Assessing Affirm’s Value After New Partnerships and a 59% Stock Surge

- Wondering if Affirm Holdings is a bargain or just riding the latest hype? You are not alone, and now is a great time to take a closer look at what is driving its value.

- The stock has jumped an impressive 59.4% over the last year, though it has given back 8.6% in the past week and is down 7.4% for the past month. This shows just how quickly sentiment can shift.

- Recently, Affirm has made headlines by forging new partnerships and expanding its buy-now-pay-later offerings into fresh markets. These moves are stirring up discussion about how much growth is left in the tank and why investors are still recalibrating their expectations.

- According to our valuation checks, Affirm scores just 1 out of 6 for being undervalued right now. Let us break down the traditional ways to assess value, and stick around because we have an even better approach to valuing stocks that you will not want to miss.

Affirm Holdings scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Affirm Holdings Excess Returns Analysis

The Excess Returns model looks at how much value a company generates above its required cost of equity. In other words, it measures how efficiently the company turns investor capital into real profit over time.

For Affirm Holdings, the average Return on Equity is 11.90%, based on analyst forecasts. The company's Book Value per share is $9.44, with a Stable EPS projected at $1.64 per share, using data from six analyst estimates. The Cost of Equity is $1.12 per share, so Affirm’s excess return is $0.52 per share. Looking forward, analysts expect the Stable Book Value to rise to $13.79 per share, according to data from four analyst estimates.

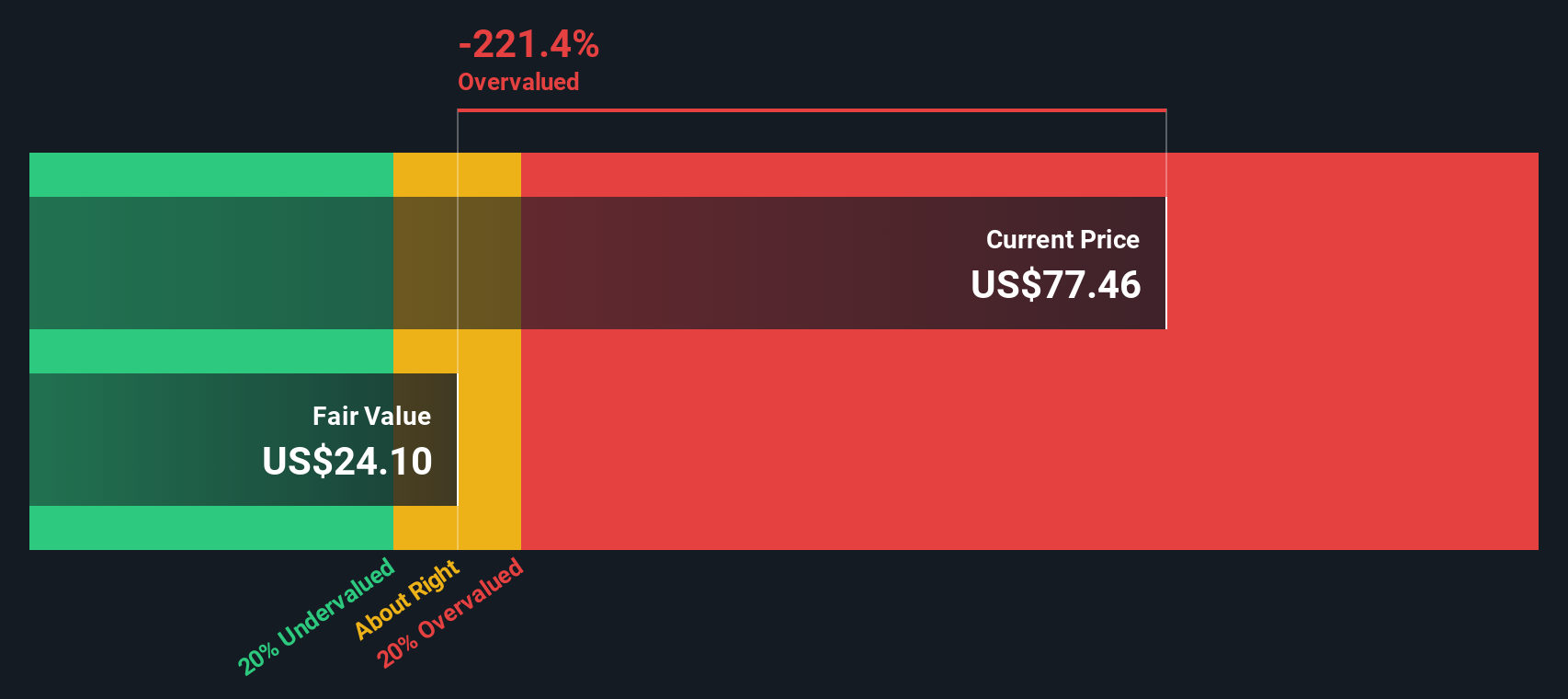

After running these figures through the model, the estimated intrinsic value of Affirm Holdings is $24.18 per share. With the current share price well above this mark, the excess returns valuation suggests Affirm is roughly 185% overvalued versus its intrinsic value.

