Daqo New Energy (NYSE:DQ) Faces Steep Losses as Forecasts Point to 33.9% Annual Revenue Growth

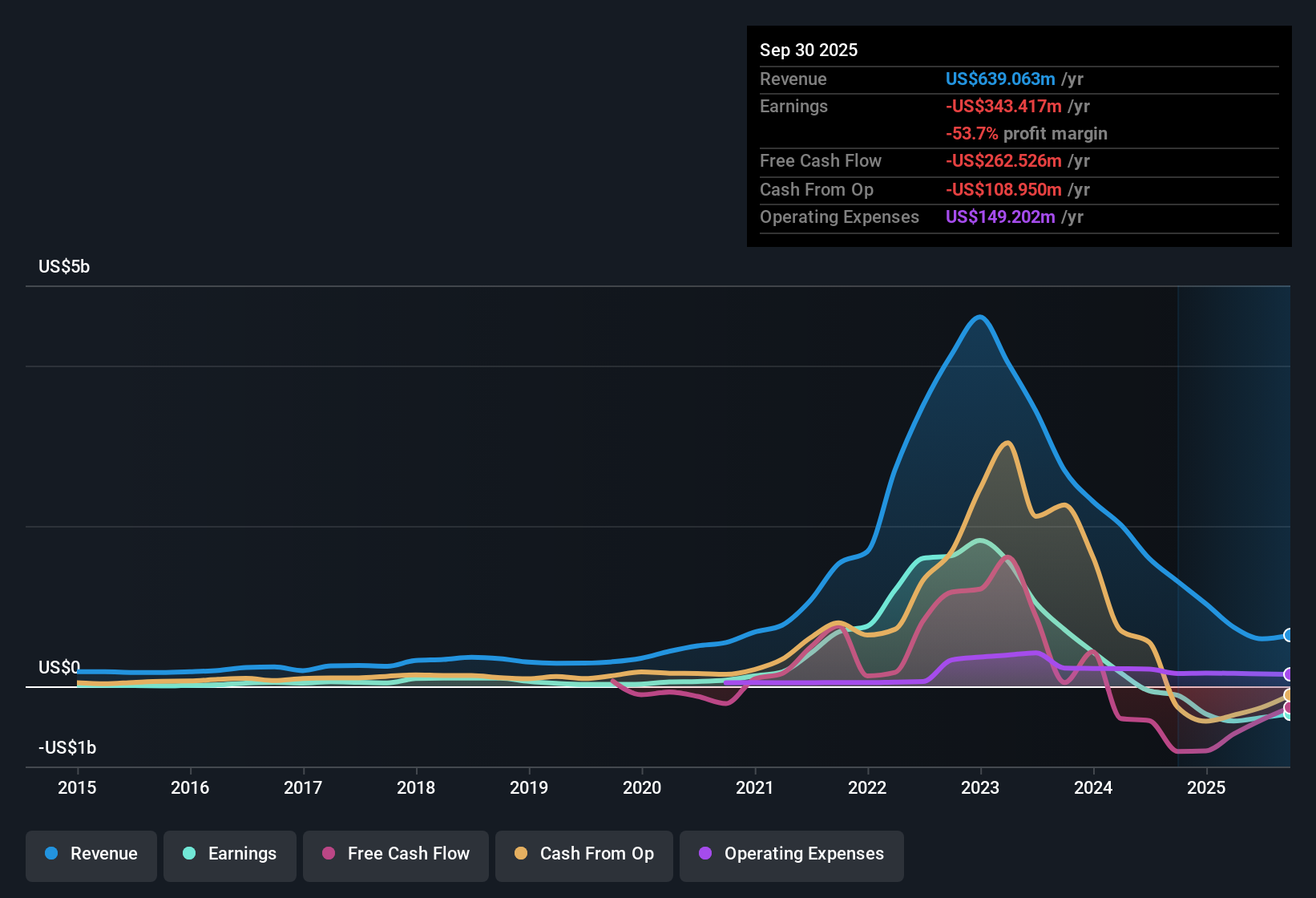

Daqo New Energy (NYSE:DQ) remains unprofitable, with losses having increased by 29.6% per year over the past five years and no meaningful improvement in profit margin. Despite these continued losses, revenue is forecast to grow at a robust 33.9% annually, far outpacing the broader US market's 10.1% yearly expectation. Earnings are expected to rise by a staggering 109.84% per year. Investors are likely to focus on these rapid growth forecasts as they weigh the company’s ongoing lack of profitability and current valuation against its outlook for transitioning to profit in the coming years.

See our full analysis for Daqo New Energy.The next section dives into how these headline numbers stack up against the narratives that investors and analysts are watching, highlighting where expectations match reality or where surprises may lurk.

See what the community is saying about Daqo New Energy

Margins Still Deep in Red Despite Sales Momentum

- Daqo's profit margin sits at a steep -65.6%, with analysts projecting a turnaround to +9.6% within three years. If achieved, this reversal would be among the sharpest improvements in the sector.

- Consensus narrative notes that regulatory support and disciplined cost management are expected to lift margins.

- Recent Chinese government policies aim to stabilize polysilicon pricing and enforce sales above cost, supporting Daqo’s industry position.

- Management is leveraging cash reserves and operational efficiencies to cushion against volatility until margins strengthen.

To dig deeper into how analysts interpret Daqo's wild profit swings and margin story, see the full Consensus Narrative for every angle on its turnaround potential. 📊 Read the full Daqo New Energy Consensus Narrative.

Cost Advantage Versus Peers and Industry

- Daqo trades at a 3.1x price-to-sales ratio, which is notably cheaper than the US semiconductor industry average of 5.3x but still above its peer group average of 2.7x.

- Analysts' consensus view underscores how Daqo’s focus on cost controls and N-type polysilicon technology may help win premium customers.

- Ongoing cost reduction, enabled by digital transformation, positions Daqo to expand share in high-margin solar segments.

- Critics highlight persistent losses and the premium to peers as warning signs that the market expects rapid improvements, which are not guaranteed.

Share Price Hovers Near Analyst Target

- Daqo's share price of $29.43 stands slightly above the analyst consensus price target of $28.53. This suggests that investors have already priced in much of the expected recovery and that the stock is seen as roughly fairly valued on current forecasts.

- Analysts' consensus narrative points to modest upside but also a lack of obvious discount relative to projected earnings.

- This reflects analysts’ belief that successful execution on growth and margin recovery is necessary to justify even incremental upside.

- Any misstep could see Daqo’s valuation support erode given the thin margin for error at the current price.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Daqo New Energy on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on these numbers? Bring your perspective to life and set your narrative in motion. Get started in just a few minutes. Do it your way

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Daqo New Energy.

See What Else Is Out There

Daqo’s ongoing losses, negative margins, and need for a dramatic turnaround highlight weak consistency and underscore the company’s volatile earnings outlook.

If you want more reliable growth and steady financial performance, check out stable growth stocks screener (2116 results) to discover companies that consistently deliver strong results through changing market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English