Why Sunrun (RUN) Is Up 6.9% After Analyst Praise on Solar Tax Credits and Market Shifts

- In the past week, analysts at UBS and Citigroup issued favorable updates on Sunrun, citing regulatory clarity on solar tax credits and anticipated shifts in market structure as factors expected to support the company’s core business model.

- Citi specifically pointed to the scheduled expiration of a federal tax credit for customer-owned systems, which may accelerate demand for third-party owned solar solutions and reinforce Sunrun’s position as a market leader in that segment.

- We'll explore how improved regulatory clarity for solar tax credits could help shape Sunrun’s long-term growth outlook and investment narrative.

Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

Sunrun Investment Narrative Recap

If you own Sunrun stock, you likely believe in the long-term need for affordable, resilient clean energy and expect Sunrun to benefit from supportive policy and the continued shift toward third-party solar ownership. The recent analyst updates sparked optimism following clearer guidance on solar tax credits, which may boost short-term demand for Sunrun’s solutions, but do not fundamentally alter the ongoing risk posed by potential regulatory changes or shifting incentive structures in the residential solar sector.

The completed US$331 million securitization of leases and power purchase agreements in July is relevant here, as it demonstrates Sunrun’s access to external capital, an important factor for ongoing growth and margin stability, especially as the industry faces policy-driven changes in demand.

However, investors should be aware that, despite favorable news, the risk of adverse regulatory or funding shifts remains material if...

Read the full narrative on Sunrun (it's free!)

Sunrun's outlook calls for $2.9 billion in revenue and $465.4 million in earnings by 2028. This scenario is based on a 10.4% annual revenue growth rate and a $3.07 billion improvement in earnings from the current level of -$2.6 billion.

Uncover how Sunrun's forecasts yield a $19.39 fair value, a 7% downside to its current price.

Exploring Other Perspectives

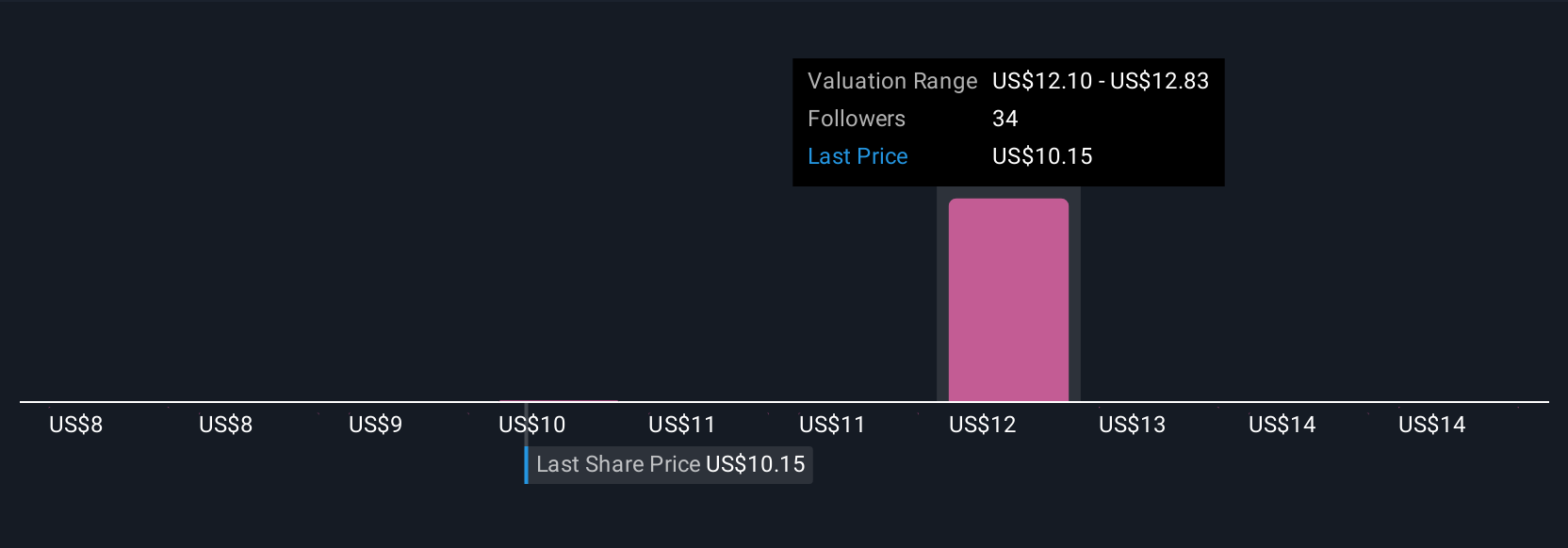

Five community members on Simply Wall St estimate Sunrun’s fair value from US$13.14 to US$23.58 per share. Some expect recurring revenue growth to offset market contraction risk, reflecting differences in how you can weigh long-term opportunities against policy uncertainty.

Explore 5 other fair value estimates on Sunrun - why the stock might be worth as much as 13% more than the current price!

Build Your Own Sunrun Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sunrun research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Sunrun research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sunrun's overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English