Canadian Solar (NasdaqGS:CSIQ): Fresh Battery Milestone and Analyst Moves Bring Valuation Under the Spotlight

Canadian Solar (NasdaqGS:CSIQ) recently marked a major milestone with its e-STORAGE subsidiary launching a large-scale battery energy storage project in Australia. At the same time, recent analyst actions have added some pressure to investor sentiment.

See our latest analysis for Canadian Solar.

After announcing the successful launch of its major battery project in Australia, Canadian Solar’s stock surged, with a 1-day share price return of nearly 16% and strong momentum carrying through the past month. Even so, despite this rally, the one-year total shareholder return sits at just 24%, reflecting that longer-term investors are still waiting for a convincing turnaround after a tough three-year stretch for the stock.

If you’re watching the renewables space heat up and want to see what else is on the move, why not check out other fast-growing companies with strong insider ownership using our discovery screener: fast growing stocks with high insider ownership

With the stock coming off a sharp rebound, but analyst targets still suggesting room for caution, investors may be wondering whether Canadian Solar is now trading at a bargain or if the market is already pricing in future gains.

Most Popular Narrative: 42% Overvalued

Canadian Solar’s last close of $17.57 sits well above the narrative’s fair value estimate of $12.37, highlighting a sharp disconnect. The narrative presents a bold outlook for revenue and margin expansion, despite significant headwinds still pressuring the company’s valuation today.

Canadian Solar is experiencing robust demand from the global acceleration of electrification (driven by booming data center, AI, and energy-intensive applications). This, combined with their expansion of energy storage solutions and solar module shipments, is likely to increase long-term revenue growth. The company's forward integration into battery storage, with plans to expand BESS manufacturing capacity from 10 GWh to 24 GWh by 2026 and battery cell capacity from 3 GWh to 9 GWh, positions Canadian Solar to capture higher-margin business and increase average order value. This could positively impact future net margins and earnings.

Can this company’s push on energy storage and smart modules really deliver the earnings liftoff that the consensus expects? The full narrative reveals the ambitious profit and margin forecasts that drive this controversial fair value, plus the surprising underlying assumptions analysts are betting on. Are you ready to see how the numbers stack up?

Result: Fair Value of $12.37 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing policy uncertainty in the U.S. and persistent cost pressures could quickly disrupt Canadian Solar’s bold forecast and cast doubt over future earnings growth.

Find out about the key risks to this Canadian Solar narrative.

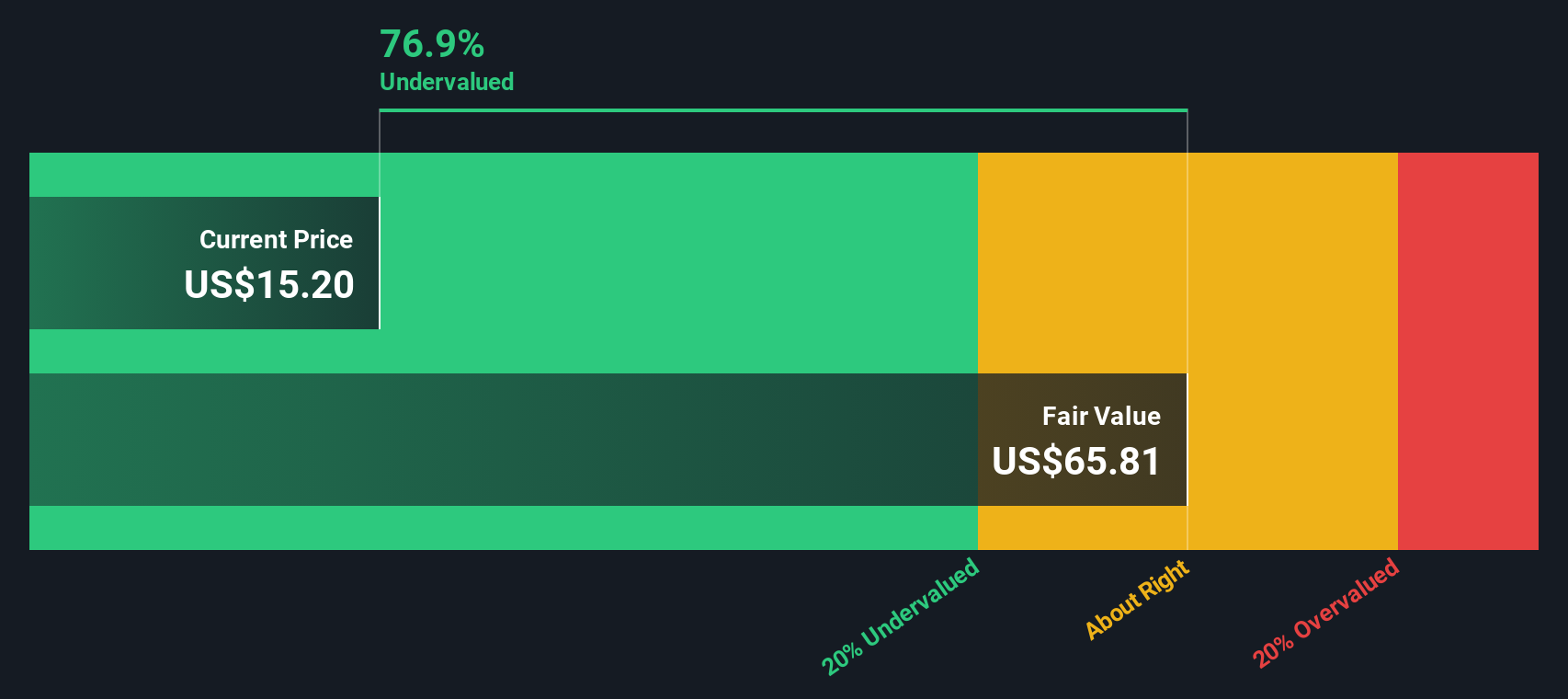

Another View: Discounted Cash Flow Signals Deep Value

While analyst targets and market multiples point to Canadian Solar being overvalued, the SWS DCF model tells a very different story. On this basis, the shares actually trade far below intrinsic value, suggesting a potential upside that many investors may be missing. Which method will prove right?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Canadian Solar Narrative

If you want to see the numbers for yourself or prefer a hands-on approach, it takes only a few minutes to put together your own perspective. Do it your way

A great starting point for your Canadian Solar research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Winning Opportunities?

Smart money never sleeps, and that’s why you should always have your radar up for stocks with untapped growth or income. Get a step ahead and target the best ideas other investors could be missing. Your future self will thank you for it.

- Capture powerful yields from companies prioritizing shareholder returns by checking out these 21 dividend stocks with yields > 3% with robust dividend payouts above 3%.

- Capitalize on innovation at the crossroads of medicine and artificial intelligence, starting with these 34 healthcare AI stocks poised to revolutionize healthcare.

- Supercharge your portfolio’s growth with under-the-radar value plays. Review these 849 undervalued stocks based on cash flows to spot attractive stocks based on their proven cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English