Rivian Expects To Draw $6 Billion Biden-Era Loan Before Production Begins At Georgia Plant In 2028: Report

Rivian Automotive Inc.'s (NASDAQ:RIVN) Chief Financial Officer, Claire McDonough, says that the automaker plans to tap into a Biden-era loan worth $6.6 billion, according to a report.

Check out the current price of RIVN here.

Rivian Plans To Draw The Loan In 2028

McDonough confirmed that the automaker would draw the loan before production begins at its Georgia plant, Bloomberg reported on Tuesday. "It'd be prior to starting production in 2028," McDonough said. The loan was agreed upon with the previous Biden administration during its final days in January.

However, uncertainty looms over the financing agreement as the Trump administration's Energy Secretary Chris Wright remained critical of the loans and said his agency wasn't moving forward with them, the report said.

McDonough also said that the automaker was targeting a 200,000-unit-per-year production capacity for its Illinois plant, which could help the company reach an operating profit by 2028.

Rivian recently broke ground on the plant in Georgia and expects it to serve as a crucial element in its upcoming R2 Crossover SUV's production. The plant will also see Rivian receive over $1.5 billion in incentives from the Georgia government.

CEO RJ Scaringe Says Lower Costs Benefit China

The news comes as Rivian recently settled a class action lawsuit filed by investors for $250 million. The lawsuit, which was filed in 2022, alleged that the company failed to disclose the costs of raw materials required for the production of the R1T and R1S vehicles, which far exceeded the sales price.

Meanwhile, company founder and CEO RJ Scaringe recently said that Chinese competitors benefit from lower cost structures and also said that the tariffs imposed by the Trump administration had an effect on Rivian's costs, but touted the EV maker's U.S.-centric supply chain to offset some of it.

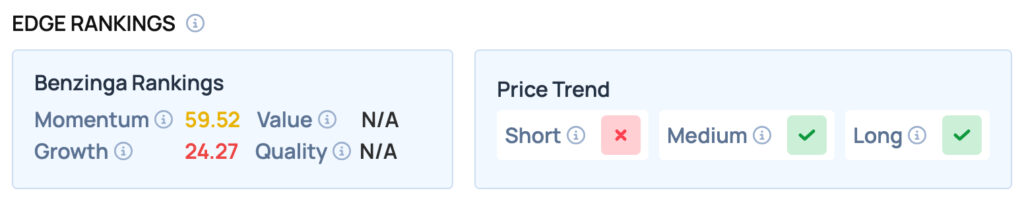

Rivian offers satisfactory Momentum, but poor Growth. Rivian also boasts a favorable price trend in the Medium and Long term. For more such insights, sign up for Benzinga Edge Stock Rankings today!

Check out more of Benzinga's Future Of Mobility coverage by following this link.

Read Next:

Image via Shutterstock

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English