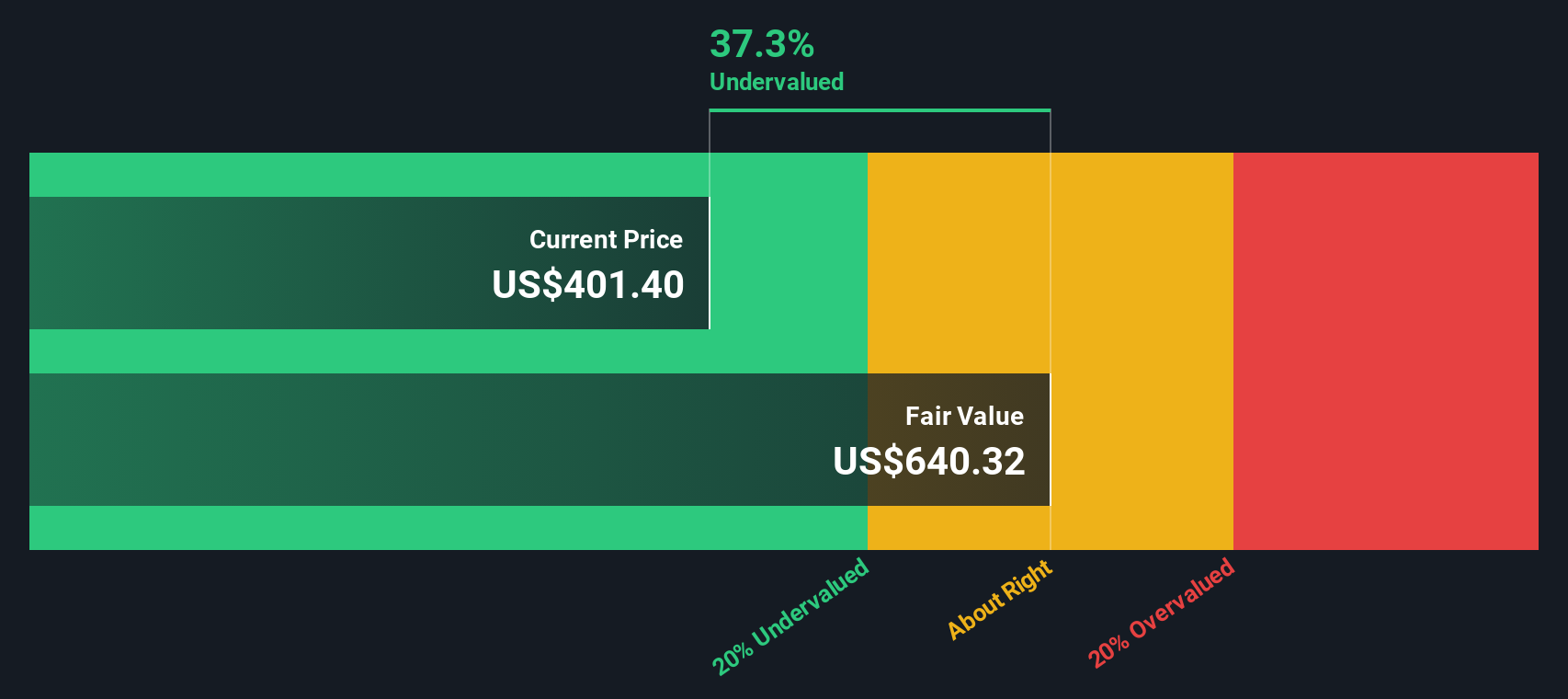

That brings us to the all-important valuation score, a kind of report card, if you will. Out of six key checks for undervaluation, Cummins passes five, earning an impressive score of 5. But numbers only tell part of the story. Let’s break down those valuation methods and see how they stack up, then we’ll explore an even better way to gauge whether Cummins truly deserves a spot in your portfolio.

Approach 1: Cummins Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is designed to estimate a company's true worth by projecting its expected future cash flows and bringing those back to their present value. By focusing on how much cash Cummins can realistically generate over time, investors get a grounded view of the business’s value, beyond market hype.

For Cummins, the latest reported Free Cash Flow (FCF) stands at $1.67 Billion. Analyst forecasts show a notable climb, with FCF expected to reach $4.63 Billion by 2029. After the initial five years, projections rely on long-term growth assumptions. These point to continued FCF expansion well into the next decade.