If you are searching for a bargain, the Excess Returns approach says Affirm Holdings is currently not one. The stock price looks stretched based on these efficiency and growth metrics.

Result: OVERVALUED

Our Excess Returns analysis suggests Affirm Holdings may be overvalued by 185.0%. Discover 834 undervalued stocks or create your own screener to find better value opportunities.

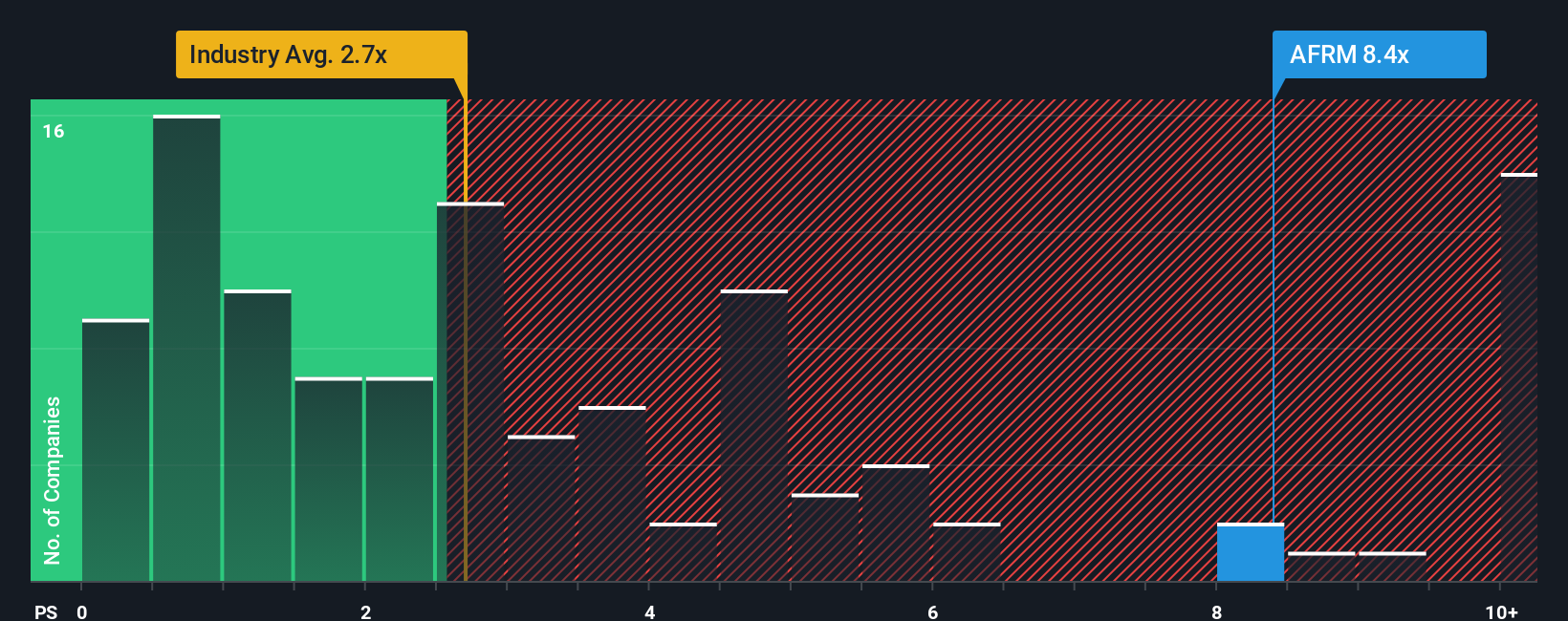

Approach 2: Affirm Holdings Price vs Sales

For companies like Affirm Holdings that are not consistently profitable, the Price-to-Sales (P/S) ratio is often preferred because it focuses on a company’s revenues rather than earnings, which can be volatile or negative for high-growth businesses. The P/S multiple helps investors compare companies on the basis of top-line performance, particularly useful where bottom-line profits may not tell the whole story.

Growth expectations and perceived risk play a large role in determining what counts as a “normal” or fair P/S ratio. Higher growth and lower risk typically command a higher P/S, while lower growth or more risks warrant lower multiples. Keeping this in mind, Affirm Holdings currently trades at a P/S of 7.0x, quite a step above the Diversified Financial industry average of 2.4x and substantially higher than the peer average of 3.6x.

