PHINIA (PHIN): $81 Million One-Off Loss Challenges Margin Recovery Narratives

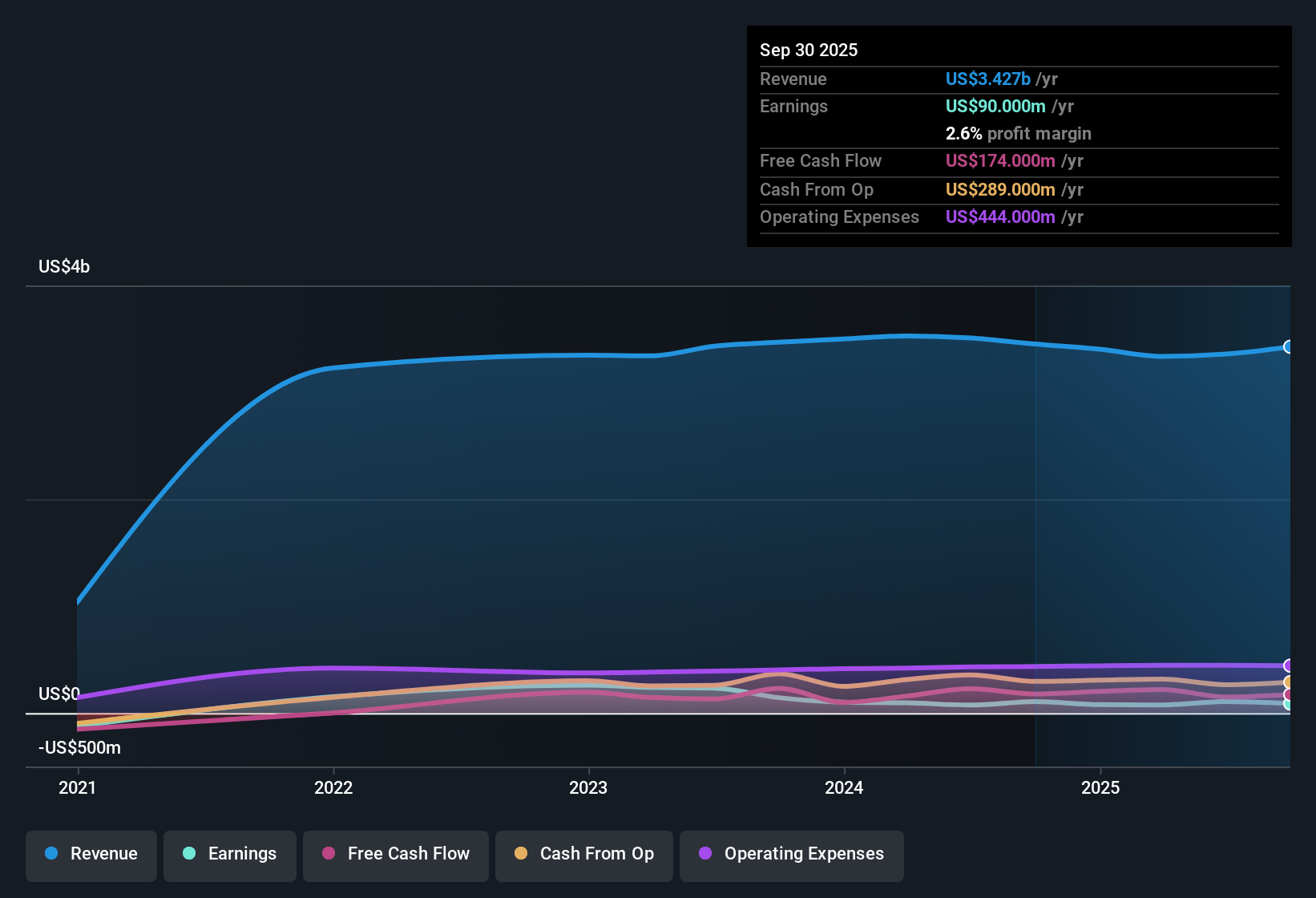

PHINIA (PHIN) reported a net profit margin of 2.6% for the twelve months ending September 30, 2025, compared to 3.1% in the prior year. The details were influenced by an $81.0 million one-off loss, even as earnings have averaged 5.2% growth per year over the last five years. While revenue is forecast to grow at a modest 1.7% annually, which is well below the broader US market's 10.2%, analysts are projecting a robust 36.9% annual increase in earnings, suggesting room for a turnaround. With valuation metrics painting the shares as good value despite mixed recent results, the current earnings report sets up a complex outlook for investors weighing near-term challenges and longer-term recovery potential.

See our full analysis for PHINIA.Next, we'll dive into how these figures compare with the prevailing narratives among investors. This will highlight where consensus stands strong and where the latest results leave room for debate.

See what the community is saying about PHINIA

Margin Expansion Target: 3.2% to 6.9% in Three Years

- Analysts are projecting PHINIA’s profit margin will more than double from 3.2% today to 6.9% by 2028, while revenue growth is forecast to average 2.3% annually over the same period.

- According to the analysts' consensus view, margin growth ambitions hinge on regulatory tailwinds and PHINIA’s progress in expanding its aftermarket and adjacent market footprint.

- Regulatory shifts toward lower vehicle emissions and alternative fuels, as well as expanded aftermarket coverage, are expected to drive more stable recurring revenue and reduce reliance on cyclical OEM business.

- The consensus narrative notes these catalysts could secure improved earnings stability, especially as cost optimization and diversification strategies are executed over the next three years.

- To see whether analysts believe these catalysts can sustain margin expansion, read the complete Consensus Narrative. 📊 Read the full PHINIA Consensus Narrative.

Large One-Off Loss: $81 Million Impact

- A notable $81.0 million one-off loss weighed on recent financials, directly impacting net profit margin and contributing to the drop from 3.1% to 2.6% over the last twelve months.

- Consensus narrative highlights that, despite robust structural trends, exposures to legacy engine technologies and external risks remain a drag on short-term margins.

- The continued dependence on internal combustion engine technologies makes PHINIA vulnerable if electrification and emissions regulations accelerate faster than anticipated.

- Exposure to major OEM clients means that issues like fuel pump recalls or shifts in ICE production could drive further losses if not offset by gains in diversification and alternative energy segments.

Valuation: Discount to Peers and DCF Fair Value

- PHINIA trades at a price-to-earnings ratio of 22.2x, below the peer group average of 33.7x. The current share price of $52.02 is roughly half of the $101.99 DCF fair value.

- The consensus narrative explains that despite slower revenue forecasts, investors are likely weighing the rapid projected earnings growth and substantial valuation discount when assessing risk and opportunity.

- Analysts have set a price target of $57.00, just 10% higher than the current share price. This reflects limited near-term upside but strong long-term potential if margins expand and diversification efforts succeed.

- The gap between the current price and DCF fair value indicates that upside exists for those who are confident in execution of PHINIA’s transformation and future profit growth.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for PHINIA on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the latest figures? Share your outlook and build your own perspective on PHINIA in just a few minutes. Do it your way.

A great starting point for your PHINIA research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite PHINIA’s margin ambitions, recent results reflect volatile earnings and exposure to one-off losses. This creates uncertainty around consistent long-term performance.

If dependable results matter most to you, use our stable growth stocks screener (2125 results) to identify companies with steadier revenue and earnings expansion, built for resilience through market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English