This two-stage DCF analysis ultimately values Cummins shares at $606.47, using projections made in US Dollars. This figure represents an implied discount of 30.5 percent compared to the current share price, suggesting the market has not yet fully caught up to the company's underlying cash flow potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Cummins is undervalued by 30.5%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

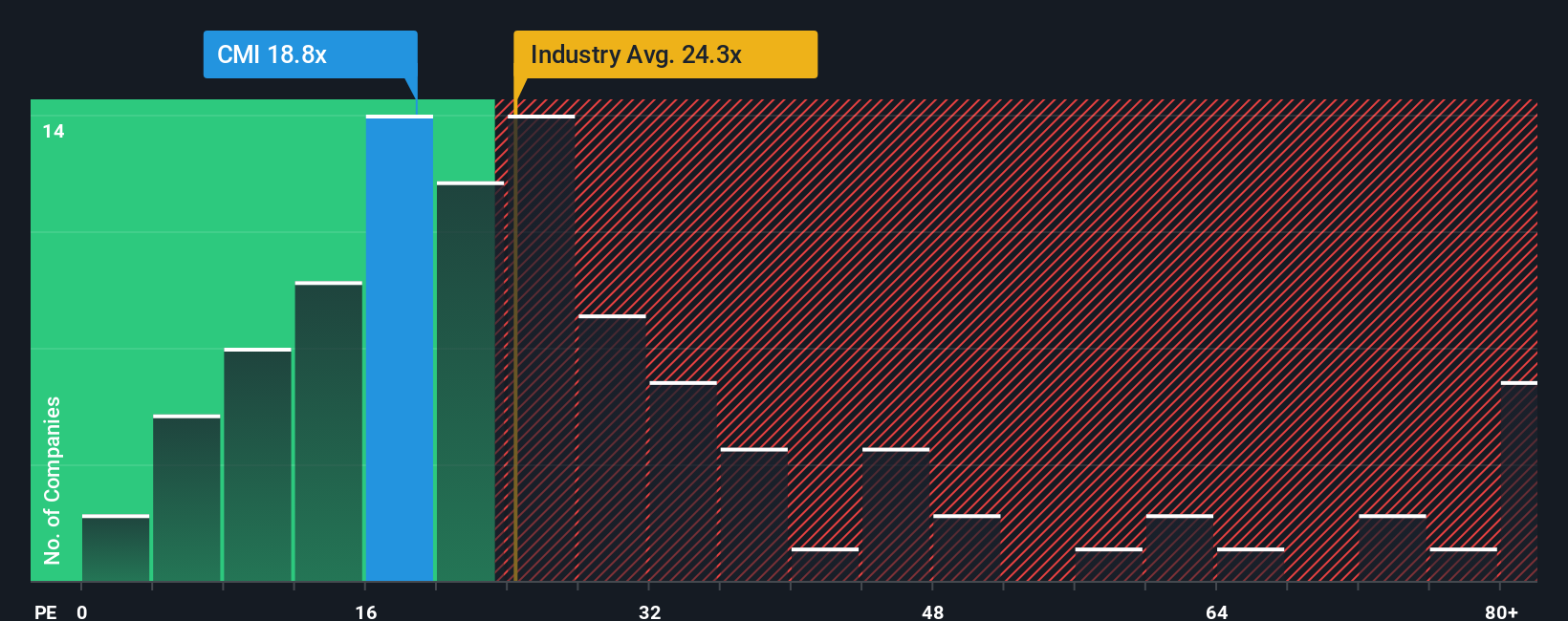

Approach 2: Cummins Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation tool for profitable companies like Cummins because it relates a company’s share price to its actual earnings. This offers investors a straightforward way to gauge what they are paying for each dollar of profit. Generally, higher growth prospects or lower risk justify a higher PE ratio, while industries facing headwinds or greater uncertainty tend to attract lower multiples.

Currently, Cummins trades on a PE ratio of 19.7x. For context, the Machinery industry average stands higher at 24.6x, and key peers are also elevated with an average of 22.1x. On the surface, Cummins appears cheaper than both its direct competitors and the broader industry, which could point to an opportunity. However, raw PE comparisons do not always tell the full story due to variations in profitability, growth outlook, or risk profiles across companies.

This is where Simply Wall St’s “Fair Ratio” comes in. The Fair Ratio, calculated to be 30.0x for Cummins, customizes the benchmark by considering the company’s own growth trajectory, profit margins, risk factors, industry, and scale. Unlike broad industry or peer averages, the Fair Ratio focuses specifically on what is reasonable for Cummins, based on its unique mix of qualities and outlook.

