RealReal (REAL) Is Up 17.8% After Surging User Base and Record Quarterly Results Has The Bull Case Changed?

- The RealReal recently reported a strong quarter, with revenues rising 14% year on year to achieve record gross merchandise value and total revenue, both exceeding analysts' expectations, and adjusted EBITDA also ahead of forecasts.

- An especially material highlight is the company's user base, which expanded by a very large 163% year on year, even as the updated full-year guidance remained weaker than its peer group.

- We'll explore how The RealReal's exceptional user growth and strong quarterly results could shift the outlook for its long-term profitability and expansion story.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

RealReal Investment Narrative Recap

To be a shareholder in The RealReal, one needs to believe in the potential for sustainable growth in high-end, authenticated resale, anchored by consumer demand for luxury goods and the company’s ability to expand its user base. While the most recent quarterly results significantly surpassed expectations and showed striking user growth, the updated full-year guidance remaining weak relative to peers means the short-term outlook for meaningful margin expansion or a reversal of cautious sentiment remains largely unchanged. Investors should still keep an eye on margins and profitability, as these remain the primary catalysts and risks for the business.

The recent leadership change, with Rati Sahi Levesque stepping in as CEO, is especially relevant in light of these results. With the company outperforming on several short-term metrics, the direction set by new management may help determine how operational strategies are refined to support continued user growth and address ongoing efficiency challenges. Any near-term progress on technology-driven cost reductions or category expansion will need to be balanced against persistent profitability pressures.

Yet, in contrast to the excitement around user growth, investors should be aware of the less obvious risk tied to the company’s take rate, which could...

Read the full narrative on RealReal (it's free!)

RealReal's narrative projects $842.8 million revenue and $40.0 million earnings by 2028. This requires 9.8% yearly revenue growth and an $75.4 million increase in earnings from the current -$35.4 million.

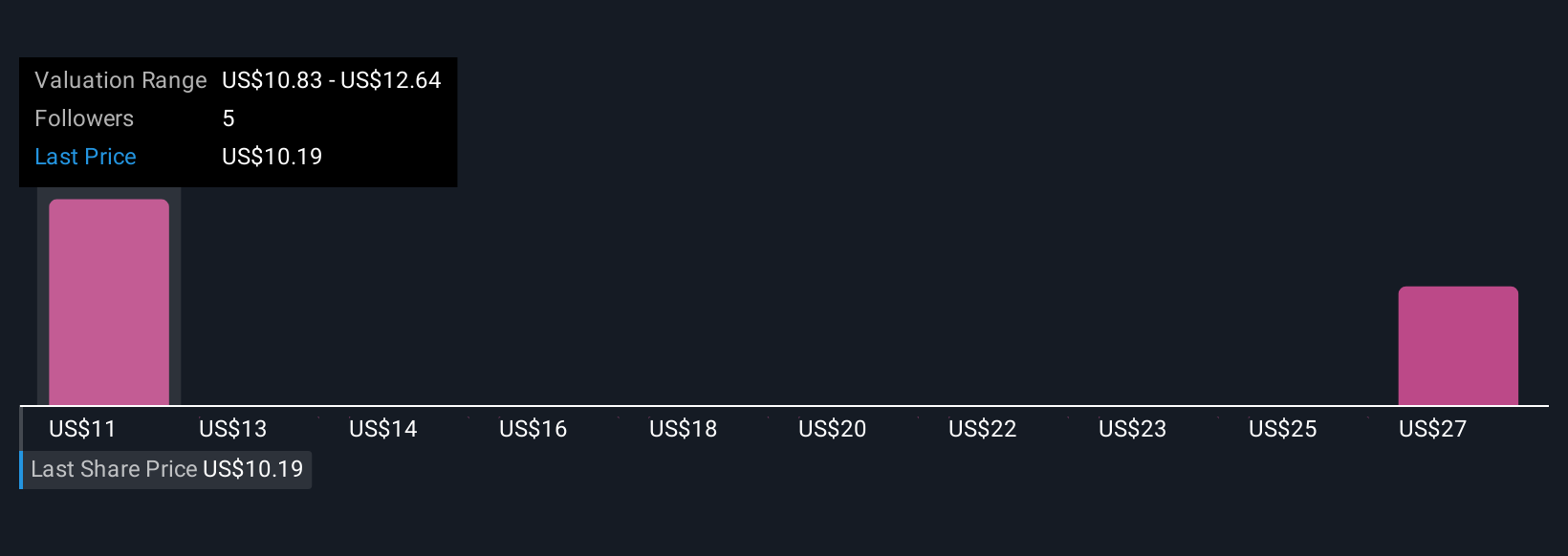

Uncover how RealReal's forecasts yield a $10.83 fair value, a 10% downside to its current price.

Exploring Other Perspectives

Fair value estimates from the Simply Wall St Community range widely between US$10.83 and US$33.13, sourced from two separate analyses. While community opinions vary, ongoing questions remain around whether RealReal’s lower take rates may hinder the path to sustainably higher profits; explore the full spectrum of investor views for a clearer picture.

Explore 2 other fair value estimates on RealReal - why the stock might be worth over 2x more than the current price!

Build Your Own RealReal Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your RealReal research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free RealReal research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate RealReal's overall financial health at a glance.

Curious About Other Options?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English