Top 3 Energy Stocks That Could Lead To Your Biggest Gains In Q4

Benzinga·10/30/2025 10:48:27

Listen to the news

The most oversold stocks in the energy sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock’s strength on days when prices go up to its strength on days when prices go down. When compared to a stock’s price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

XCF Global Inc (NASDAQ:SAFX)

- On Oct. 23, XCF Global announced a binding term sheet with New Rise Australia to expand sustainable aviation fuel production in Australia. Mihir Dange, Chief Executive Officer of XCF Global, said, “Our partnership with New Rise AU accelerates XCF’s global expansion strategy and underscores the scalability of our modular renewable fuel platform. Australia combines strong policy momentum, growing aviation demand, and abundant feedstock resources, creating an excellent environment to develop renewable fuel facilities.” The company's stock fell around 35% over the past month and has a 52-week low of $0.84.

- RSI Value: 25.6

- SAFX Price Action: Shares of XCF Global fell 5.8% to close at $0.86 on Wednesday.

- Benzinga Pro’s charting tool helped identify the trend in SAFX stock

Mesa Royalty Trust (NYSE:MTR)

- On Oct. 16, Mesa Royalty Trust announced today the Trust income distribution for the month of October. Unitholders of record on Oct. 31, 2025 will receive distributions amounting to $0.018350966 per unit, payable on Jan. 30, 2026. The company's stock fell around 12% over the past month and has a 52-week low of $4.68.

- RSI Value: 26

- MTR Price Action: Shares of Mesa Royalty Trust fell 1.1% to close at $4.70 on Wednesday.

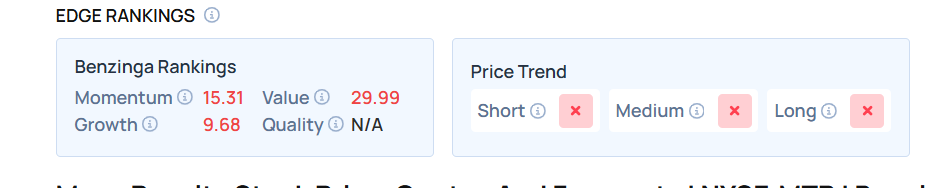

- Edge Stock Ratings: 15.31 Momentum score with Value at 29.99.

ONEOK Inc (NYSE:OKE)

- On Oct. 28, ONEOK posted better-than-expected quarterly earnings. “ONEOK’s strong third quarter demonstrates the consistent execution of acquisition- related integration strategies by our employees, as well as the continued solid performance of our contiguously integrated assets,” said Pierce H. Norton II, ONEOK president and chief executive officer. “We continued to benefit from steady demand across our businesses and increasing production in all of the basins where we operate.” The company's stock fell around 8% over the past month and has a 52-week low of $66.56.

- RSI Value: 28.7

- OKE Price Action: Shares of ONEOK fell 2.8% to close at $67.20 on Wednesday.

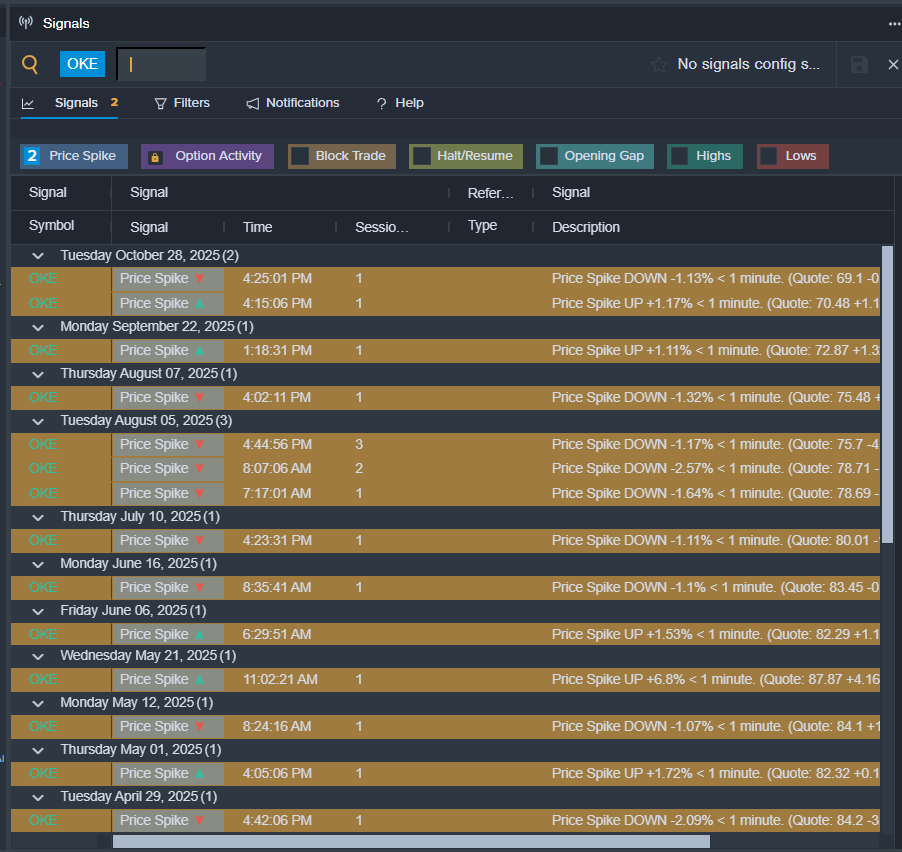

- Benzinga Pro’s signals feature notified of a potential breakout in OKE shares.

Learn more about BZ Edge Rankings—click to see scores for other stocks in the sector and see how they compare.

Read This Next:

Photo via Shutterstock

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkRisk Disclosure: The content of this page is not an investment advice and does not constitute any offer or solicitation to offer or recommendation of any investment product. It is for general purposes only and does not take into account your individual needs, investment objectives and specific financial circumstances. All investments involve risk and the past performance of securities, or financial products does not guarantee future results or returns. Keep in mind that while diversification may help spread risk it does not assure a profit, or protect against loss, in a down market. There is always the potential of losing money when you invest in securities, or other financial products. Investors should consider their investment objectives and risks carefully before investing. For more details, please refer to risk disclosure.

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

Language

English

©2025 Webull Securities Limited. All rights reserved.