Comparing the Fair Ratio (30.0x) with Cummins’ current PE (19.7x) suggests that the stock is trading well below where its fundamentals imply it should be valued. This indicates Cummins may be significantly undervalued by this key measure.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

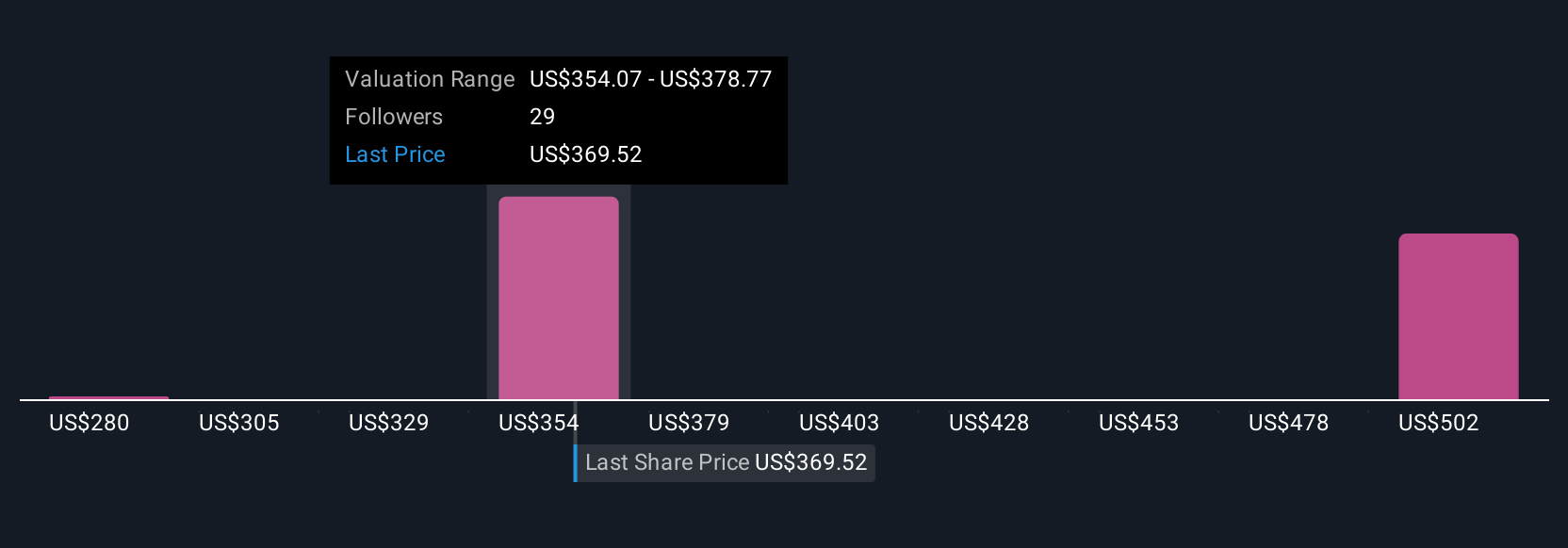

Upgrade Your Decision Making: Choose your Cummins Narrative

Earlier, we mentioned there's an even better way to understand valuation. Let's introduce you to Narratives. Narratives are a tool that lets you connect your view of Cummins by combining your own story about the company’s future with your financial assumptions to create a personalized forecast and estimated fair value. Instead of just relying on static numbers, Narratives help you tell the story behind your beliefs, such as what you think Cummins will achieve in terms of revenue, profit margins, and growth, and instantly see how these expectations impact its calculated fair value.

Available right on the Simply Wall St Community page and used by millions of everyday and professional investors, Narratives make it easy to clarify your investment thesis and check if it still holds up when new information, such as earnings announcements or news, arrives. They help you decide whether to buy, hold, or sell Cummins by directly comparing your fair value estimate to the current market price. This way, you’re always up-to-date as events unfold.

For example, some investors posting recent Narratives for Cummins have predicted a bullish fair value as high as $500 if strong data center and electrification trends materialize. Others are more cautious, seeing fair value near $350 if market risks cut growth short. Narratives ensure you have your own roadmap, not just the consensus, for every investment decision.

Do you think there's more to the story for Cummins? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English