Is CDW's Expanding AI Role With Small Businesses Altering the Investment Case for CDW (CDW)?

- During the third quarter of 2025, Wedgewood Partners highlighted CDW Corporation for strong 10% revenue growth and a 2% rise in adjusted operating income, noting the company’s expanding role in serving small businesses upgrading for AI.

- Despite not yet being widely viewed by the market as an “AI winner,” CDW’s involvement in enabling AI adoption among small business clients is drawing renewed investor interest.

- We’ll review how CDW’s growing role in AI infrastructure for small businesses may impact its investment outlook going forward.

The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

CDW Investment Narrative Recap

To be a shareholder in CDW today, you need to believe that its ability to help small businesses upgrade IT for AI positions it to capture emerging demand, despite mixed financial trends and limited recognition as an “AI winner.” The recent 10% revenue growth highlighted by Wedgewood Partners reinforces optimism around AI-driven catalysts, but this news does not materially change the short-term risk, which remains the pressure on profit margins from a shift in revenue mix and subdued operating leverage.

The most relevant new development is CDW’s strategic partnership with Asato Corporation, announced this July, which brings AI-powered IT asset intelligence to CDW’s client offerings. This aligns closely with renewed investor focus on the company’s AI infrastructure exposure and highlights one way CDW is expanding its value proposition to support AI adoption among small business clients.

Yet, despite growing AI engagement, a key risk investors should not overlook is that profit margins could remain under pressure if large enterprise hardware deals and a lower-margin product mix persist...

Read the full narrative on CDW (it's free!)

CDW's narrative projects $24.3 billion revenue and $1.3 billion earnings by 2028. This requires 3.5% yearly revenue growth and a $0.2 billion earnings increase from $1.1 billion today.

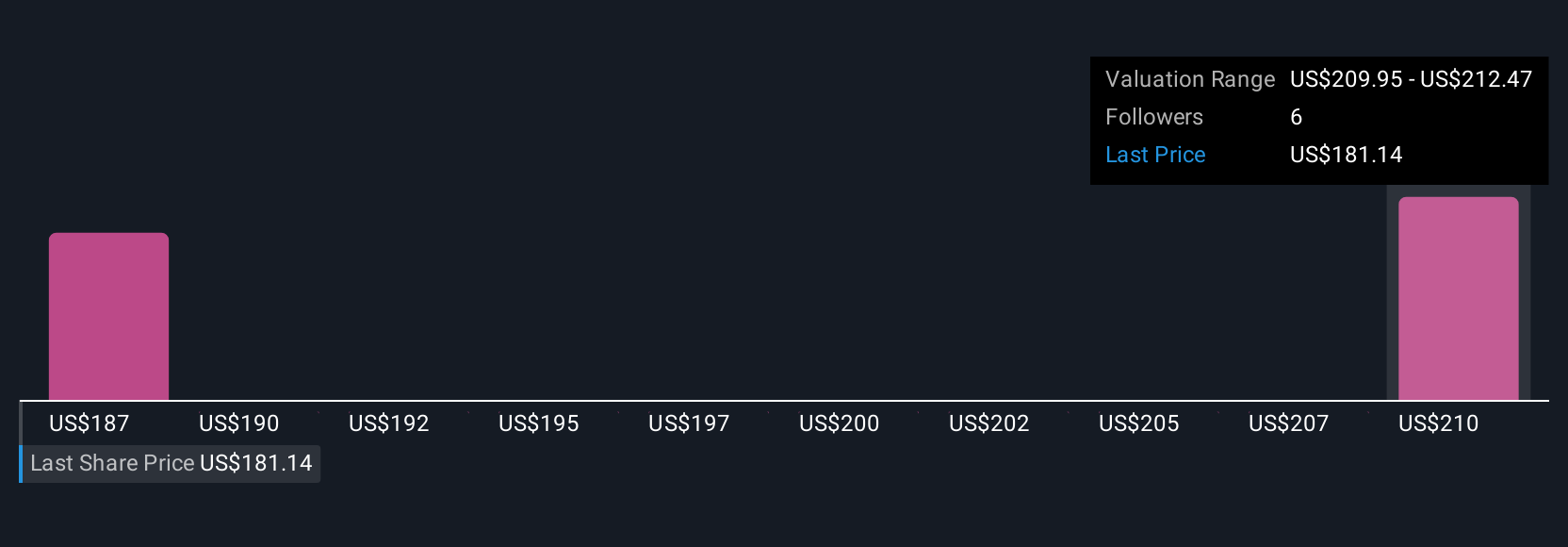

Uncover how CDW's forecasts yield a $206.80 fair value, a 31% upside to its current price.

Exploring Other Perspectives

Three individual fair value estimates from the Simply Wall St Community range from US$195.27 to US$234.14 per share. While these perspectives differ, many remain focused on how changing profit margins and evolving technology demand could shape the company’s next phase, take time to compare these contrasting viewpoints for yourself.

Explore 3 other fair value estimates on CDW - why the stock might be worth just $195.27!

Build Your Own CDW Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CDW research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free CDW research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CDW's overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English