Will LCI Industries' (LCII) Strong Q3 Results and Raised Guidance Change Its Growth Narrative?

- LCI Industries recently reported third-quarter results, posting revenue of US$1.04 billion and net income of US$62.49 million, both rising from the previous year, while also issuing stronger sales guidance for October 2025.

- The company's upbeat projections and improved profitability highlight ongoing momentum in recreational vehicle parts demand and expanding opportunities beyond its traditional markets.

- We'll explore how LCI Industries' better-than-expected profits and raised sales guidance could impact its long-term growth outlook.

This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

LCI Industries Investment Narrative Recap

To own shares of LCI Industries, you need to believe that the company can deliver consistent growth by capturing a larger share of the expanding RV and outdoor recreation markets, while also successfully managing its exposure to cyclical industry swings. The company's strong third-quarter report and optimistic sales guidance for October 2025 appear to reinforce confidence in improving demand for RV components, which could be the key short-term catalyst, although ongoing margin pressure from tariffs and higher materials costs remains a material risk and is unchanged by this update.

Among the recent announcements, management's October 2025 sales guidance is most relevant for gauging near-term momentum. The projection of US$380 million in net sales for the month, up 15% from a year earlier, supports the view that LCI's core RV-related business continues to recover, which may provide some relief to concerns about weak dealer restocking trends.

Yet, despite this positive news, investors should be aware that ongoing margin compression from elevated raw material costs and tariffs could still...

Read the full narrative on LCI Industries (it's free!)

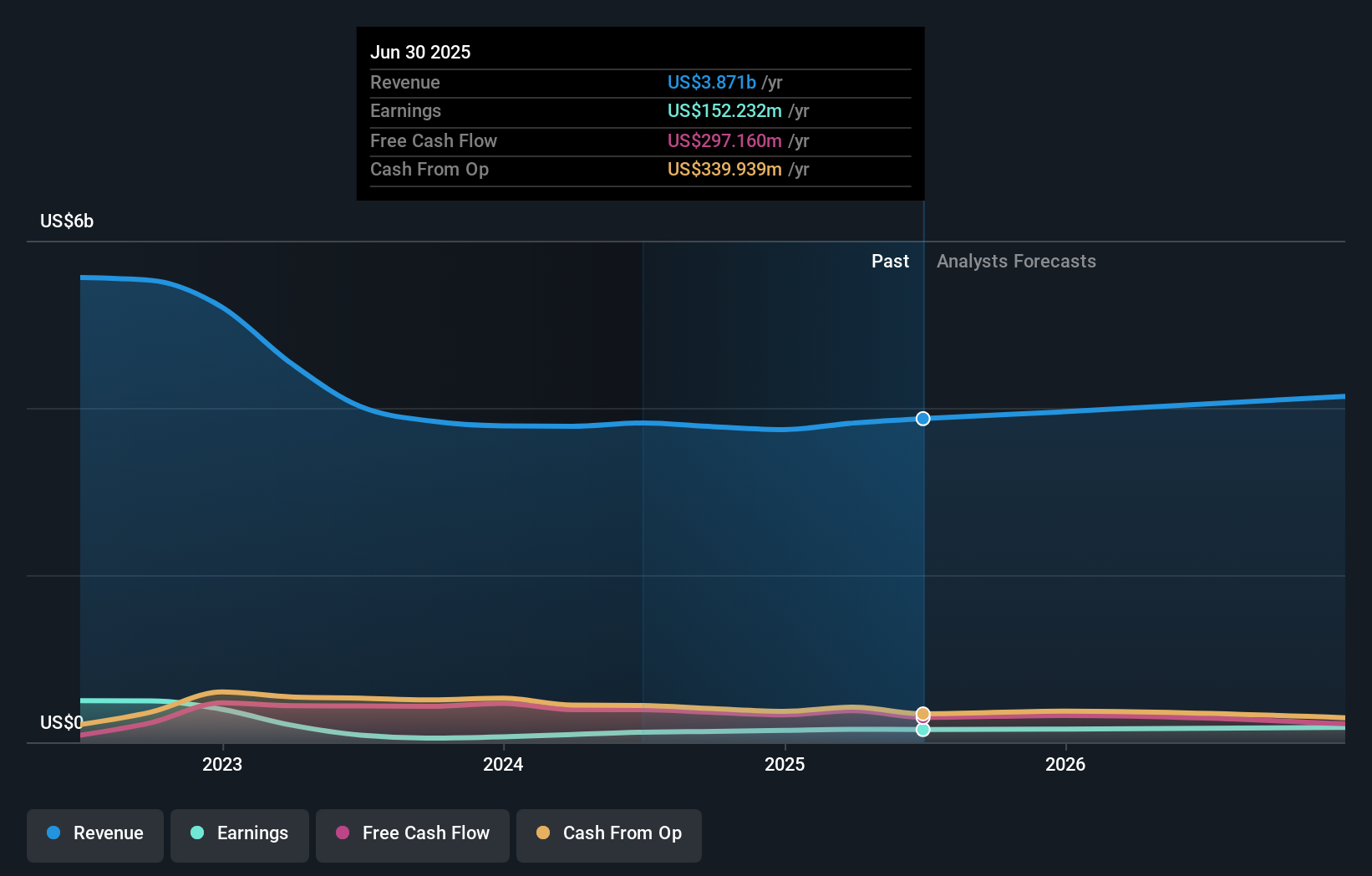

LCI Industries is projected to achieve $4.4 billion in revenue and $206.6 million in earnings by 2028. This outlook assumes annual revenue growth of 4.5% and a $54.4 million increase in earnings from the current figure of $152.2 million.

Uncover how LCI Industries' forecasts yield a $104.75 fair value, a 16% upside to its current price.

Exploring Other Perspectives

Two Simply Wall St Community members estimate fair value for LCI Industries between US$89.04 and US$104.75 per share. While some anticipate expanding RV demand as a growth driver, opinions on the impact of cyclical risks remain sharply divided, be sure to consider every angle before making conclusions.

Explore 2 other fair value estimates on LCI Industries - why the stock might be worth just $89.04!

Build Your Own LCI Industries Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your LCI Industries research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free LCI Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate LCI Industries' overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English