Operational Shifts and Debt Concerns Might Change the Case for Investing in Kohl's (KSS)

- Retailers such as Kohl's have recently undertaken significant operational changes in response to disappointing same-store sales and shifts in customer preferences, with additional concerns emerging around elevated debt and revenue outlooks.

- Industry observers are raising the possibility of asset sales or dilutive financing for these retailers if customer engagement fails to recover and operational pressures persist.

- We'll now explore how worries about weak customer engagement and financial flexibility are shaping Kohl's investment narrative.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

Kohl's Investment Narrative Recap

To be a shareholder in Kohl’s today, an investor needs confidence that ongoing operational adjustments, such as new store formats and digital investments, will successfully address declining in-store engagement and pressure on sales. The recent news, highlighting continued weak same-store sales and potential financial strain, intensifies focus on customer traffic trends as the primary short-term catalyst, while risk around the company's financial flexibility remains. These developments could prove material if negative trends persist, potentially accelerating concern around funding and restructuring options.

Of recent announcements, Kohl’s appointment of a new Chief Digital Officer directly addresses current challenges outlined in the news event. Strengthening digital execution is closely tied to both customer engagement and near-term sales performance, key catalysts for supporting Kohl’s revenue base and margin stability as shopping habits shift further online.

By contrast, the persistence of high debt levels could limit the company’s options if store traffic does not rebound, a risk investors should keep in mind as...

Read the full narrative on Kohl's (it's free!)

Kohl's narrative projects $15.2 billion revenue and $199.4 million earnings by 2028. This requires a 1.6% yearly revenue decline and a $9.6 million decrease in earnings from the current $209.0 million.

Uncover how Kohl's forecasts yield a $14.92 fair value, a 9% downside to its current price.

Exploring Other Perspectives

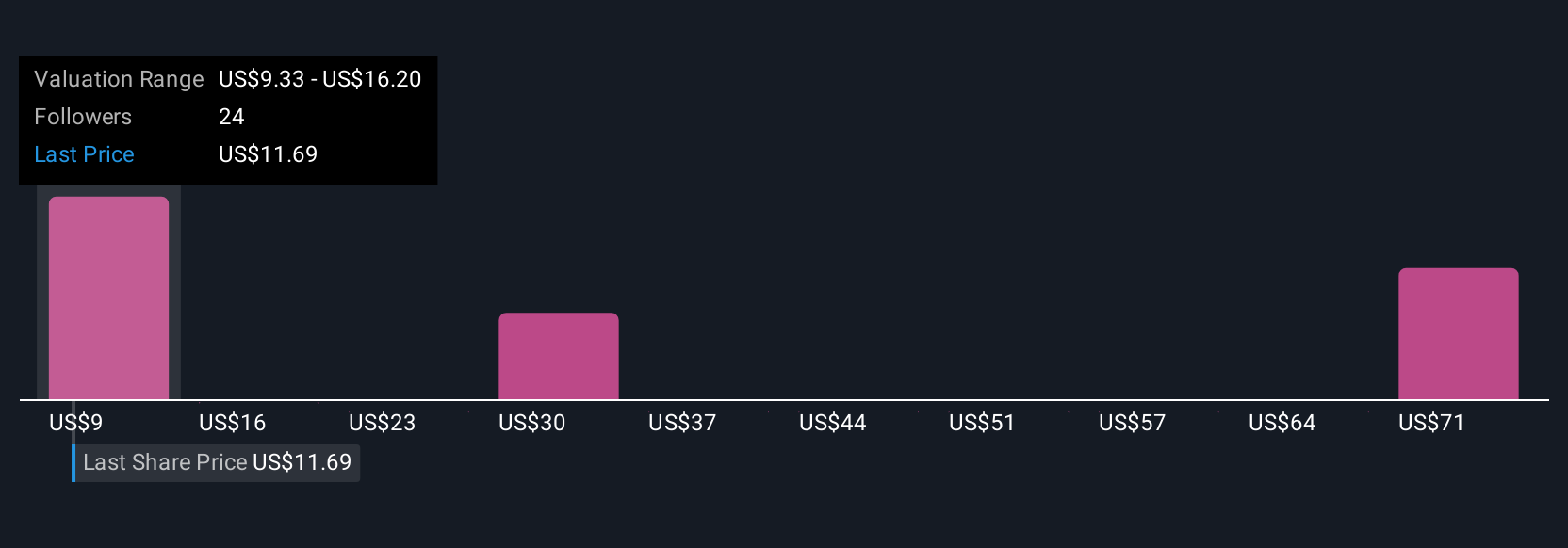

Five fair value estimates from the Simply Wall St Community range widely from US$14.72 to US$61.47 per share. With store traffic and digital growth in focus, you will find significant differences across viewpoints that may shape how you see Kohl’s future.

Explore 5 other fair value estimates on Kohl's - why the stock might be worth 10% less than the current price!

Build Your Own Kohl's Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kohl's research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Kohl's research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kohl's overall financial health at a glance.

Looking For Alternative Opportunities?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English