This is where Simply Wall St’s “Fair Ratio” comes in. Unlike simple industry or peer comparisons, the Fair Ratio, here 4.2x, incorporates Affirm’s future growth, risks, profit margins, size, and sector characteristics. This proprietary ratio offers a more tailored benchmark, providing a realistic perspective on what multiple the stock truly deserves. In Affirm's case, the Fair Ratio is below its actual P/S, signaling that the stock is priced at a premium and may be overvalued at current levels.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1390 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Affirm Holdings Narrative

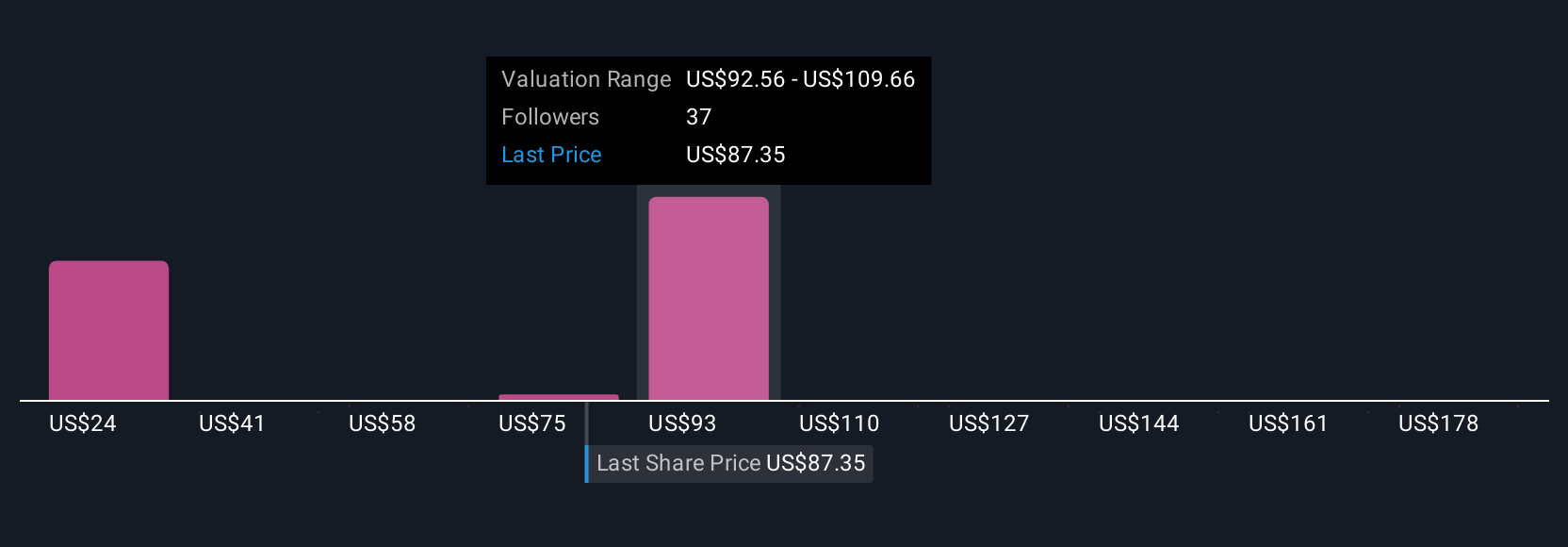

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative is a story you build around your own view of a company, essentially your perspective on where Affirm Holdings is headed, brought to life with your own estimates of future revenue, earnings, and margins. Narratives give you a way to connect the story behind the business to a transparent financial forecast, which in turn leads to a personalized fair value for the stock.

Using Narratives is easy and accessible, already powering smarter decisions for millions of investors on the Simply Wall St Community page. With Narratives, you can see not just the numbers but the thinking behind them, helping you decide when to buy or sell by directly comparing your calculated Fair Value to the current market Price.

Best of all, Narratives update in real time whenever new information, like earnings releases or breaking news, becomes available. This keeps your forecast relevant. For example, looking at Affirm Holdings, one investor's optimistic Narrative supports a fair value of $115, while another more conservative Narrative values it at just $64. This flexibility lets you express your own outlook and adjust instantly as things change.

Do you think there's more to the story for Affirm Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Contact Us

Contact Number : +852 3852 8500Service Email : service@webull.hkBusiness Cooperation : marketinghk@webull.hkWebull Securities Limited is licensed with the Securities and Futures Commission of Hong Kong (CE No. BNG700) for carrying out Type 1 License for Dealing in Securities, Type 2 License for Dealing in Futures Contracts and Type 4 License for Advising on Securities.

English