FuelCell Energy (FCEL) Stock Is Surging Wednesday: What's Going On?

Shares of FuelCell Energy Inc (NASDAQ:FCEL) are surging Wednesday afternoon, potentially trading in sympathy with clean energy peer Bloom Energy, which hit an all-time high.

- FCEL stock is showing exceptional strength. Get the inside scoop here.

What To Know: Bloom Energy shares soared after the company reported blockbuster third-quarter financial results that beat analyst estimates.

Bloom's CEO cited "powerful tailwinds," including surging electricity demand driven by artificial intelligence, fueling investor optimism across the sector. The positive sentiment for Bloom could be spilling over to FuelCell, which has rallied on a similar narrative.

Earlier in October, FuelCell shares soared following its own strong earnings report, which featured a 97% year-over-year revenue increase. Investor enthusiasm has been linked to the company's carbonate fuel cell platforms, viewed as a key solution for providing reliable, continuous power to energy-intensive AI data centers.

While some analysts remain neutral, several firms have recently revised price targets upwards, acknowledging the growing potential from the AI boom.

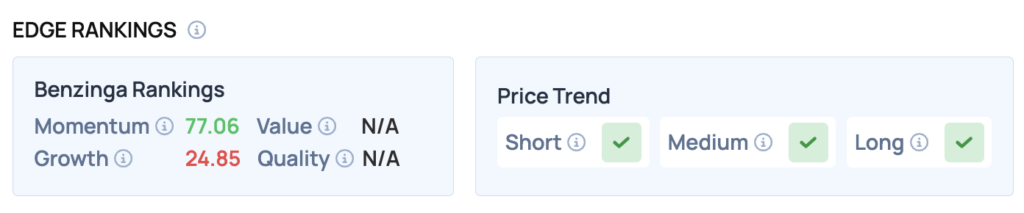

Benzinga Edge Rankings: The stock’s rally Wednesday is reflected in its strong Benzinga Edge Momentum score of 77.06.

FCEL Price Action: FuelCell Energy shares were up 8.91% at $8.31 at the time of publication on Wednesday, according to Benzinga Pro data.

Read Also: S&P 500 Tops 6,900 Ahead Fed Rate Move, Gold Reclaims $4,000: What’s Moving Markets Wednesday?

How To Buy FCEL Stock

Besides going to a brokerage platform to purchase a share – or fractional share – of stock, you can also gain access to shares either by buying an exchange traded fund (ETF) that holds the stock itself, or by allocating yourself to a strategy in your 401(k) that would seek to acquire shares in a mutual fund or other instrument.

For example, in FuelCell Energy’s case, it is in the Industrials sector. An ETF will likely hold shares in many liquid and large companies that help track that sector, allowing an investor to gain exposure to the trends within that segment.

Image: Shutterstock

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English