Sherwin-Williams (SHW) Margins Hold at 11%, Challenging Bullish Margin Expansion Narratives

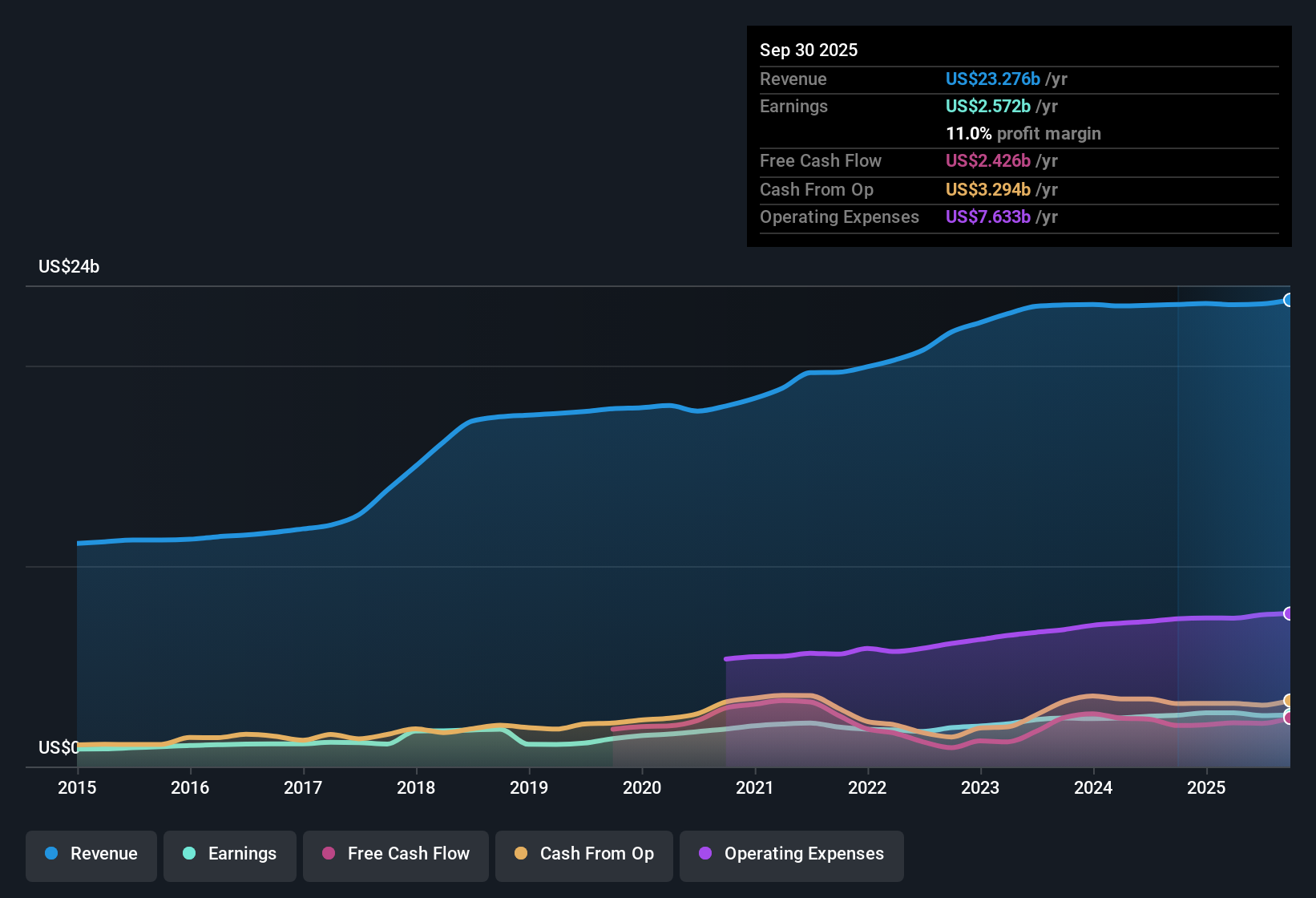

Sherwin-Williams (SHW) posted a net profit margin of 11%, just below last year’s 11.1%, pointing to robust but stable profitability. Over the last five years, the company has grown earnings at a 7.5% annual rate, and forward-looking estimates peg earnings expansion at 8.9% per year, which is slower than the broader US market's expected 15.6% annual pace. Revenue is projected to climb 4.3% annually, which also trails the national benchmark. Notably, the most recent year’s earnings growth of 0.6% came in below the company’s five-year average. While the ongoing record of profit growth stands out, investors face a premium-priced stock, as Sherwin-Williams trades at 33.1x earnings, well above both industry and peer averages.

See our full analysis for Sherwin-Williams.The next section puts these headline numbers under the microscope, comparing Sherwin-Williams’ results to the most widely held narratives in the market. Let's see what holds up and what might surprise investors.

See what the community is saying about Sherwin-Williams

Profit Margin Stays at Double Digits

- The company reported a net profit margin of 11%, maintaining a double-digit level but slightly lower than last year’s 11.1%.

- Bullish narrative claims robust investments and direct distribution can push margins higher, especially with automation and sustainability focus supporting recurring, higher-margin revenue streams.

- With margin stability near 11%, Sherwin-Williams has not yet captured the significant margin expansion bulls expect from cost efficiencies and premium pricing for eco-friendly coatings.

- Bulls believe automation and new store growth present upside, but the current flat trend suggests these gains may take longer to materialize in the reported numbers.

Growth Outlook Lags U.S. Benchmarks

- Sherwin-Williams’ expected annual revenue growth of 4.3% and earnings growth of 8.9% both trail the broader U.S. market, where earnings are pegged to rise 15.6% yearly and revenue is forecast at 10.2%.

- Analysts' consensus view acknowledges that while management is aggressively expanding the store footprint and doubling down on cost controls, the forecasts still lag the strong market averages for future growth.

- The consensus sees cost control and new R&D as key levers, but the reality is that organic revenue and earnings power are improving more slowly than bulls anticipate, and momentum is not yet industry-leading.

- Ongoing investments in new growth areas and international expansion are expected to help, but North American exposure and near-term operating headwinds still make it difficult to outpace the national benchmarks.

Valuation Premium Remains Exceptionally High

- At a share price of $345.73, Sherwin-Williams trades at 33.1x earnings, which is significantly above both the U.S. chemicals industry average (26.4x) and its peer group (22.3x), and well above its own DCF fair value estimate of $264.52.

- Analysts' consensus view notes that despite consistent profits, the limited gap between the current share price and the consensus analyst target of $384.62 suggests investors are already paying for much of the company’s expected upside.

- The valuation gap with the DCF fair value and sector medians highlights the challenge in calling Sherwin-Williams undervalued. Investors are betting future growth will accelerate or margins will structurally step up.

- This leaves little margin for error if top-line momentum remains below market pace, making it crucial to watch for confirmation of profitable execution in future reports.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Sherwin-Williams on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think the data tells a different story? Take a few minutes to put your perspective into a narrative and share your unique view: Do it your way.

A great starting point for your Sherwin-Williams research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Sherwin-Williams’ premium valuation and slower earnings growth mean investors face higher risks if profit momentum does not accelerate as expected.

If you’re seeking greater value and upside potential, use these 849 undervalued stocks based on cash flows to spot companies priced more attractively relative to their future earnings prospects.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English