Modine (MOD): Net Margin Tops Expectations, Reinforcing Bullish Community Narratives

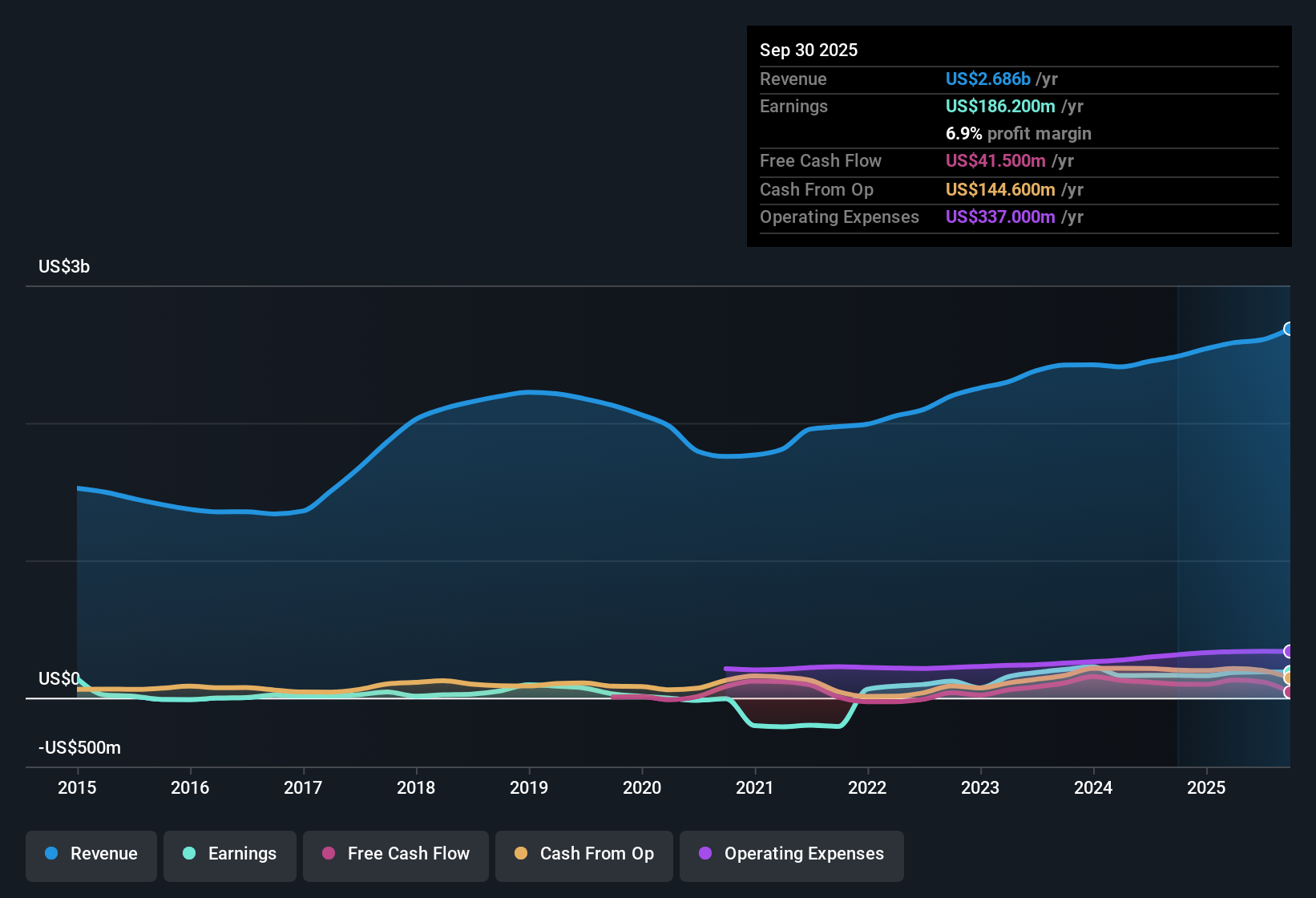

Modine Manufacturing (MOD) reported robust earnings quality with a net profit margin of 6.9%, edging past last year’s 6.6%. Over the past five years, the company has averaged annual earnings growth of 49.9%. However, the latest year’s growth rate of 13.8% trails its recent historic pace. Looking ahead, consensus forecasts are calling for annual earnings growth of 30.6% and revenue growth of 14.7% per year. These projected rates are above US market averages and support a positive longer-term outlook.

See our full analysis for Modine Manufacturing.The real test is how these numbers measure up to the narrative investors are following. Some expectations may be confirmed, while others could be challenged in the deeper analysis ahead.

See what the community is saying about Modine Manufacturing

Margins Outpace Peers at 6.9%

- Modine’s net profit margin stands at 6.9%, well above last year’s 6.6% and surpassing most US Auto Components peers.

- Analysts’ consensus view highlights that surging demand from data centers and energy-efficient solutions, especially with the potential to double data center revenue by 2028, is driving structural margin improvement.

- Strong secular tailwinds in digital infrastructure and HVAC markets give Modine multi-year visibility into high-margin projects.

- Strategic acquisitions, supply chain localization, and product innovation are expanding long-term earning power as margins move toward the projected 11.4% in three years.

Consensus view reinforces momentum: See how the latest expansion into data center solutions is shaping the outlook for Modine Manufacturing in the community narrative. 📊 Read the full Modine Manufacturing Consensus Narrative.

Valuation Premium Defies Industry Norms

- The company’s price-to-earnings ratio is currently 43.8x, well above both the industry average of 18.9x and the peer average of 19.9x. However, the current share price of $155.26 trades at a discount to DCF fair value at $212.40.

- Analysts’ consensus narrative contends that even at this premium, Modine is considered undervalued by cash flow-based models and supported by robust growth forecasts.

- The consensus analyst price target stands at $179.00, suggesting a 15% upside from current levels, assuming profitability and margin gains meet projections.

- To justify the target, Modine would need to achieve $4.0 billion in revenues and $453.0 million in earnings by 2028, while narrowing its PE ratio closer to sector norms over time.

Portfolio Transformation Raises Execution Stakes

- Recent strategic acquisitions (AbsolutAire, L.B. White, CDI) and phased divestiture of $250 to $300 million in light-duty business mark a major portfolio shift. The execution of integration and restructuring is critical to future earnings stability.

- Analysts’ consensus narrative draws attention to risks around capacity utilization and regional concentration as Modine builds out US-focused manufacturing and relies on rapid growth from data center and HVAC verticals.

- Delays or underutilization in data center buildouts, or integration stumbles, could pressure both net margins and cash flow despite top-line momentum.

- Operational challenges from restructuring could lead to periods of lower free cash flow as the company absorbs one-time costs and concentrates business risk during the transition phase.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Modine Manufacturing on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a new angle on the results? Start shaping your story and create your unique narrative in just a few minutes. Do it your way

A great starting point for your Modine Manufacturing research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Modine’s ambitious transformation, involving major acquisitions and restructuring, leaves it exposed to execution risk and potential periods of unsteady cash flow, even though there are growth prospects.

If you prefer companies with dependable performance, use our stable growth stocks screener (2121 results) to focus on businesses delivering steady earnings and revenue regardless of the cycle.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English