Did Pitney Bowes' (PBI) Q3 Profit Reversal and Dividend Boost Just Shift Its Investment Narrative?

- Pitney Bowes reported third quarter 2025 results, showing revenue of US$459.68 million and net income of US$51.96 million, alongside the declaration of a US$0.09 per share quarterly dividend payable in December.

- The turnaround to positive net income, compared to a net loss in the prior year, reflects key operational improvements despite lower revenues.

- We'll examine how Pitney Bowes' return to profitability and continued dividend payments may influence its investment narrative and outlook.

AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Pitney Bowes Investment Narrative Recap

To own Pitney Bowes shares today, you need to believe the company can successfully offset ongoing declines in its core mailing business by delivering profitable growth in digital shipping and logistics solutions. The recent swing back to profitability is encouraging but does little to change the main short-term catalyst, continued operating margin improvement from efficiency gains, and does not materially shift the biggest near-term risk: persistent revenue erosion in legacy business lines.

The Board’s decision to maintain its US$0.09 per share quarterly dividend following third-quarter results is particularly relevant. Sustained dividend payments help reinforce confidence that recent operational gains are translating into real cash flow, though this doesn’t directly address the long-term risk of shrinking physical mail volumes or the need for ongoing reinvestment into logistics and technology solutions.

In contrast, investors should be aware that despite recent earnings improvements, the risk of further revenue contraction in legacy businesses remains...

Read the full narrative on Pitney Bowes (it's free!)

Pitney Bowes' outlook anticipates $1.9 billion in revenue and $348.2 million in earnings by 2028. This is based on a projected 2.1% annual revenue decline and a $202.3 million increase in earnings from the current $145.9 million.

Uncover how Pitney Bowes' forecasts yield a $17.00 fair value, a 52% upside to its current price.

Exploring Other Perspectives

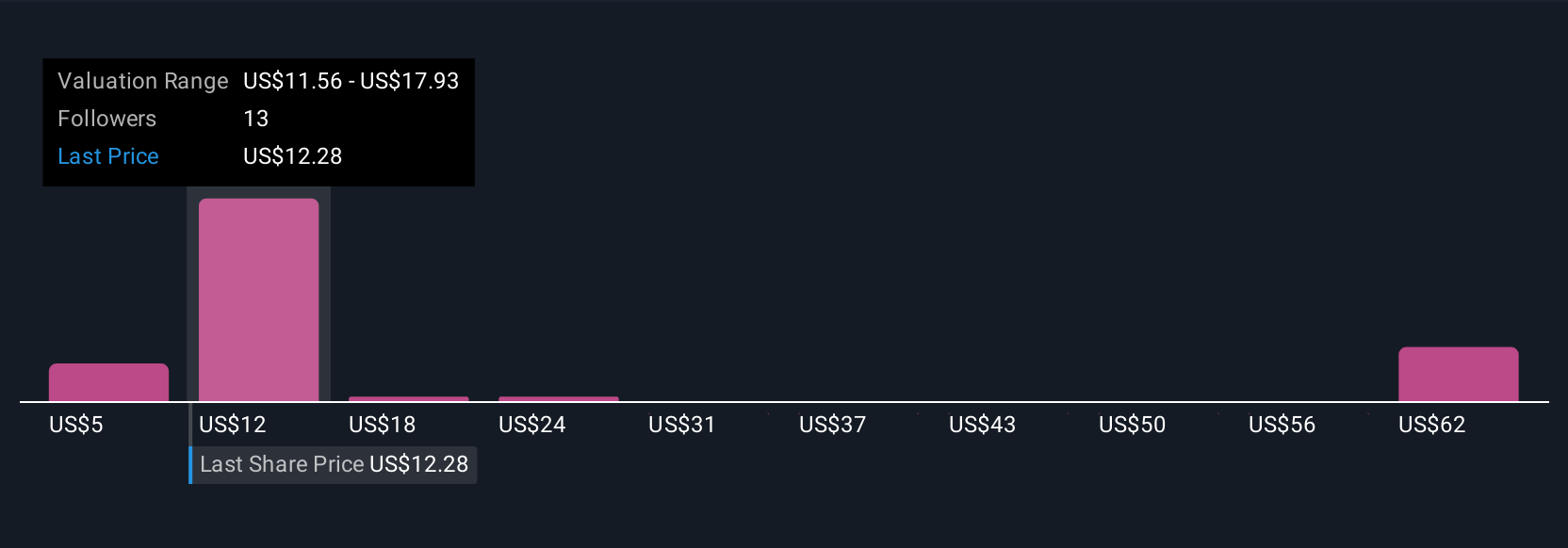

Private investors in the Simply Wall St Community estimate Pitney Bowes’ fair value anywhere from US$5.20 to a high of US$67.35, across 11 different outlooks. While some anticipate margin and profit growth offsetting revenue declines, others point out that shrinking mail volumes could limit sustained gains, so be sure to check out these differing views before forming your own opinion.

Explore 11 other fair value estimates on Pitney Bowes - why the stock might be worth over 6x more than the current price!

Build Your Own Pitney Bowes Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Pitney Bowes research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Pitney Bowes research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Pitney Bowes' overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English