Revolve Group (RVLV): Examining Valuation After Recent Share Price Momentum

Revolve Group (RVLV) shares have moved slightly lower in recent trading, giving investors a reason to revisit the company’s performance. Over the past month, the stock has gained 7%, which offers some perspective on current momentum.

See our latest analysis for Revolve Group.

Looking beyond the recent uptick, Revolve Group’s 30-day share price return of 6.6% suggests momentum may be returning, even as the year-to-date performance remains deep in the red at -30.1%. Over the past year, total shareholder return stands at -9%. This serves as a reminder that while short-term buzz is building, longer-term holders are still waiting for a bigger turnaround.

If you’re ready to see how other fast-moving names are performing, now’s a great opportunity to broaden your search with our fast growing stocks with high insider ownership

With recent gains contrasting longer-term losses, the question now looms: is Revolve Group trading below its true value, or is the current price already reflecting all the growth investors can hope for?

Most Popular Narrative: 4.6% Undervalued

Revolve Group's most widely followed narrative sets a fair value just above the latest closing price, hinting that upside could still remain despite the recent comeback. This perspective is shaped by expectations for stronger future margins and international growth, which are key talking points among market watchers right now.

Data-driven personalization, enhanced AI-powered search and merchandising, and increased efficiency in marketing campaigns are boosting average revenue per active customer and expected to improve customer retention. These factors are driving future topline and margin expansion.

Curious how advanced marketing tactics and digital innovation could push margins into new territory? The narrative hinges on an ambitious set of expansion goals and bold profitability assumptions you will not want to miss. What surprising projections are behind this “undervalued” label? Dive deeper to see the numbers driving this call.

Result: Fair Value of $24.57 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising tariff volatility and a shift in consumer buying habits could easily challenge these upbeat expectations. This could potentially impact margins and revenue growth ahead.

Find out about the key risks to this Revolve Group narrative.

Another View: Market Multiples Raise Caution

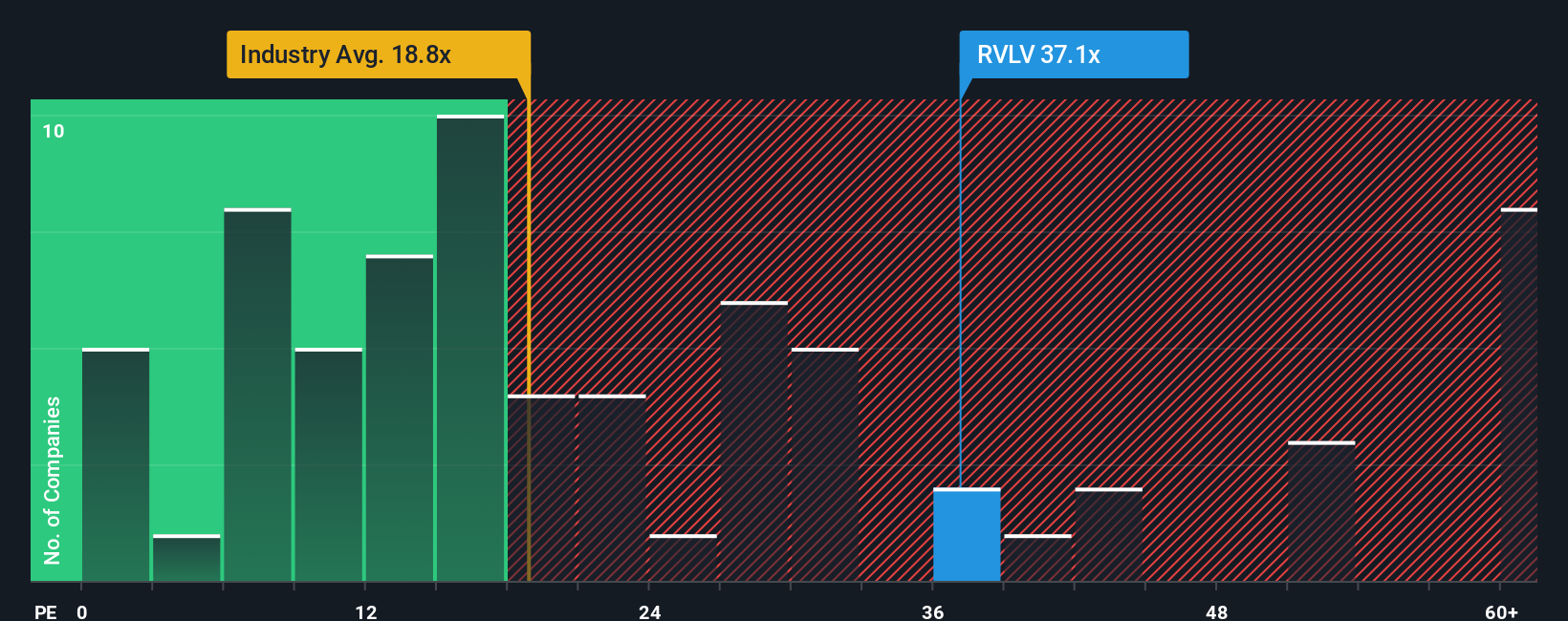

Looking through the lens of market valuation tools, Revolve Group’s price-to-earnings ratio stands out at 36.9x. This is more than double the US Specialty Retail industry average of 16.8x and well above its peers' average at 16x. The so-called fair ratio is just 17.5x. That wide gap could mean investors are accepting more risk for expected growth, or are they just getting ahead of themselves?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Revolve Group Narrative

If you would rather run the numbers yourself or come to your own conclusions, crafting a personal narrative only takes a few minutes. Why not give it a try and Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Revolve Group.

Looking for More Smart Investment Ideas?

Great investors never settle for just one opportunity. Level up your strategy by tapping into unique stock ideas tailored to today’s markets. Don’t get left behind.

- Accelerate your search for outsized growth by targeting these 3575 penny stocks with strong financials with strong financials and untapped upside potential right now.

- Boost your portfolio with relentless income by reviewing these 21 dividend stocks with yields > 3% offering yields above 3% and a proven track record through market cycles.

- Capitalize on breakthroughs in the digital future. Check out these 26 AI penny stocks that are transforming industries through artificial intelligence and automation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English