How China Unicom (SEHK:762)'s Soaring IoT Connections May Shape Its Long-Term Investment Outlook

- China Unicom (Hong Kong) reported its third quarter and nine-month 2025 results, posting increases in total connections, 5G package users, and Internet-of-things terminal connections, with revenue reaching CNY292.99 billion and net income of CNY20.00 billion for the period.

- A key insight from the report is the rapid expansion of IoT terminal connections, which now total over 703 million, highlighting China Unicom’s accelerating role in digital infrastructure adoption.

- We'll explore how this surge in IoT terminal connections may shape China Unicom (Hong Kong)'s longer-term investment narrative.

These 14 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

China Unicom (Hong Kong) Investment Narrative Recap

To be a shareholder in China Unicom (Hong Kong), you need to believe that continued expansion in 5G and industrial digitalization, particularly through its surge in IoT terminal connections, will drive sustained revenue and margin growth. The latest results reinforce this catalyst by highlighting robust connection gains and solid earnings, but do not materially shift the focus from the immediate challenge: keeping pace with industry-wide network upgrades, where capex constraints remain a potential stumbling block.

Among recent announcements, the company’s reporting of 703 million IoT terminal connections in Q3 2025 is particularly relevant, underscoring China Unicom’s push to gain ground in digital infrastructure and industrial connectivity. This is directly tied to market catalysts, as the IoT customer base is seen as a cornerstone of future revenue growth, especially with strong gains shown consistently over previous quarters.

Yet, in contrast, investors should also be aware of the ongoing risk posed by China Unicom’s investment pace falling behind rivals, especially as…

Read the full narrative on China Unicom (Hong Kong) (it's free!)

China Unicom (Hong Kong)'s outlook anticipates CN¥433.1 billion in revenue and CN¥25.8 billion in earnings by 2028. This is based on a forecast annual revenue growth rate of 3.3% and a CN¥4.5 billion increase in earnings from the current CN¥21.3 billion level.

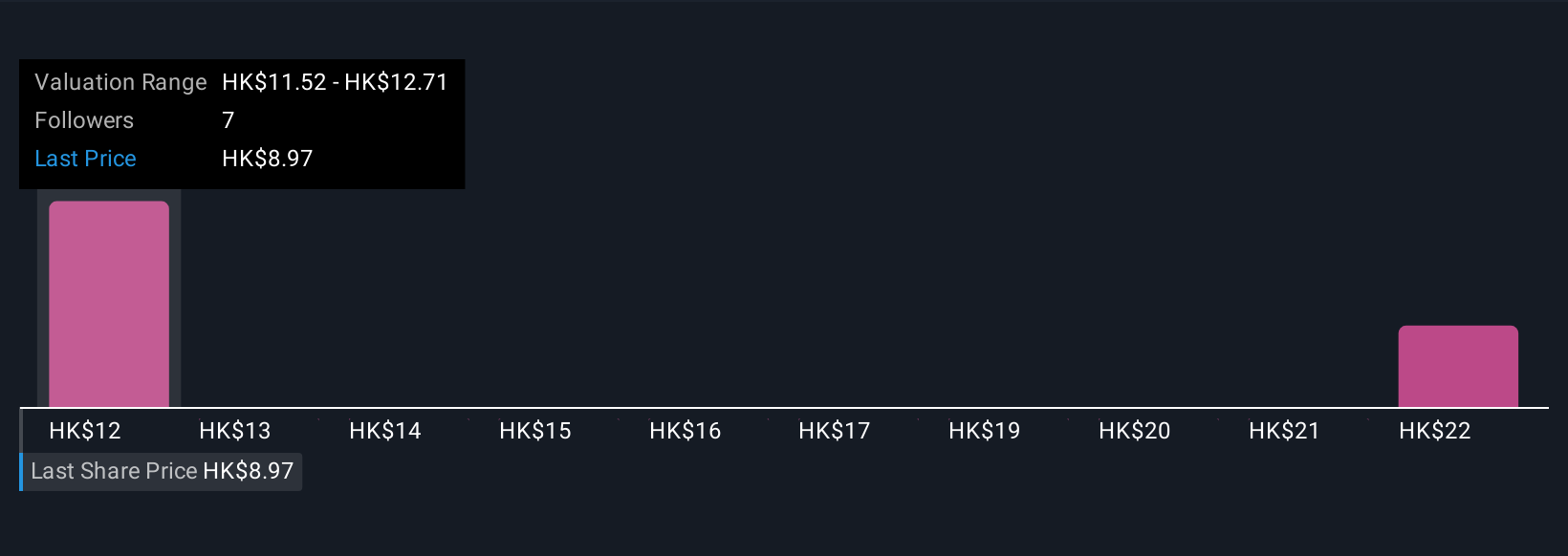

Uncover how China Unicom (Hong Kong)'s forecasts yield a HK$11.52 fair value, a 24% upside to its current price.

Exploring Other Perspectives

Fair value estimates from the Simply Wall St Community range widely, from HK$11.52 to HK$23.44, with just 2 member analyses informing this view. While many see compelling long-term catalysts such as rising IoT connections, you will find sharply differing opinions to consider for China Unicom’s future performance.

Explore 2 other fair value estimates on China Unicom (Hong Kong) - why the stock might be worth just HK$11.52!

Build Your Own China Unicom (Hong Kong) Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your China Unicom (Hong Kong) research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free China Unicom (Hong Kong) research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate China Unicom (Hong Kong)'s overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Webull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English