Dorman Products (DORM): Margin Gains Reinforce Bullish Narratives as Profit Growth Outpaces Expectations

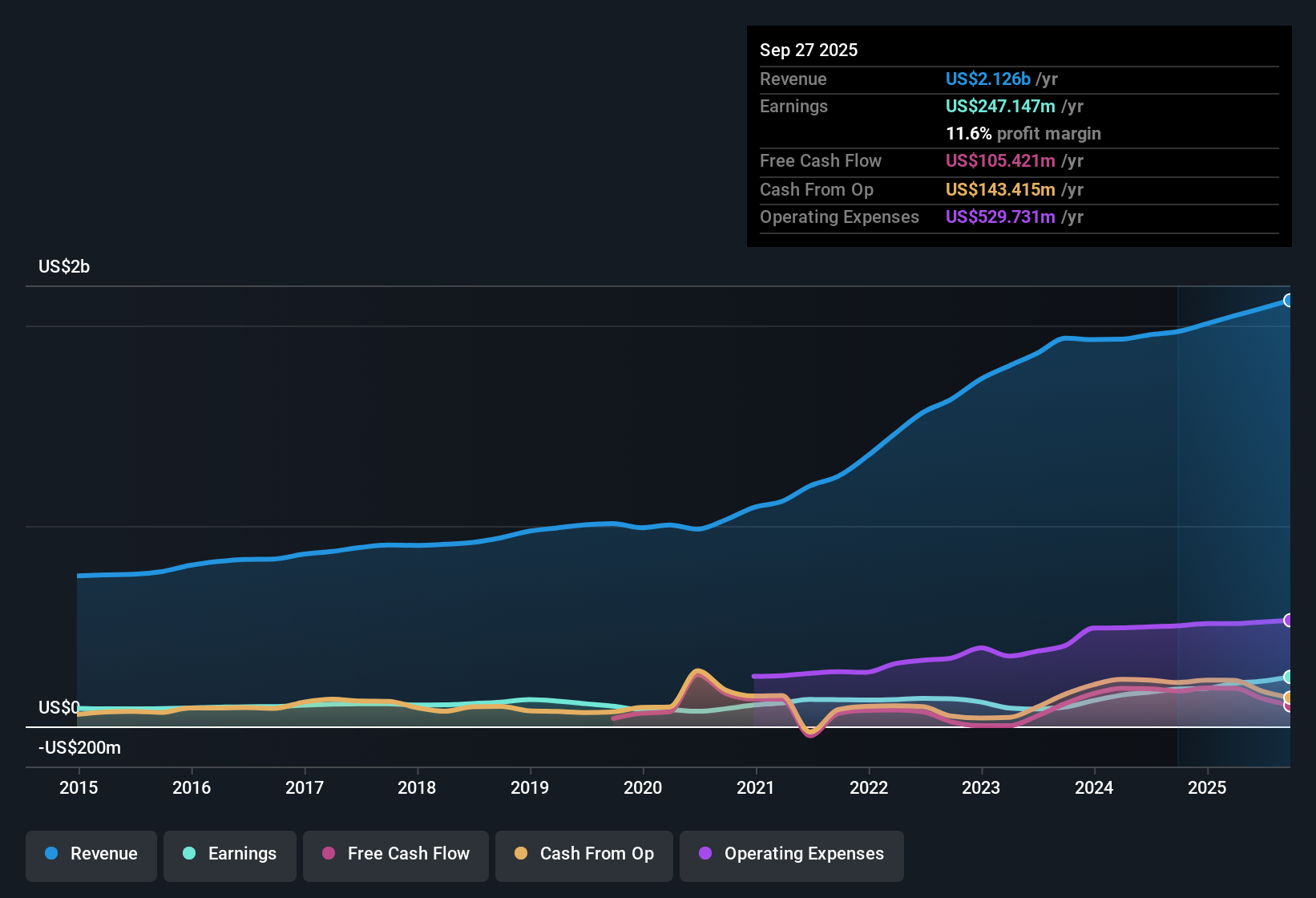

Dorman Products (DORM) posted a 33.2% jump in earnings for the most recent year, outpacing its impressive 15.3% annual growth over the past five years. Net profit margins climbed to 11.6%, improving from last year’s 9.4%. Investors will note the stock trades at a discount to both industry and peer-average earnings multiples. Future growth rates for earnings and revenue are forecast to moderate compared to recent performance and the broader US market.

See our full analysis for Dorman Products.Next, we will compare these fresh earnings results with the narratives shaping the market’s view, highlighting where the new data supports or questions the consensus story.

See what the community is saying about Dorman Products

Margin Expansion Signals Operational Strength

- Net profit margins climbed to 11.6%, up from last year’s 9.4%, reflecting ongoing gains from new high-margin, proprietary product launches and cost-saving measures.

- Consensus narrative highlights that Dorman’s move to innovate with its own aftermarket products, while pursuing automation and supply chain improvements, is not only expanding margins in the near term,

- but also enhancing the company’s resilience against cost headwinds and supporting steady operating margin gains.

- Analysts note that executing on these strategies has provided visible improvements in profitability, which may help offset risks from rising complexity and supply pressures.

Consensus narrative underscores how Dorman’s solid margin gains add credibility to forecasts of continued profitability, despite industry-wide cost volatility. 📊 Read the full Dorman Products Consensus Narrative.

Price-to-Earnings Discount vs. Peers

- Dorman trades at a 17.2x price-to-earnings ratio, below the 18.5x industry average and 20.3x peer group, giving it a value advantage while the share price sits at $138.73.

- Analysts' consensus view sees this discount as supportive of long-term upside if the company delivers even modest growth and avoids margin compression,

- especially given market expectations for Dorman to reach $237 million in earnings by 2028 and aspirations for a future PE of 26.2x, which is substantially higher than today’s multiple.

- However, a current gap between today’s $138.73 price and the latest target price of $173.13 means much of the rerating relies on the company translating efficiencies and market share gains into sustainable earnings power.

Moderating Growth Against Industry Trends

- Forward earnings are expected to rise at 4.7% yearly and revenue at 5.4% per year, lagging both the company’s past averages and broader US market expectations.

- Consensus narrative stresses that while recurring demand from an aging vehicle fleet and delayed new car purchases is fueling stability,

- Dorman still faces longer-term pressures from EV adoption and customer concentration, which could weigh on future growth rates beyond the current forecast horizon.

- Despite near-term drivers, analysts are cautious about assuming that structural tailwinds will fully offset these sector headwinds as the market evolves.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Dorman Products on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own take on the latest figures? Share your perspective and craft a unique narrative in just a few minutes by selecting Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Dorman Products.

See What Else Is Out There

Although Dorman’s recent growth is solid, long-term concerns around moderating revenue forecasts and headwinds from industry shifts could limit future outperformance.

If you’re looking for steadier prospects, use stable growth stocks screener (2117 results) to uncover companies with proven, consistent expansion and resilience across changing market environments.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English