How Investors Are Reacting To TJX (TJX) Analyst Optimism Ahead of Third-Quarter Earnings

- TJX Companies recently attracted strong analyst optimism ahead of its third-quarter earnings release, following a consistent pattern of exceeding profit expectations and operational benchmarks.

- This positive sentiment reflects confidence in the company's ongoing same-store sales growth, effective management, and ability to capitalize on favorable industry conditions.

- We'll explore how analyst optimism, fueled by TJX's history of outperforming forecasts, could further reinforce its investment narrative.

The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

TJX Companies Investment Narrative Recap

Shareholders in TJX Companies typically believe in the resilience of its value-based, in-store shopping experience and its ability to consistently grow same-store sales, even through uncertain retail cycles. The recent surge in analyst optimism ahead of third-quarter earnings may provide added momentum as a near-term catalyst, but it does not fundamentally alter the core risk: that the business remains heavily exposed to shifting consumer preferences toward e-commerce, which could gradually erode in-store traffic if not effectively addressed.

One highly relevant recent announcement was the board’s decision in March 2025 to increase TJX’s quarterly dividend by 13% to US$0.425 per share. This move underscores management’s confidence in ongoing cash generation and may reinforce the company’s investment narrative, especially as analysts highlight TJX’s continued outperformance against industry peers.

In contrast, an area investors should carefully watch is how TJX’s limited digital investment, relative to its strong in-store execution, could...

Read the full narrative on TJX Companies (it's free!)

TJX Companies' narrative projects $68.6 billion revenue and $6.3 billion earnings by 2028. This requires 5.8% yearly revenue growth and a $1.3 billion earnings increase from $5.0 billion today.

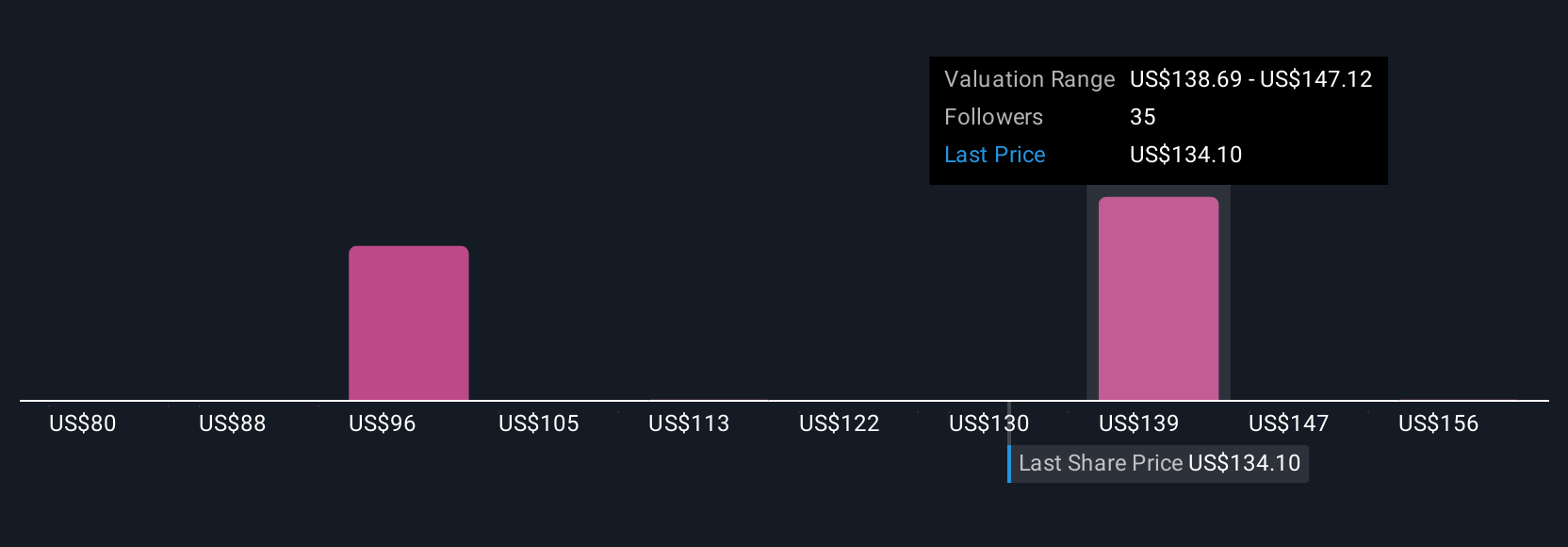

Uncover how TJX Companies' forecasts yield a $151.37 fair value, a 5% upside to its current price.

Exploring Other Perspectives

Some of the highest analyst forecasts prior to this news expected TJX’s annual revenue to reach US$71.0 billion and earnings to climb to US$6.6 billion by 2028, based on accelerated global store openings and digital investments. These more optimistic views present a sharper contrast to consensus, underlining that your expectations for TJX may look very different, and could change as new events unfold.

Explore 6 other fair value estimates on TJX Companies - why the stock might be worth as much as 14% more than the current price!

Build Your Own TJX Companies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TJX Companies research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free TJX Companies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TJX Companies' overall financial health at a glance.

Want Some Alternatives?

Our top stock finds are flying under the radar-for now. Get in early:

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English