Daqo New Energy (NYSE:DQ): Fresh Q3 Profits and Rising Output Shape New Valuation Outlook

Daqo New Energy (NYSE:DQ) just released its third quarter results, highlighting positive EBITDA and adjusted net income as production and sales volumes climbed and costs continued to fall. The company also issued upbeat production guidance for the upcoming quarter.

See our latest analysis for Daqo New Energy.

After a tough stretch, Daqo New Energy’s share price has bounced back impressively with an 11.7% gain over the last 90 days and a year-to-date share price return of 28.6%. The 1-year total shareholder return sits at -10.7%. Improving quarterly results and upbeat production guidance seem to be shifting sentiment, but it is still a long road for investors who bought in three or five years ago.

If Daqo’s recent turnaround piques your interest, it could be the perfect moment to broaden your search and see what’s happening with fast growing stocks with high insider ownership.

With Daqo’s fundamentals turning a corner and production set to increase, is the recent rally just the start of a bigger recovery, or has the market already factored in the company’s future growth potential?

Most Popular Narrative: 2.1% Undervalued

With Daqo’s fair value from the most popular narrative just a touch above the last closing price, investors are weighing whether recent optimism and improved guidance signal more room to run or if the market has already caught up.

Recent regulatory interventions by Chinese authorities to curb irrational competition and enforce sales above production costs are expected to stabilize polysilicon prices and improve industry profitability, directly supporting future revenue and margins for Daqo. Global momentum in solar installations, driven by policy incentives and increasing cost-competitiveness of solar power, remains robust, positioning Daqo to benefit from sustained long-term demand growth, which supports a recovery in sales volumes and top-line growth once market conditions normalize.

Want to know what’s supercharging this valuation target? One bold call links Daqo’s fair value to a rare set of aggressive future growth drivers and sector tailwinds. Wondering which combination of growth, profitability, and savvy market bets sets this price estimate apart? Unlock the full story hidden in the detailed narrative.

Result: Fair Value of $26.58 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent industry overcapacity and Daqo’s ongoing operating losses could limit any sustained recovery if market discipline or demand improvement weakens.

Find out about the key risks to this Daqo New Energy narrative.

Another View: Multiples Tell a Different Story

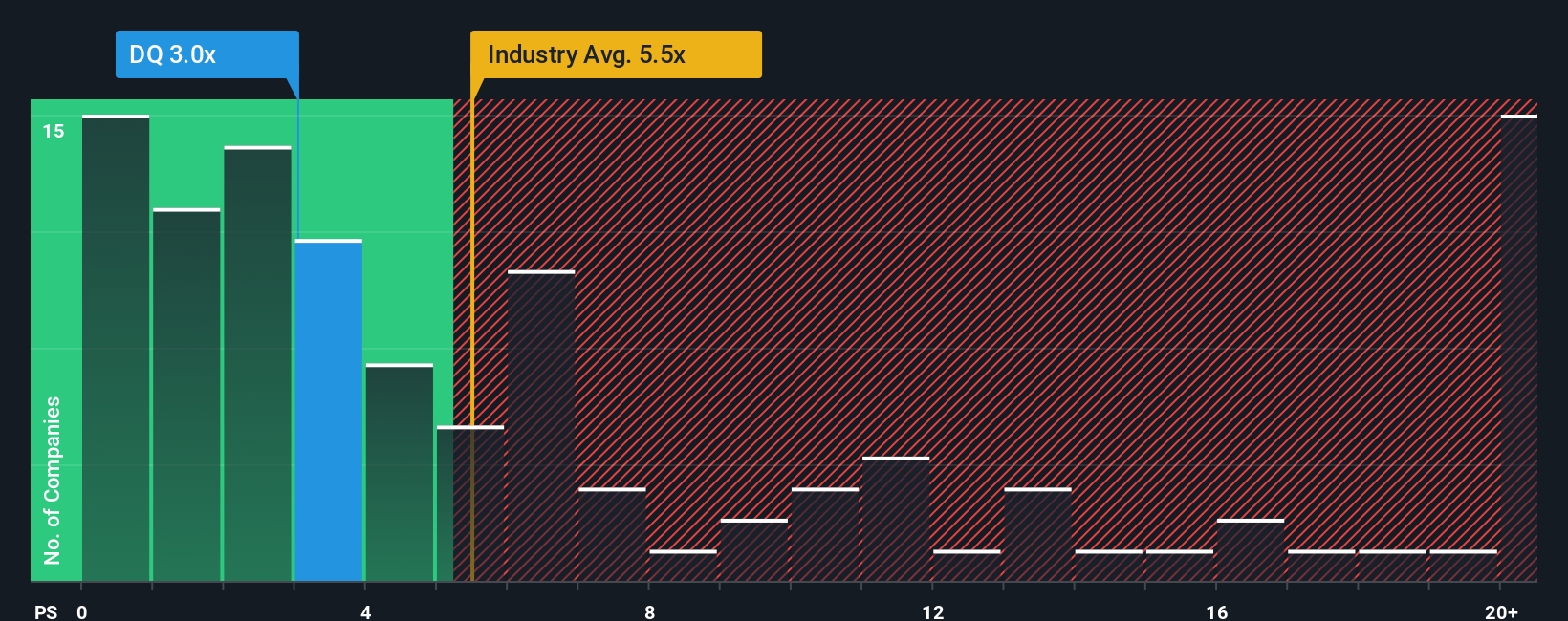

While some valuations see Daqo as undervalued, a look at its price-to-sales ratio paints a more expensive picture. Trading at 2.9 times sales, it stands above its own fair ratio of 0.8 times, as well as above peer and industry averages. Does this raise caution for buyers, or is the risk overblown?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Daqo New Energy Narrative

If this perspective does not align with your view, or you prefer to form your own conclusions from the data, you can create a personalized take in under three minutes, Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Daqo New Energy.

Looking for More Investment Ideas?

Smart investors always have their next move ready. Don’t miss the chance to act now. These curated ideas could put you one step ahead:

- Unlock fresh opportunities for high income as you scan the market’s best-yielding options with these 17 dividend stocks with yields > 3%.

- Catch the momentum of tomorrow’s breakthroughs by targeting artificial intelligence leaders through these 27 AI penny stocks.

- Seize potential growth before the crowd and uncover strong fundamentals with these 3556 penny stocks with strong financials.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English