What to Expect From Dollar General's Next Quarterly Earnings Report

Goodlettsville, Tennessee-based Dollar General Corporation (DG) operates as a discount retailer providing various merchandise products, including consumable products, laundry products, food & beverage, and more. With a market cap of approximately $22.5 billion, Dollar General operates thousands of retail stores across the U.S.

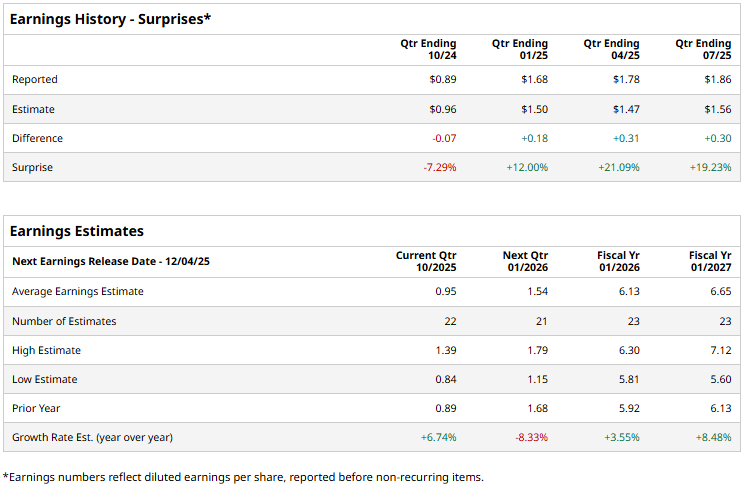

The retail giant is expected to announce its third-quarter results in early December. Ahead of the event, analysts expect DG to report a profit of $0.95 per share, up 6.7% from $0.89 per share reported in the year-ago quarter. The company has a mixed earnings surprise history. It has surpassed the Street’s bottom-line estimates thrice over the past four quarters while missing on one other occasion.

For the full fiscal 2026, analysts expect Dollar General to report an EPS of $6.13, up 3.6% from $5.92 in fiscal 2025. While in fiscal 2027, its earnings are expected to grow 8.5% year-over-year, reaching $6.65 per share.

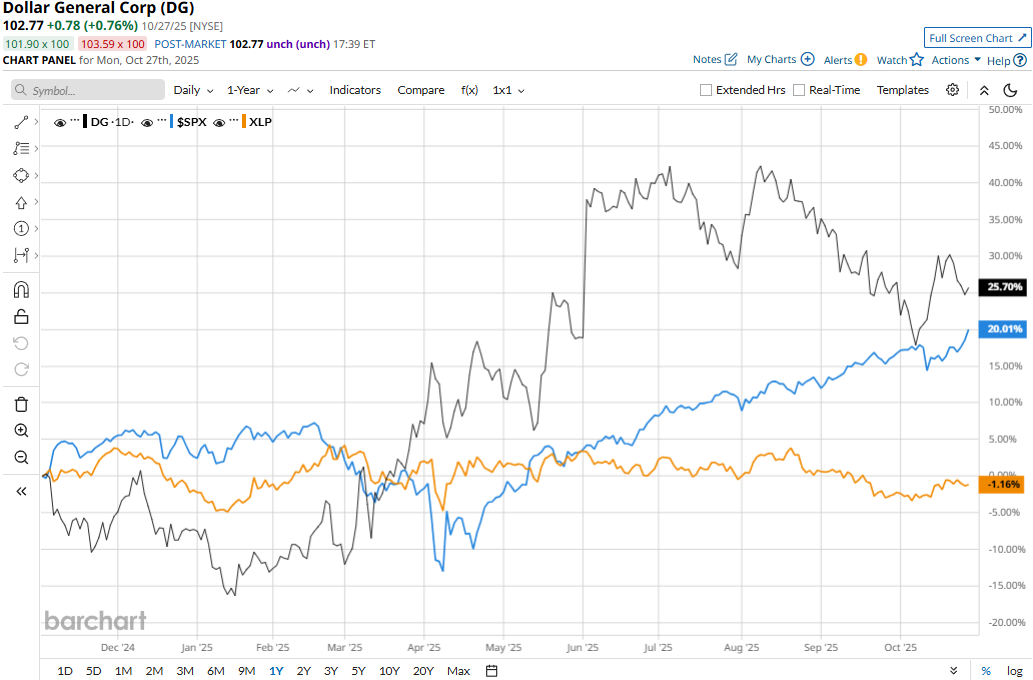

DG stock prices have soared 27.9% over the past 52 weeks, notably outperforming the S&P 500 Index’s ($SPX) 18.4% gains and the Consumer Staples Select Sector SPDR Fund’s (XLP) 2.3% decline during the same time frame.

Dollar General’s stock prices observed a marginal uptick in the trading session following the release of its better-than-expected Q2 results on Aug. 28. The improved execution, along with progress in advancing its key initiative, has resonated with its existing as well as new customers, leading to a 2.8% growth in same-store sales. Meanwhile, the company’s overall net sales for the quarter jumped 5.1% year-over-year to $10.7 billion, exceeding the Street expectations by 47 bps. Moreover, driven by margin expansion, Dollar General’s EPS grew by a robust 9.4% year-over-year to $1.86, surpassing the consensus estimates by a staggering 19.2%.

Analysts remain optimistic about the stock’s prospects. DG has a consensus “Moderate Buy” rating overall. Of the 30 analysts covering the stock, opinions include 12 “Strong Buys,” one “Moderate Buy,” and 17 “Holds.” Its mean price target of $120.86 suggests a 17.6% upside potential from current price levels.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English